Lens Protocol – decentralized social networking platform launched testnet on May 18, 2022. But what few people notice is that the project is developed by a party not related to this field. That’s the team behind the loan platform Aave. Why did they develop Lens Protocol? The following article will help clarify somewhat about this platform.

Introduction Aave

Aave is a decentralized non-custodial liquidity market protocol where users can participate as depositors or borrowers. Depositors provide liquidity to the market to earn a passive income, while borrowers are able to borrow in an overcollateralized (perpetually) or undercollateralized (one-block liquidity) fashion.

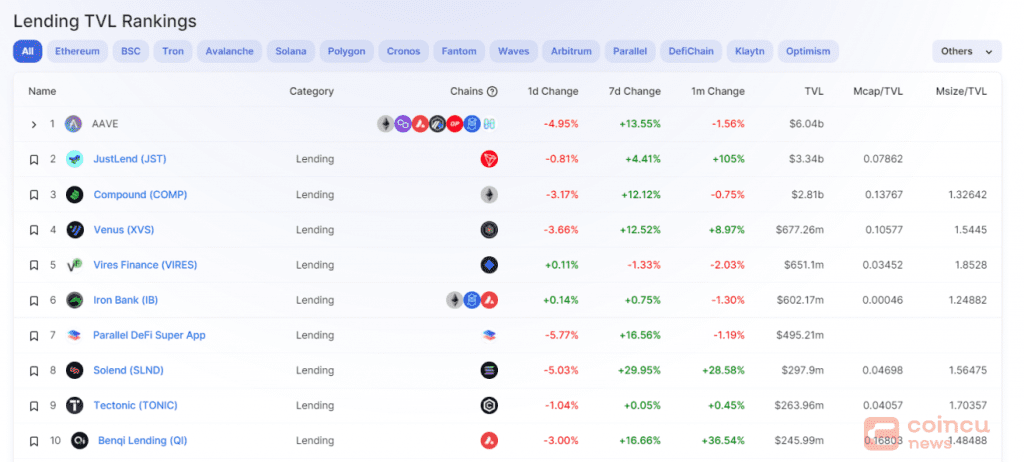

Aave is the leading Defi lending platform with TVL at its peak at around $20 billion. During the first half of 2022, the market was adverse, with BTC steadily declining by more than 50% from its $60,000 peak dating back to November 2021. But this didn’t stop Aave from taking first place in TVL in the Lending segment on Defillama.

Analytics

Total Value Locked plummeted

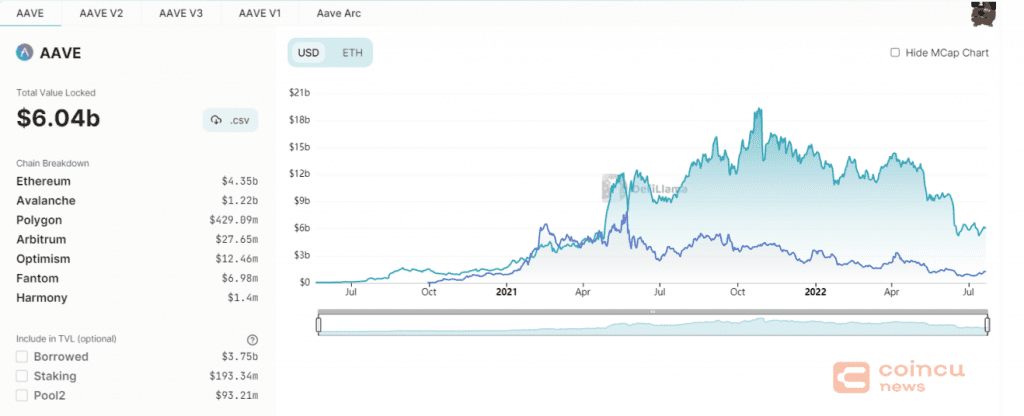

Since Defi exploded in the summer of 2020, Aave has shown strong growth in TVL. Within a year from September 2020, TVL hit the highest level of nearly 20 billion USD.

However, after that, TVL gradually decreased. By mid-July 2022, the value of assets locked in Aave was only about 7 billion USD.

Outstanding Loan

An outstanding Loan is the number of assets being borrowed out of the Lending protocol. If this number is large, it means that there are many assets being borrowed and vice versa.

The largest value of Aave’s Outstanding Loan is approximately $700 million in April 2021. However, from then to June 2021, this number dropped sharply to nearly 10 times. Nearly a year later, the loan amount is 100 times smaller than it peaked.

The number of borrowers plummeted

Similar to the above indicators, there were more than 600 borrowers per day around September 2020. But this number is less than 10 people, even 1 or 2 people in July 2022.

Causes and solutions

The cause of Aave’s decline

The first is the general market. From November 2021, BTC peaked at about 69,000 USD. But then it gradually decreased, leading to a tripling from the peak in July 2022.

In addition, the total amount in crypto is also gradually decreasing from November 2021. That means it has been half a year without new money flowing into crypto.

Next is DeFi, the TVL of the total decentralized finance market, which dropped sharply from more than 240 billion USD to about 80 billion USD in July 2022.

Solutions of Aave Team

Over the past time, Aave has continuously updated with new features. At the end of 2020, the project launches Aave V2 with unique features such as Flash Loan, Credit Lending…

After that, the project launched Aave V3 in early 2022, allowing assets to move easily to borrow money and a bunch of other features.

To see how dynamic Aave is, let’s take a look at its competitor Compound. Their last update was in June 2021, with the launch of the Compound Treasury for traditional financial institutions that deposit money and receive a fixed 4% interest rate. Or the V2 version of Compound was born 2 years ago.

But based on the above figures, that much effort is not enough for Aave to attract users like before. So they started working on a new project. It’s Lens Protocol.

About Lens Protocol

Lens Protocol is a social networking product based on blockchain technology, which received a lot of attention when the founder of the project, Stani Kulechov, is also the founder of Aave (AAVE). The leading lending platform on Ethereum.

Lens is an open-source social graph that allows developers to launch Web3-ready social media platforms and profiles. It is built on Polygon blockchain and works to enable creators to take ownership of their content wherever they go in a Web3 environment.

This platform was created with the desire to overcome the disadvantages of Web2 social networks: all records, data, and connections are stored in a centralized manner, not owned by the user but belonging to the user ownership of the operating company.

What problem does Lens Protocol solve?

Lens Protocol allows users to build Social Graph on blockchain. Social Graph can be understood simply as the relationship between entities (for example, users) with each other. Social Graph contains a lot of information such as name, age, who you follow, who follows you…

According to CBS, in 2018, the Social Graphs of users on social networks like Meta (formerly Facebook) were leaked. This shows that current centralized platforms possess a lot of user information.

With Lens Protocol, this information is owned by the user. You don’t even need to provide an email, ID card, etc. to register, just a wallet address.

Speaking of decentralization, Twitter users must be no stranger to the “sweeping” of accounts that do not comply with regulations. But in fact, there are many people who do not violate and also have their accounts locked. And yet, even though these people have submitted an explanation, only a part is unlocked. The rest have to create another account.

What can Lens Protocol do?

Users don’t need to think about what they can do with Lens Protocol, as the project itself has suggested quite a lot on the homepage, as well as tweeting on Twitter. It is a fair connection platform between KOLs and fans; social networks such as Twitter; the project supports users in the full right to use their data (for example, to make a profit)…

Why did Aave build Lens Protocol?

With the leading position in the Lending segment along with decreasing indexes, Aave shows that it is hitting the development threshold of this segment.

This does not mean that the project cannot grow. If the cash flow returns, according to the mechanism of “water on the boat”, Aave will still “float” with crypto. But if they want to go against the current downtrend, they need to innovate.

Based on social network data, it can be seen that this is a potential segment for the past 10 years, and there is no sign of stopping. Therefore, Lens Protocol can be used to acquire more users effectively.

This is a good move by Aave. Initially, we can see that there is no connection between the development of the Lending project and the social networking platform. But the main goal not only in these two areas but in any industry is to attract as many users as possible.

Once they have a large user base, they can dump this value on Aave. Or a worst-case scenario, when Aave is no longer used by many users, Stani and his teammates still have the “other card” is Lens Protocol, which they are developing while Aave is still standing at the top position in Lending.

Verdict

Web3 is now proving to be the coming trend of the world. In which social network is an area with a lot of potentials. Lens Protocol is only in the early stages of development, it is not known if it will succeed in the future, but it shows that Aave’s direction is on the right trend.

If you have any questions, comments, suggestions, or ideas about the project, please email ventures@coincu.com.

DISCLAIMER: The Information on this website is provided as general market commentary, and does not constitute investment advice. We encourage you to do your own research before investing.

Issac

Coincu Ventures