Through recent moves, it can be seen that Polygon is focusing on building blockchain infrastructure, and expanding blockchain’s scaling capabilities.

This is a Polygon Panorama series that analyzes notable events in the Polygon ecosystem on a weekly basis.

IMPORTANT UPDATE IN THE POLYGON ECOSYSTEM

- On-chain activity on Polygon PoS Chain is trending down. However, the number of contracts deployed on the Polygon PoS Chain increased sharply in Q2.

- Polygon ID, specific purpose rollup involves payments like Polygon Hermez & Polygon Nightfall but it will be a while before we see early applications of this technology. The general purpose rollup is still in the research and development phase.

- The DeFi ecosystem on the Polygon PoS Chain “slows down”.

- The Gaming & NFT system on Polygon PoS Chain has dropped sharply since the beginning of 2022.

ANALYZING EACH PUZZLE PIECE ON POLYGON

General Status Of Polygon PoS Chain

Similar to other EVM chains, the Polygon PoS chain is a temporary scaling solution for Ethereum overload. However, the approach of Polygon PoS chain brings PoS Chain the following limitations;

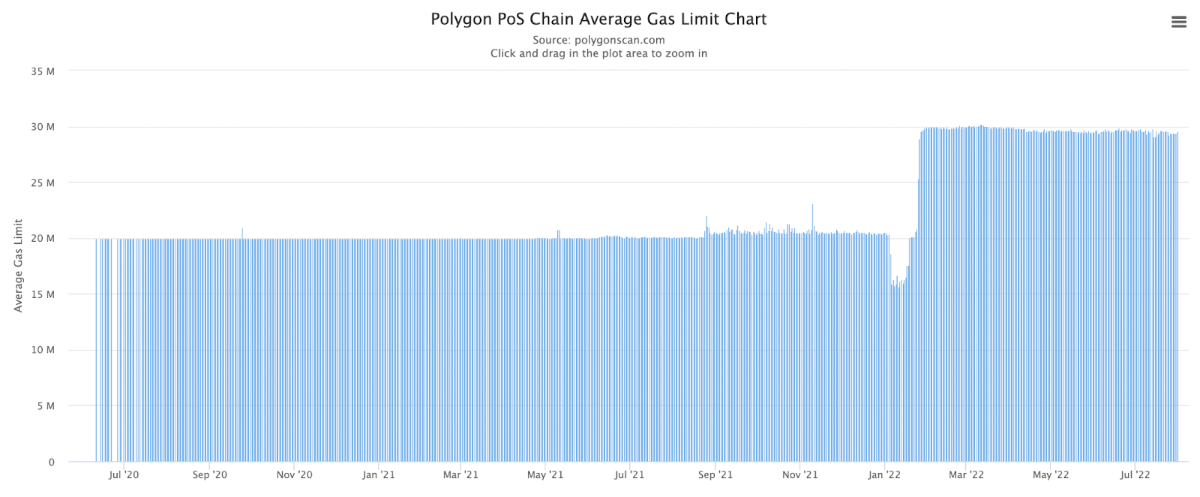

Increase the block limit by 50% from 20M Gas to 30M Gas

This means increasing the resource limit that a block can use. This basically increases the upper limit of the Polygon PoS Chain. In case the network has a sudden increase in usage, the Polygon PoS Chain can still handle it.

However, in the long term, this choice will pay the price with a “heavier” network state, affecting network decentralization and synchronization. In general, scaling the network by increasing the block limit is a trade-off between short-term efficiency and long-term scalability of the network.

Activity on Polygon PoS Chain is trending down

Expressed through the following parameters: daily gas price tends to increase, daily gas used, and daily transactions of the whole network tend to decrease.

As we all know, Gas is a unit used to measure the amount of computational effort required to perform specific actions on the Polygon PoS Chain. The simplest operation is sending a transaction from wallet address A to wallet address B costs 21,000 gas, swapping tokens from wallet address X to wallet address Y costs 100,000 gas, more complex operations will take a lot of gas than to perform.

However, the gas cost does not indicate how much we have to pay for a particular transaction. To calculate the transaction fee for a particular operation on the PoS Chain, we have to multiply the gas cost by the gas price (gas cost * gas price).

Although, the total revenue of the network tends to increase slightly, but this increase comes mainly from the increase in gas price, while, daily transaction and daily gas used tend to decrease.

The number of contracts deployed on Polygon PoS Chain increased sharply in Q2

In Q2, 90,000 new wallets put contracts on Polygon PoS Chain. This is triple Q1, bringing the total number of successful deployments to Polygon PoS Chain to 789,000.

Update Development Status Of Polygon Products

PoS Chain is just a product of Polygon. Polygon is developing a lot of different products that focus on blockchain infrastructure.

Polygon ID is a blockchain-native, privacy-focused identity system. Polygon ID is programmable to empower people and enable trusted interactions with web3. Polygon ID is currently live on the mainnet but it will be a while before we see early applications of this technology.

The rest of Polygon’s products focus on the blockchain scaling story;

- Focus on Rollup technology: Polygon Avail, Polygon Zero, Polygon Nighfall, Polygon Miden, Polygon Hermez.

- Focus on sidechain technology: Polygon Edge, Polygon PoS.

In particular, the specific purpose rollup related to payment such as Polygon Hermez & Polygon Nightfall has mainnet. General purpose rollups like Polygon Avail, Polygon Miden & Polygon Zero are still in the research and development stage. The launch time of the general purpose rollup may fall in the range of Q1/2023 – Q3/2023.

For the App-chain trend, Polygon also follows the trend when providing developers with 2 development solutions, Polygon Supernets and Polygon Edge. According to information provided by Polygon, there have been more than 20 projects participating in app-chain development on the Polygon Supernets and Polygon Edge infrastructure.

DeFi Ecosystem On Polygon PoS Chain Stalls

In general, the DeFi ecosystem on the Polygon PoS chain has “stagnated” in the past few months. New capital flows are not moving into PoS Chain. The volatility of TVL is mainly due to the price fluctuations of the tokens.

Primitive DeFi protocols like AMM and lending make up the majority of the TVL of the entire Polygon PoS Chain ecosystem:

- Featured AMMs include Quickswap, Curve, Uniswap, Meshswap & Sushiswap. Which, Quickswap & Curve are the two AMMs that occupy the majority of the market.

- Aave occupies a “monopoly” position on the Polygon PoS Chain as no lending protocol can compete with it.

The majority of DeFi protocols on the Polygon PoS Chain were forked from successful DeFi protocols on Ethereum or as part of a multi-chain development strategy of major protocols on Ethereum.

Similar to DeFi on other EVM chain ecosystems, DeFi on the Polygon PoS chain lacks real use, bootstrapping and token distribution are similar to other EVM chains.

Gaming & NFT Collectibles Plummeted

The NFT market experienced a sharp drop after the crypto market plummeted in June. In general, the downtrend started in early 2022, monthly trading volume, and daily trading volume, and The number of active wallets decreases steadily every month.

The drop of Opensea is a general situation in the crypto market, it reflects the growth of the NFT & gaming ecosystem on the Polygon PoS Chain, which is outstanding in quantity but rather poor in quality.

VERDICT

The move to focus on blockchain infrastructure instead of the application layer seems to be a pretty smart approach by Polygon in the current context. However, the limitation of this approach is that it requires a lot of time to build.

If you have any questions, comments, suggestions, or ideas about the project, please email ventures@coincu.com.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Marcus

Coincu Venture