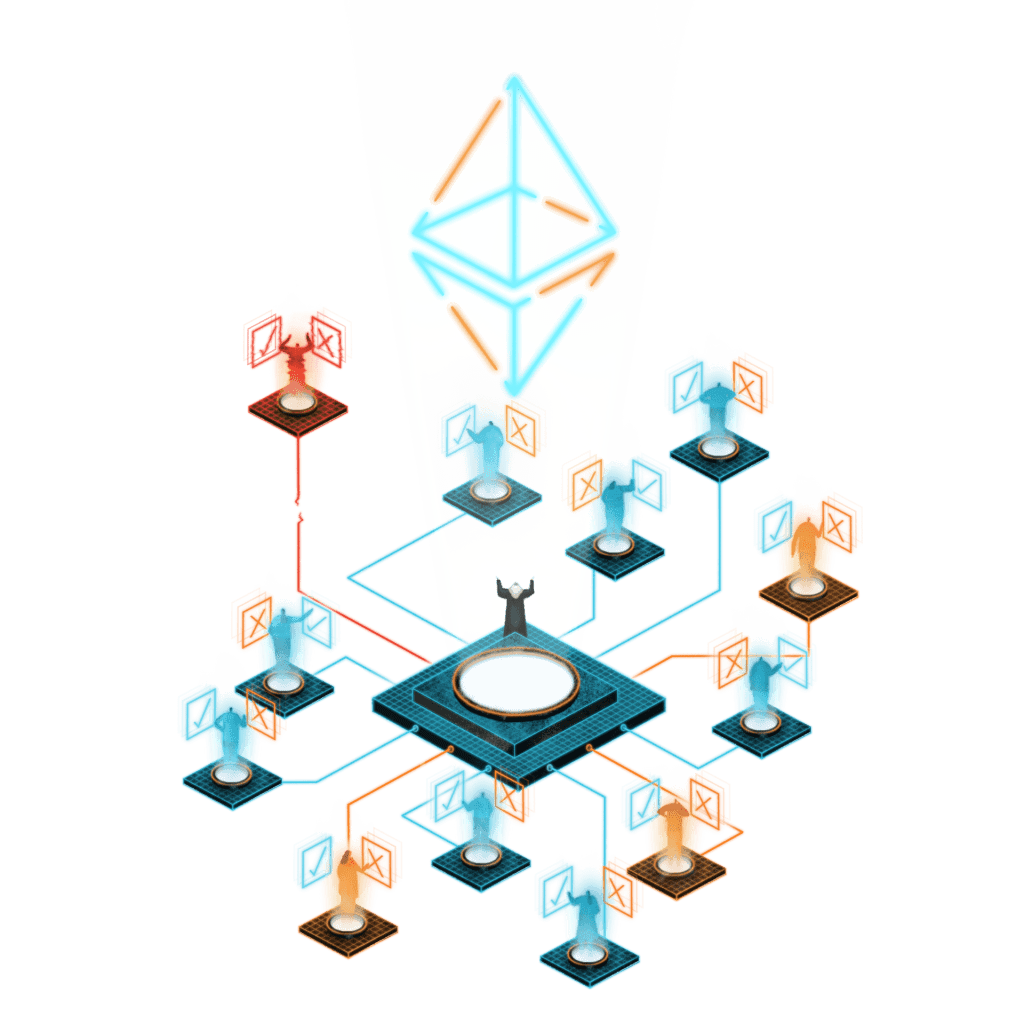

DAOs – Is it possible that when Web3 tools are increasingly extensively used, a similar tendency could emerge globally? A worldwide workforce can be unlocked through decentralized autonomous organizations (DAOs), which are borderless enterprises that attract talent and skill from all over the world.

As a result, individuals who reside in nations with underdeveloped financial systems are no longer restricted to commercial or employment opportunities that are physically close enough to pay them in local currency. And it might have substantial consequences for the 1.7 billion adults globally who, according to the World Bank, do not have a bank account, making it far more difficult for them to find well-paying employment, accumulate funds safely, and make sizeable investments.

DAOs provide a mirror picture of the Great Migration’s dynamic to the unbanked worldwide. For the first time, they are able to live better than they might have in their current communities without having to relocate.

Fair, merit-based remuneration is promoted by DAOs

DAOs make merit-based progression possible. Allowing members to stay anonymous is one approach to do this because contributions are then evaluated simply on their own merits, free from the social dynamics and prejudices that are all too frequently present in conventional workplace systems.

According to a recent article in the Harvard Business Review, more women were accepted for limited Hubble Space Telescope time slots when applications were made anonymous.

It has significant implications for eliminating biases based on race, country, gender, and other identity factors that are unrelated to the value of an employee’s contributions that DAOs provide the prospect of this kind of anonymity on a large scale.

While this is more equitable for everyone, the unbanked stand to benefit the most from it. It eliminates the negative pressure on remuneration brought on by the belief that those without banking options do not have good alternatives.

Additionally, because blockchain transactions are open, DAOs can encourage pay that is consistent with the value that employees produce, which contributes to competitive salaries inside and throughout the crypto ecosystem.

DAOs assist the unbanked in building wealth

Without a bank account to safely accumulate and earn interest on value, it is very challenging to accumulate wealth. This problem is even more difficult for unbanked people who reside in unstable economies, particularly in nations with significant hyperinflation like Venezuela, Sudan, Zimbabwe, and Yemen.

A secure, predictable, and equitable investing environment that is guided by laws rather than the whims of individuals is the optimum environment for generating wealth. An accurate working substitute for the condition of a nation’s investment climate is Transparency International’s annual Corruption Perceptions Index (CPI). On a scale from 0 (“very corrupt”) to 100 (“extremely clean”), the CPI assigns a corruption perception index score to 180 nations.

Only seven nations make up over half of the world’s unbanked population, according to the World Bank report mentioned above: Bangladesh, China, India, Indonesia, Mexico, Nigeria, and Pakistan. None of these nations get a CPI score greater than 45. All but two of them are placed among the worst half of nations.

By providing the transparency and clarity on governing institutions that many economies lack, DAOs can help to create a more favorable climate for wealth creation.

DAO’s code is open source, anyone may examine it and determine exactly what it will do

Most significant DAOs opt to have audits performed by renowned security professionals, even if one is not a developer. This indicates that DAOs distribute profits on investment in a predictable and equitable manner. A DAO’s members are additionally shielded from any theft, graft, or corruption that may be taking place among their local public authorities or private bankers because they communicate with the organization directly rather than through the traditional financial system.

Additionally, the unbanked can invest anywhere in the world because to the global nature of DAOs and the DeFi ecosystem. They can receive payments or keep deposits in a variety of cryptocurrencies, including stablecoins backed by a variety of assets or pegged to the top fiat currencies in the world. For individuals whose local currencies are prone to weakness or depreciation, this can be a big benefit.

There have historically been many disadvantages for the unbanked, but DAOs could signal a turning point. The unbanked can obtain meaningful access to opportunity, just remuneration, and a genuine opportunity to create wealth if certain Web3 protocols are widely adopted.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Annie

CoinCu News