Key Points:

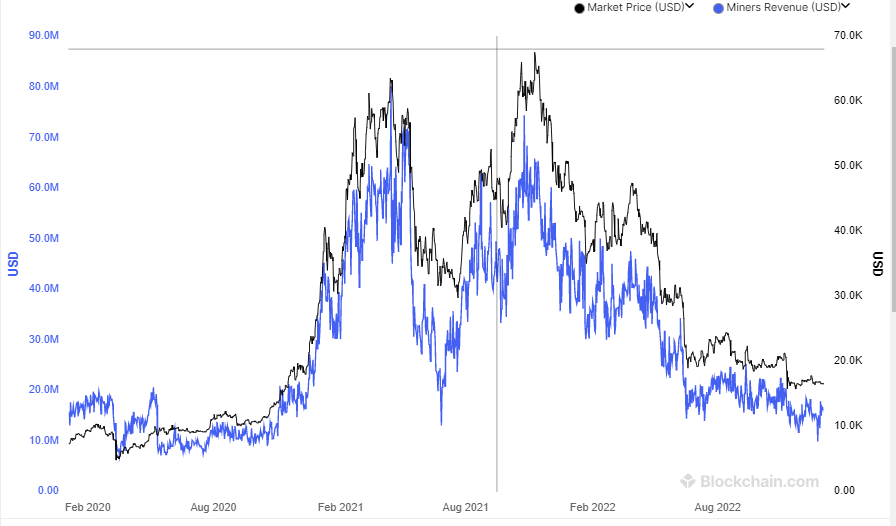

- Bitcoin mining revenue in 2022 fell 37.5% year-on-year to $9.55 billion.

- The market suffered the most from the collapse of LUNA-UST in May and the fall of FTX in November.

- Top miners such as Core Scientific, Greenidge Generation, and Stronghold Digital Mining also hit hard.

Along with poor market conditions, miners also suffered from high electricity costs and record mining difficulty. Data shows that Bitcoin mining revenue in 2022 will drop to $9.55 billion, down 37.5 percent from $15.3 billion in 2021.

Since the culmination of a significant rally in 2021, the cryptocurrency has lost more than $2 trillion in market capitalization to less than $900 billion.

Bitcoin, the world’s largest digital currency, has dropped more than 70% since it hit an all-time high of nearly $69,000 in November. In addition, several companies and projects that failed famously have caused shock waves in the past year.

Crypto winter lasts longer due to central shocks. The event to mention originated in May with the collapse of Terra, causing the two famous coins LUNA and UST to decrease in price to 0 gradually. This has caused many investors to suffer and even lose the actual money they save.

This also led to the collapse of other companies, such as Three Arrows Capital, a crypto-oriented hedge fund, and Celsius, a well-known crypto lender.

Unable to recover yet, the market suffered another bigger shock in November when FTX, one of the largest cryptocurrency exchanges in the world, crashed unexpectedly and quickly, which affected the market. It substantially impacts the entire industry and is said to “pull back” the development of the cryptocurrency industry by decades.

In addition, the prolonged inflation caused the Fed to take measures to raise interest rates. This is also a lid, given the pressure on risky assets, such as stocks and cryptocurrencies, along with crypto-specific failures.

As investors become wary of volatile assets, worsening market conditions also affect miners. Besides market conditions, miners face high electricity costs and record mining difficulty. In 2022, mining difficulty reached a record high due to rising hash rates, leaving some miners struggling to turn a profit.

As a result, the miner’s daily revenue plummeted to $16.173 million – down from $63,548 million on November 10, 2021.

According to the Hashrate Index, debt-to-equity ratios more than tripled for many miners, indicating greater financial leverage. As updated in an earlier Coincu News article, Core Scientific has the highest debt-to-equity ratio of 26.7, followed by Greenidge and Stronghold at 18 and 11.1, respectively. Argo also has a high debt-to-equity ratio of 8.7.

According to Core Scientific’s balance sheet, as of September 30, the company owes the most, with $1.3 billion in debt. The second largest debtor is Marathon, with $851 million in debt.

As a result, miners with high debt-to-equity ratios, such as Core Scientific (CORZ), filed for bankruptcy. At the same time, Greenidge Generation (GREE) and Stronghold Digital Mining have restructured their debt obligations.

Well-known public miners suffered significant losses in 2022. The average loss increased by more than 90%.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Website: coincu.com

Foxy

Coincu News