Following part 2, in part 3 we will guide and practice some single candlestick patterns capable of signaling reversals. Through these candlesticks, you can predict the next trend and prepare yourself a perfect trading plan. Let’s go with Coincu.

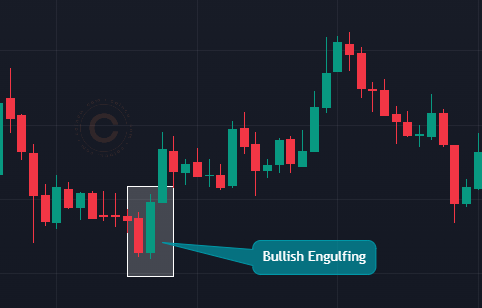

8) Bullish Engulfing Candlestick Pattern

A bullish engulfing pattern is a green candlestick that closes higher than the previous day’s opening after opening lower than the previous day’s close. It can be identified when a small red candlestick, showing a bearish trend, is followed the next day by a large white candlestick, showing a bullish trend, the body of which completely overlaps or engulfs the body of the previous day’s candlestick. A bullish engulfing pattern may be contrasted with a bearish engulfing pattern.

- The opening price and low price of the second candle must be lower than the closing price of the first candle. The closing price and high of the second candle must be higher than the opening price of the first candle.

- The Bullish Engulfing candlestick pattern usually appears at the end of a long downtrend or after a sharp drop.

- If the first candle of Bullish Engulfing is a Doji candlestick, the reliability of the pattern will be higher.

How to trade with Bullish Engulfing

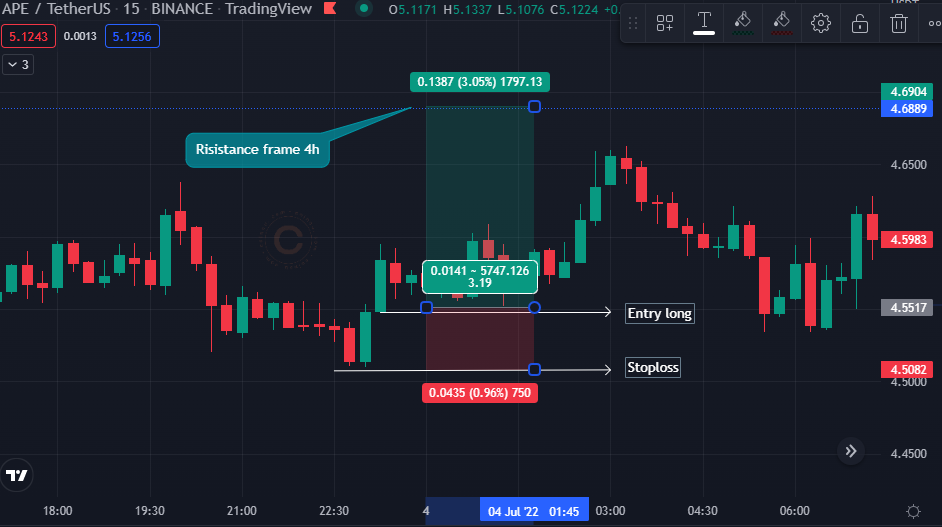

Looking at the chart APE/USDT 15′, the Bullish Engulfing pattern appears after a long downtrend. Now, to get an attractive profit, you can refer to the following order setup with R:R 1:3

- Entry point: take order at the opening price of the 3rd candle.

- Stop loss : below the low of the pattern.

- Take profit : take profit at the resistance level of the trend as shown in the picture.

9) Bearish Engulfing

Bearish means down trend, which implies that the market is expecting the price to fall. In it, Engulfing means to drown. Basically, the Bearish Engulfing candlestick pattern provides a reliable signal that the price will reverse the trend from bullish to bearish. It is also a pattern that appears quite commonly on the chart.

The pattern is composed of 2 candles with opposite components. In which, the first candle is a bullish candle (green candle) with a body that is not too large. Conversely, the second candle is a bearish candle (red candle) with a very long real body.

The bearish engulfing candlestick pattern is an extremely accurate tool for predicting market trends. This is why most investors, especially price action traders, need to clearly understand the important identifying features of this candlestick pattern. Specifically:

- The opening price of the 2nd candle must be higher than the closing price of the 1st candle. At the same time, the closing price of the 2nd candle must be lower than the opening price of the previous green candle. Therefore, the length of the green candle must completely “submerge” the previous red candle, this is the most important identifying feature of the pattern.

- The trading volume of the red candle (2nd candle) is very large.

- A bearish Engulfing pattern occurs at the top of a long uptrend or after a strong rally. It can also be formed at the resistance area.

How to trade with Bearish Engulfing

Before starting to enter orders, traders should note that they should trade when the bearish engulfing candlestick pattern has actually been confirmed. In particular, it should not be applied in case the market is sideways or choppy price; The best trading conditions are after an uptrend.

- Entry point: take an order at the opening price of the 3rd candle.

- Stop loss: Above the highest of the pattern.

- Take profit: take profit at the support zone or ratio R:R 1:3

10) Dark Cloud Cover

Dark Cloud Cover Pattern is one of the candlestick patterns that signal the trend will reverse from up to down. This pattern usually appears at the end of uptrends and is a warning signal that the price will drop sharply in the future. This is considered an imperfect Bearish Engulfing (bearish engulfing) candlestick pattern and appears more.

This candlestick pattern is made up of a strong bullish candle (green) and a strong bearish candle (red). In fact, investors should enter the trade when the price is still falling on the 3rd candle, because at this time the downtrend will be confirmed correctly and will have high rate ratio.

- The first candle in the pattern is a large bullish candle (green) with a long body.

- The second candle is a bearish candle (red ) with closing price below 50% of the body of candle 1.

- The opening price of candle 2 is not necessarily above the closing price of candle 1.

- The pattern usually appears at the top of an uptrend, signaling the end of an uptrend in preparation for a trend reversal.

How to trade with Dark Cloud Cover

After understanding the identifying characteristics of the dark cloud cover candlestick pattern, we will learn how to trade with this candlestick pattern to get maximum profits, while managing risks effectively. According to the experience of professional investors, the H4 and D1 time frames are the most reasonable and the least risky but if you wait for the h4 and D1 frames, the entry point will be very little.

- The trading volume at the opening of the 2nd candle is large. The reason is that a large number of traders have fallen into the trap but can still exit the order.

- The red candle tends to retreat deeply to the bullish candle, so the percentage of the top broken is very large.

- Especially when the pattern appears at the resistance area, the bearish reversal signal proves to be extremely reliable and safe.

- Do not trade with the Dark cloud cover pattern when the price is in a sideways phase or there is no clear trend.

- Entry short: take an order at the opening price of the 3rd candle.

- Stop loss: Above the highest of the pattern.

- Take profit: take profit at the support zone

11) Piercing Pattern

Piercing Pattern is the reverse version of Dark Cloud Cover candlestick pattern and is also one of the candlestick patterns that signals the end of a downtrend to start a new trend, be it bullish or sideways (Sideway). The Piercing Pattern is also known as the Bullish Piercing Line and its opposite is the Dark Cloud Cover / Bearish Piercing Line.

In the Piercing Pattern, the large bearish candle (candle 1) confirms that the downtrend is still continuing to create a new bottom. Candle 2 opens with a decreasing gap, sellers are still dominating the market.

However, instead of falling lower, the price started to move up erasing more than half of the price drop made by the sellers in the previous session. The point to note here is that the new bottom of the previous downtrend has been bounced off and the bulls are poised to take control of the market. And the Piercing Pattern will be invalidated if the next candle after the pattern breaks the bottom of candle 2.

The following characteristics should be noted to identify the Piercing Pattern:

- The more candlestick 2 penetrates the price zone of candle 1, the stronger the pattern and the more similar it will be to the Bullish Engulfing pattern.

- The key support was penetrated when the 2nd candle opened below but then the price bounced back and closed above the support.

- Large trading volume combined with strong bullish candle 2

How to trade with Piercing Pattern

Piercing Pattern is a reversal candlestick pattern, similar to Bullish Engulfing but weaker. This pattern appears at the end of a downtrend and at the beginning of an uptrend, so it has a very attractive Risk/Reward ratio when entering a trade.

- Entry long: After having more supporting index, we have two ways to enter the Piercing Pattern. The first way is to enter the trade as opening price of next candle. The second way is to wait patiently for another candle if this candle continues to rise and break through the first candle. The way to enter the second order will be safer and more certain, but the Risk/Reward will not be as attractive as entering the first one.

- Stop Loss: The Piercing Pattern will be invalidated if the next candle after the pattern breaks the bottom of candle 2, so we can place a stop loss just below the bottom created.

- Take Profit: Take profit will be placed at the above support zone.

Verdict

Above are some candlestick patterns that signal the possibility of reversal, in the next article we will learn about typical candlestick clusters commonly used in crypto trading as well as other financial markets.

If you have any questions, comments, suggestions, or ideas about the project, please email ventures@coincu.com.

DISCLAIMER: The Information on this website is provided as general market commentary, and does not constitute investment advice. We encourage you to do your own research before investing.

Alan

Coincu Ventures