Key Points:

- Djed, a much-awaited algorithmic stablecoin on Cardano, has launched. However, the con artists didn’t pass up this chance.

- COTI team worked over a year to restore confidence in algorithmic stablecoins with the assistance of Input Output Global (the Cardano developers).

- Over 40 partnerships have joined the Djed ecosystem to promote the adoption of the new stablecoin. It is traded on independent markets including MuesliSwap, Wingriders, and MinSwap.

Djed, a much-awaited algorithmic stablecoin on Cardano, has launched. However, the con artists didn’t pass up this chance.

Negative perception of this class of stablecoins was sparked by the collapse of UST, the algorithmic stablecoin on the Terra platform. Investors lost billions as a result of last year’s fall, which further pushed the cryptocurrency market into a bear market.

The COTI team worked over a year to restore confidence in algorithmic stablecoins with the assistance of Input Output Global (the Cardano developers). Finally, with the introduction of Djed, they declared “a new era of stablecoins.”

Djed launches on Cardano mainnet

Over 40 partnerships have joined the Djed ecosystem to promote the adoption of the new stablecoin. It is traded on independent markets including MuesliSwap, Wingriders, and MinSwap.

Djed has not yet been listed on centralized exchanges. However, Bitrue declared that it would offer the cryptocurrency on its platform before any other centralized exchange.

The team has constructed Djed to be overcollateralized by 400%–800% by Cardano’s native token ADA and reserve coin Shen in order to combat the unfavorable perceptions of algorithmic stablecoins. Investors will be able to view the on-chain proof of reserves to determine the reserve ratio.

Along with adding Wrapped Bitcoin (WBTC) and Wrapped Ethereum (WETH) as reserves, the team also announced that they intended to add other assets.

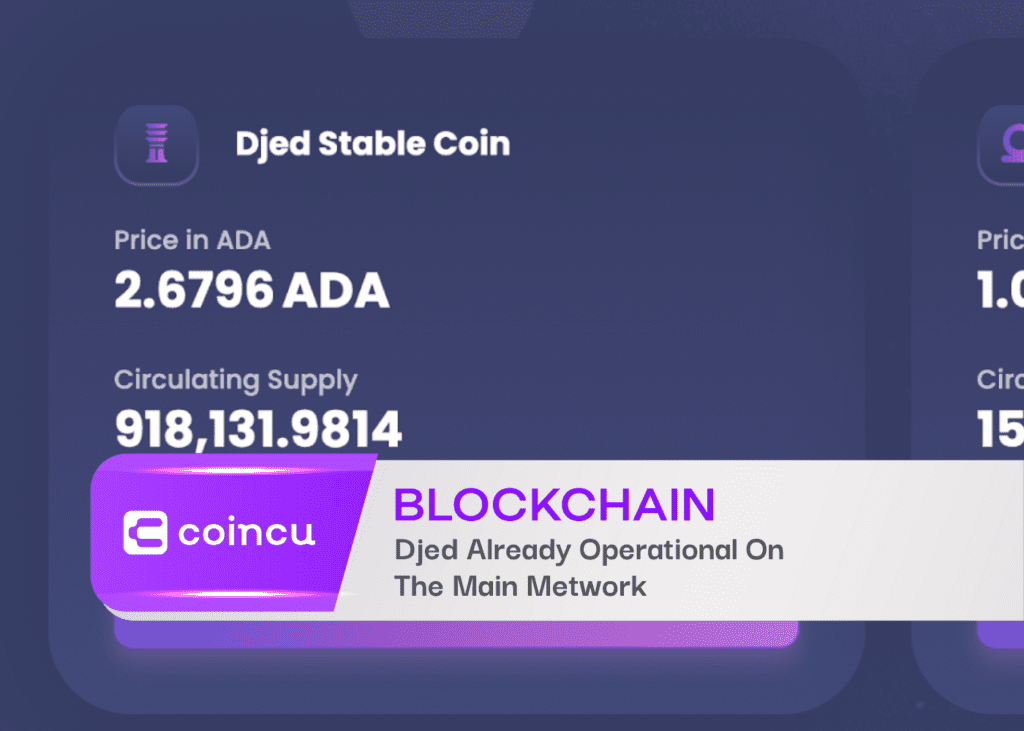

Djed costs 2.67 ADA, while Shen costs 1.08 ADA, per the company’s official website. Currently, it is funded by over 20 million ADA tokens and has a reserve ratio of 783%.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Website: coincu.com

Annie

Coincu News