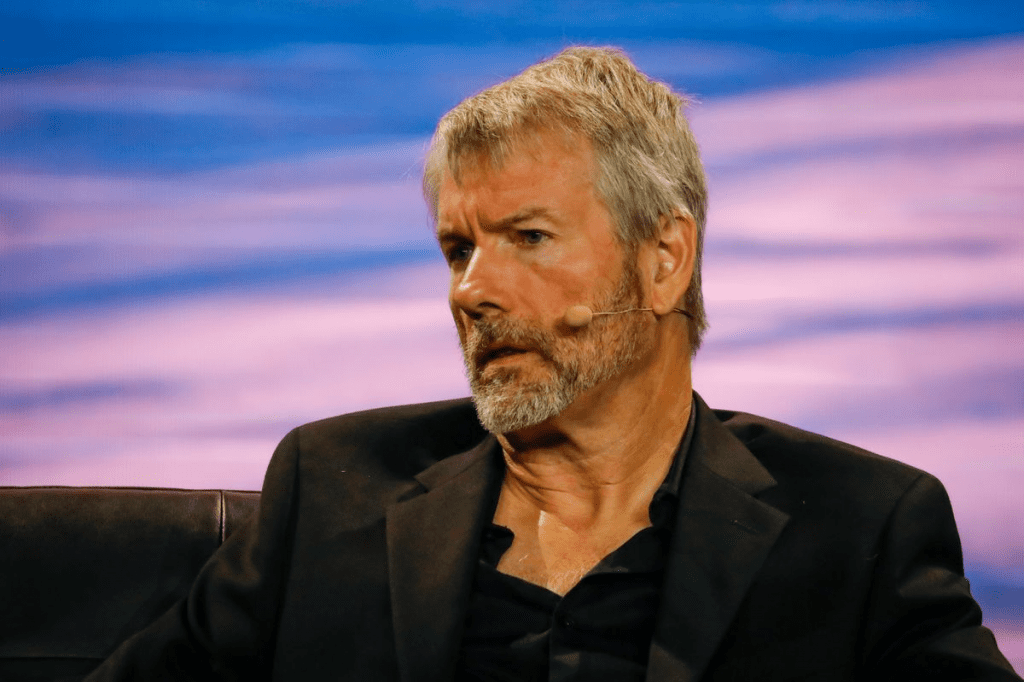

MicroStrategy’s 129,699 BTC Trove Not For Sale After CEO's Exit

In a new statement, MicroStrategy announces that Saylor will be its new executive chairman effective August 8 to focus on innovation and long-term corporate strategy. Saylor is assuming his new position as Bitcoin trades at just a third of its all-time high.

MicroStrategy currently owns 129,699 BTC, which the company bought for an average price of $30,664 per Bitcoin. The purchase value of the company’s BTC trove is nearly $4 billion, but as the flagship crypto asset trades for $22,800 at the time of writing, the Bitcoin acquisition is now worth just $2,960,000,000.

The company’s latest financial report says its digital asset impairment loss for Q2 of 2022 is $917.8 million. Despite this, MicroStrategy is not selling its crypto assets soon. In comparison, MSTR’s stock price plunged 42% in the same period.

MicroStrategy also has amassed $2.4 billion in long-term debts with $46.6 million in interest expenses. Therefore, the company could be unable to meet its debt obligations if it continues to suffer losses at the current pace.

In other words, the company could pledge its nearly $2 billion worth of Bitcoin holdings as collateral or sell them to raise capital.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Harold

CoinCu News

CFTC Chairman Rostin Behnam will step down on January 20, with his official departure on…

Georgetown, Saint Vincent & The Grenadines, 7th January 2025, Chainwire

In 2024, MicroStrategy Bitcoin investment surpasses $22.07 billion, bringing its total holdings to 447,470 BTC.

Qubetics hits 13,500 holders, Litecoin jumps 8%, and Filecoin surges – discover why these hot…

Ripple stablecoin RLUSD was integrated Chainlink Price Feeds to enhance its usability.

Dubai, United Arab Emirates, 7th January 2025, Chainwire

This website uses cookies.