Clearing and settlement house Depository Trust and Clearing Corporation (DTCC) has launched a private and permissioned blockchain network as an alternative settlement platform.

On August 21, company announcement launched a private and licensed blockchain network as an alternative payment platform to leverage distributed ledger technology (DLT), which is currently processing an average of 100,000 Bilateral stock trading every day.

DLT provides a safer, cheaper, and more efficient alternative to traditional settlement methods, Murray Pozmanter, said in the statement. Pozmanter is the managing director and president of DTCC clearing agency services and head of global business operations.

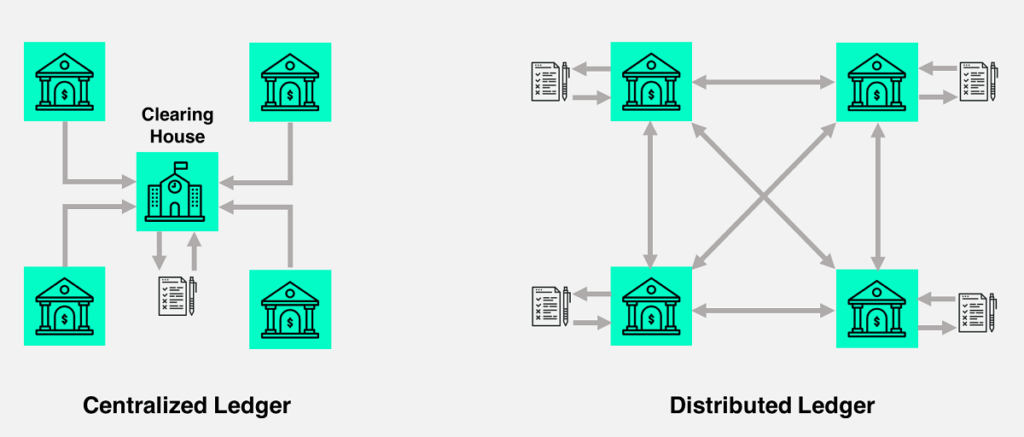

A distributed ledger is a record of transactions held between a network of computers, or nodes. The use of DLT generally relies on cryptography to allow nodes to securely propose, validate and record changes and updates to the synchronized ledger without necessarily needing a central authority, as a 2020 report from the Bank of International Settlements (BIS) explained.

Project Ion is being designed to adhere to rigorous regulatory standards and deliver the resiliency, volume capacity, security, scalability and risk controls that DTCC is known for, the firm said in the statement.

With over 45 years of experience, DTCC is the premier post-trade market infrastructure for the global financial services industry. From 21 locations around the world, DTCC, through its subsidiaries, automates, centralizes and standardizes the processing of financial transactions, mitigating risk, increasing transparency and driving efficiency for thousands of broker/dealers, custodian banks and asset managers.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Foxy

CoinCu News