SEC officials discovered that cryptocurrency firm Bloom advertised its tokens as investment contracts, so defining them as securities.

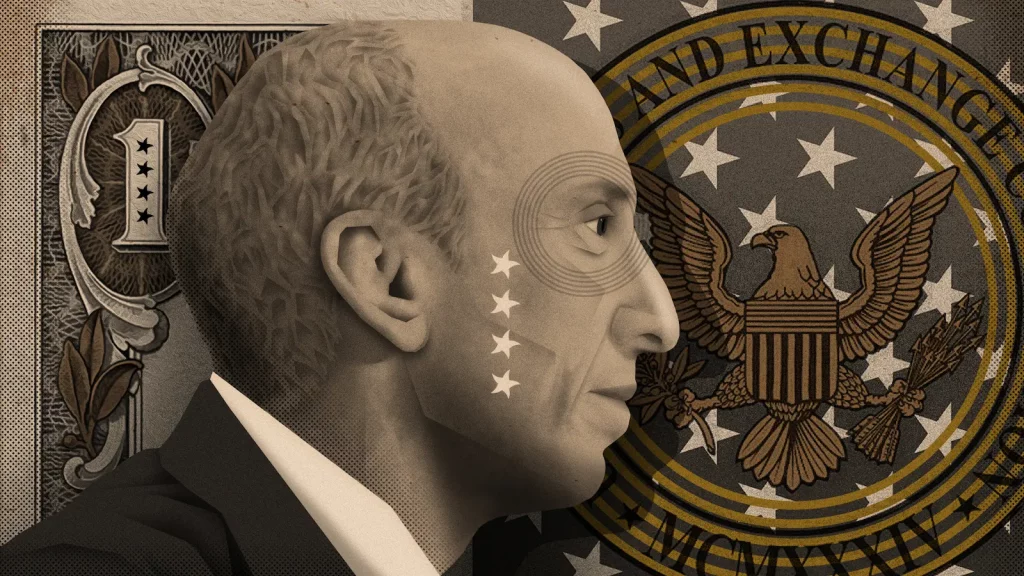

Crypto startup Bloom Protocol has been ordered by the US Securities and Exchange Commission to register its tokens or face a $31 million fine.

The SEC issued a cease-and-desist order to the company on Tuesday, accusing it of offering unregistered securities.

By offering and selling Bloom Tokens (BLT) in an unlicensed ICO between November 2017 and January 2018, Bloom broke the Securities Act, the court said.

The Gibraltar-registered company was successful in raising $30.9 million from about 7,400 investors worldwide, including those in the US, and the SEC intends to punish Bloom for the amount of cryptocurrency raised in its ICO.

Bloom describes itself as a blockchain-powered credit scoring solution that promises to lower the risk of identity theft. Bloom was founded in 2017. It asserts that its solution reduces the expense of customer onboarding and fraud protection.

Bloom promoted BLT as investment contracts which inherently marks them as securities, in line with the Howey Test, according to the SEC.

“A purchaser in the offering of BLT would have had a reasonable expectation of obtaining a future profit based upon Bloom’s efforts … to create an online identity attestation system that would increase the token’s value on crypto asset trading platforms,” the regulator said.

After the SEC order, Bloom’s crypto falls even worse

BLT began trading in late January 2018 at a price close to $1.38, which is still a record high from the previous bull market. Over the ensuing months, BLT experienced a subsequent up to 80% decline. This period was extremely volatile for cryptocurrencies in general, but especially for small and illiquid ones like BLT.

BLT’s price has been steadily suppressed since since in May 2018, when it briefly climbed beyond $1. The value of Bloom’s token has dropped to less than one penny after the SEC’s action was announced, a 70% drop.

BLT’s market value peaked at around $60 million, but it is currently less than $500,000.

The limited presale for Bloom, according to allegations made against the company, was “oversubscribed” and raised a “hard cap of $50 million overall.” Regulators discovered that the average investment during the pre-sale was $340,000 and the average during the public sale was $2,000, which when added together do not equal the maximum that was claimed.

Within 270 days, Bloom is expected to register BLT as a class of securities and notify investors of any claims for money back within 60 days. It is required to complete all investor payments within three months of the claim form’s due date.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Annie

CoinCu News