According to a fresh prospectus filed to the Securities and Exchange Commission (SEC), MicroStrategy has a deal with brokers Cowen and Company and BTIG to sell up to $500 million in stock with the potential to buy more Bitcoin.

According to the filing:

“We intend to use the net proceeds from this offering for general corporate purposes, including the acquisition of bitcoin, unless otherwise indicated in the applicable prospectus supplement. We have not determined the amount of net proceeds to be used specifically for any particular purpose.”

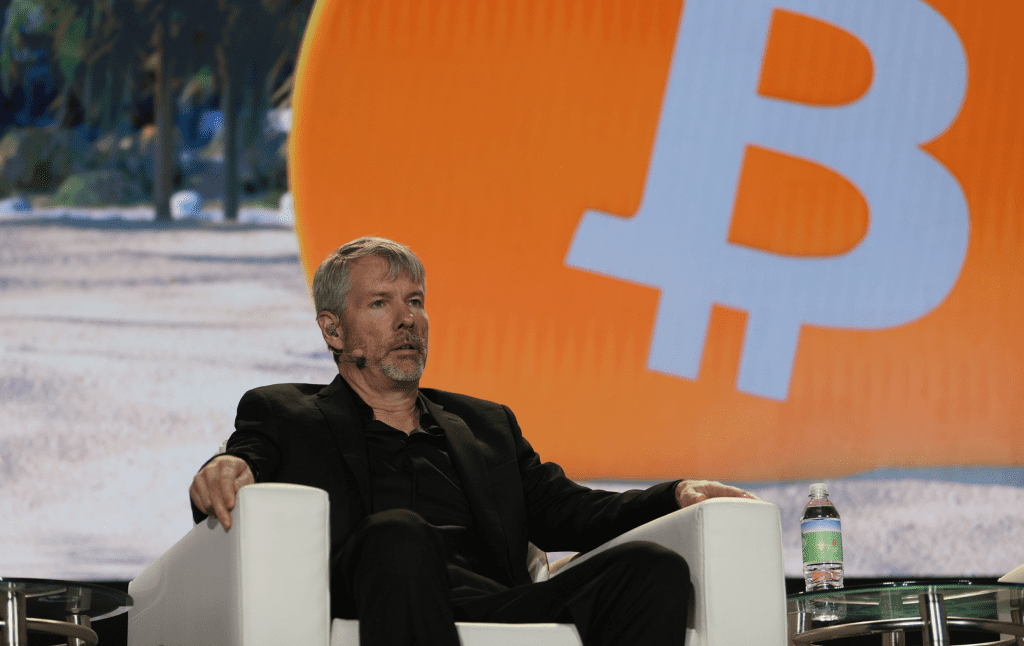

Under former CEO and Bitcoin bull Michael Saylor, MicroStrategy started adding significant amounts of Bitcoin to its balance sheet.

The company still intends to keep Bitcoin over the long term, according to incoming CEO Phong Le. The remarks were made as MicroStrategy disclosed impairment costs of over $900 million as a result of the wider crypto market upheaval and the sharp decline in Bitcoin’s price.

“We have not set any specific target for the amount of bitcoin we seek to hold, and we will continue to monitor market conditions in determining whether to engage in additional financings to purchase additional Bitcoin,” said the business strategy portion of the filing.

BTC was trading up 10%, above $21,000, at the time of writing.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Harold

CoinCu News