The volume of Open Interest spiked when Bitcoin (BTC) surpassed $21,000 yesterday. Here are a few more detailed observations of the market situation.

The heated derivatives market got hotter and hotter before Bitcoin’s rebounding volatility yesterday.

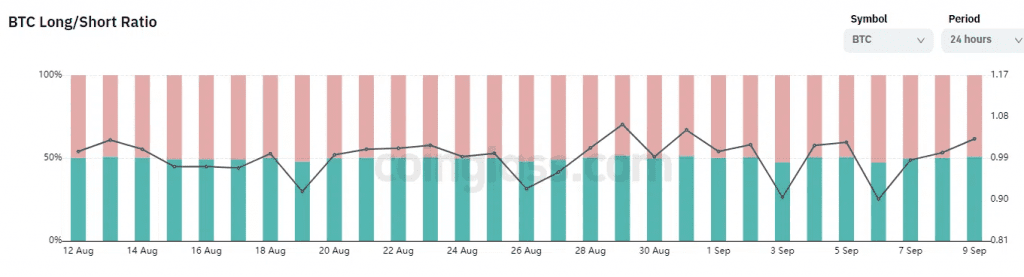

The chart above shows that during the past 3 months, each time the volume of Long/Short positions spiked, there were short-term Bitcoin pumps/dumps (circular markers). The volume of these open positions increased 12% in just a few hours and is close to where Bitcoin was sold at $25,000 last month.

While the amount of Bitcoin on the spot floor is constantly hitting lows, the number of derivatives positions is increasing, which does not help motivate a new redistribution process. Not to mention, last month, the new USDT was not printed in the market but tended to move to the derivatives exchange instead of the spot.

Data from Coinglass shows that, in the past month, the number of Short tends to be more than Long.

In about a month, there are 20 more Short days than Long and 8 more Long days than Short. While this data is somewhat pessimistic, it cannot reflect which side has suffered more as it does not take into account leverage or liquidation prices.

At the time of writing, BTC is trading at $21,300.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Harold

CoinCu News