Key Points:

- Delphi Labs and Attic Labs have completed the main development of the Cosmos-compatible Passive Concentrated Liquidity AMM protocol code.

- Using the PCL method, AMM will The exponential moving average automatically adjusts the acceptable price range, algorithmically amplifying the liquidity around the current market price of any pair of tokens.

- This will serve as a fork of the Astroport protocol, which is currently awaiting finalized audit results.

Delphi Labs and Attic Labs have completed the main development of the Cosmos-compatible Passive Concentrated Liquidity (PCL) AMM protocol code.

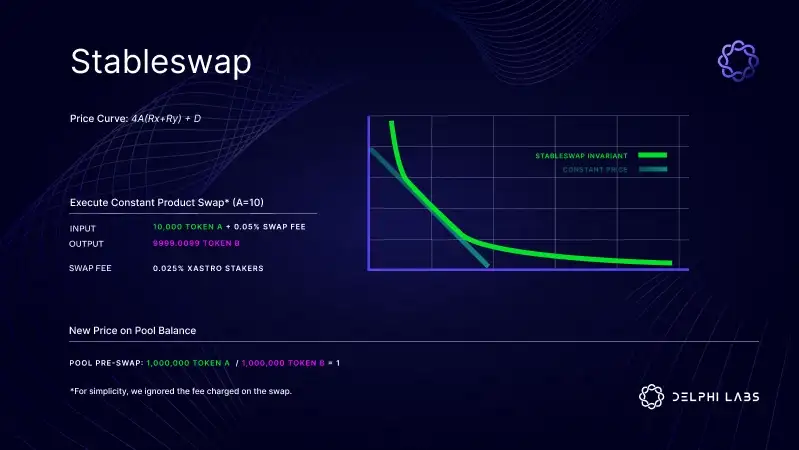

Liquidity around a specific price is concentrated (or amplified) via concentrated liquidity pools. Stableswap pools that are now active on Terra 2 and in other Cosmos ecosystem chains provide a fantastic illustration of a very particular kind of focused liquidity. They function by focusing liquidity for assets like stablecoins at a 1:1 ratio.

In particular, stableswap pools modify the formula for the typical constant product pool by adding an amplification component. How closely the stableswap curve should resemble the typical XYK constant product curve is determined by the amplification parameter (A).

Higher values of A move the curve closer to the constant price curve, resulting in smaller slippage at exchange rates close to 1:1. An amplification value of 0 (A = 0) produces results equal to those of the constant product pool method.

With a PCL approach, an AMM would instead automatically adjust the acceptable price range based on the exponential moving average of the tokens in the pool. This will serve as a fork of the Astroport protocol, which is currently awaiting finalized audit results.

For decreased trade slippage, constant product pools need exceptionally deep liquidity. PCL pools can provide better execution with a fraction of the depth of CPPs by focusing liquidity around a particular price.

PCL has implemented dynamic fees in an effort to reduce risk concentration (or amplification). Fees would automatically move higher or lower depending on volatility as opposed to being fixed. As a result, LPs profit more when the market is volatile.

By enabling LPs to explicitly choose a certain price range where they’d like to deploy their liquidity, Uniswap v3 provides LPs more control. Instead, using a PCL strategy, an AMM would automatically alter the permissible price range in accordance with the tokens in the pool’s exponential moving average.

This enables LPs to offer liquidity only once and to do so with confidence, knowing that their tokens will continue to operate as active liquidity on the AMM. This method favors passive LPing over finer-grained control.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News