Key Points:

- In comparison to a loss of $90 million during the same time the previous year, MicroStrategy reported a net loss of $249.7 million for the fourth quarter of 2022.

- When compared to the same period last year, revenue came in at $132.6 million, above analyst estimates, which were $134.5 million.

- The company stated that $197.6 million in charges for the impairment of digital assets had an impact on the net loss.

MicroStrategy on Thursday reported its fourth quarter 2022 financial results.

MicroStrategy’s latest earnings report showed that the company had a net loss of $249.7 million in the fourth quarter of 2022, compared with a loss of $90 million in the same period last year. MicroStrategy noted that the net loss was primarily due to a $197.6 million Bitcoin impairment charge. During the period covered by the latest earnings report, Bitcoin is down over 60%.

The company said it sold 704 Bitcoins for $11.8 million in cash in the fourth quarter of last year. Overall, the company’s total Bitcoin holdings increased to 132,500 Bitcoins, worth $1.8 billion, by the end of 2022, compared to 130,000 at the end of the third quarter. The company said its cumulative impairment losses on bitcoin holdings reached $2.2 billion.

Andrew Kang, the Chief Financial Officer of MicroStrategy, said in the statement:

“I am pleased to report we again increased our bitcoin holdings this past quarter to a total of 132,500 bitcoins. Our corporate strategy and conviction in acquiring, holding, and growing our bitcoin position for the long term remains unchanged. And while we encountered macroeconomic and foreign currency headwinds in 2022, we continue to shift to higher quality, recurring revenues as we grow and scale our cloud business. We remain intentional and precise in prioritizing costs, focusing on areas that drive revenue growth while preserving margins.”

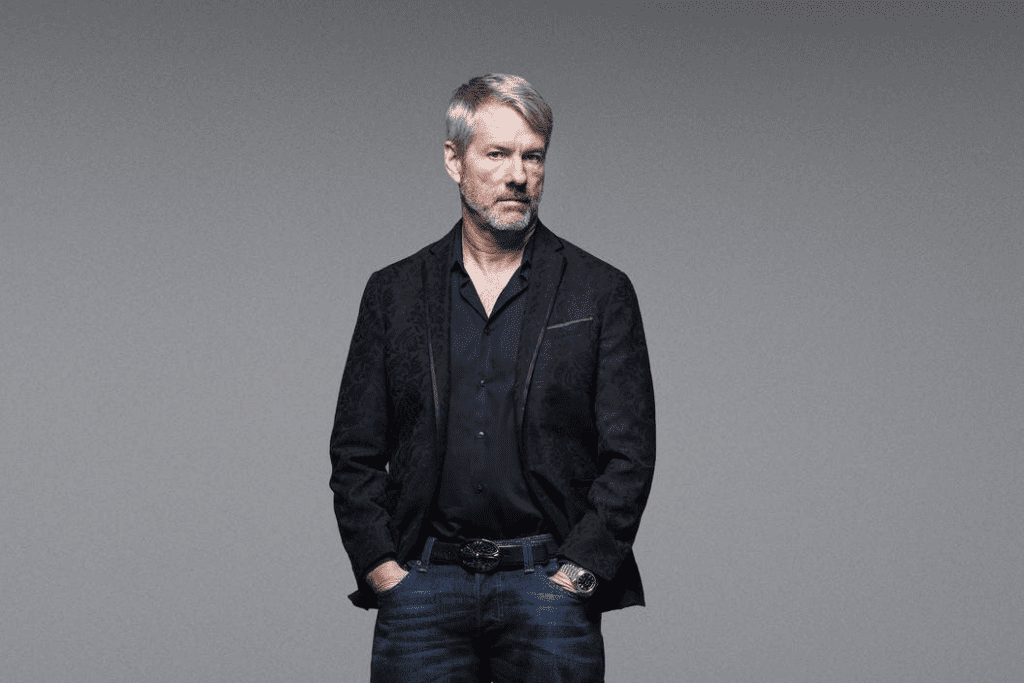

Co-founder Michael Saylor once again affirmed his belief in Bitcoin after the report was published.

But since the company started buying Bitcoin in August 2020, MicroStrategy stock has outperformed major indexes and big tech monopolies Google, including Apple, Microsoft and Amazon.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News