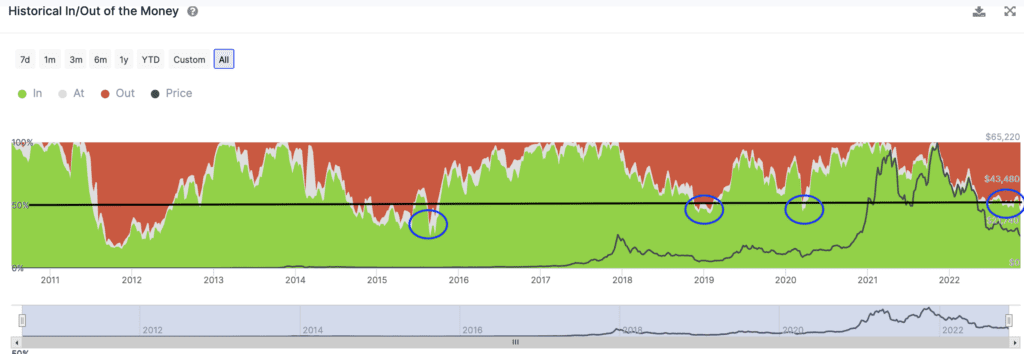

Most addresses holding bitcoin, the largest cryptocurrency, are now losing money, the first time that’s happened since the start of the coronavirus-induced crash of March 2020.

Just over 51%, or 24.56 million addresses of the total 47.85 million, are below purchase price on their investments, according to data provided by blockchain analytics firm IntoTheBlock. About 45% are in the money, that is, boasting unrealized gains, while the rest are roughly at breakeven

IntoTheBlock defines out-of-the-money addresses as those that acquired coins at an average price higher than bitcoin’s going market rate of $16,067.

The bearish momentum looks overdone, according to IntoTheBlock’s Lucas Outumuro.

Previous bear markets ended with the majority of addresses being out-of-the-money.

The percentage of out-of-the-money addresses stood at 55% in January 2019. Bitcoin bottomed near $3,200 around the same time and began a bull run three months later.

The percentage of addresses out-of-the-money rose to 62% during the depths of the 2015 bear market.

Past data, however, is no guarantee of future results and the fallout from the recent collapse of FTX may bring more pain to the market.

Source: Coindesk

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Website: coincu.com

Annie

CoinCu News