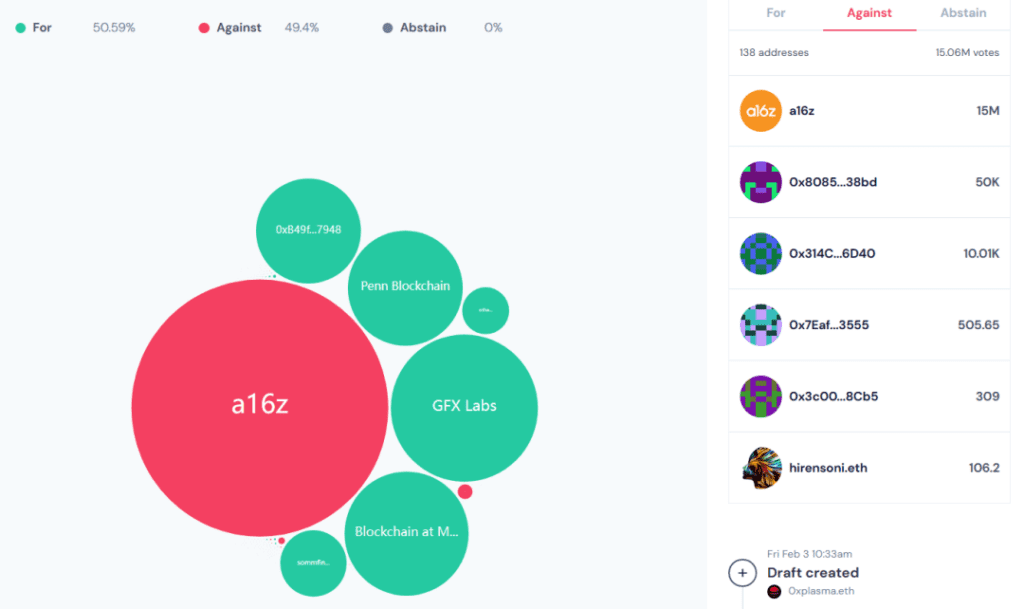

On February 5, a16z voted against the final proposal to deploy Uniswap V3 on the BNB Chain, which led to the shelving of Uniswap’s plan to land on the BNB Chain.

Community KOL directly questioned, saying, “Uniswap is controlled by a16z?” and quoted speculation about a16z’s suspected personal interests:

“The reason why a16z used its entire voting weight to oppose Uniswap’s use of the Wormhole cross-chain bridge to start Uniswap on the BNB Chain. The agreement was proposed because it is a large investor in Wormhole competitor LayerZero.”

The VC figure behind the DeFi protocol

In fact, a16z is indeed a key figure behind Uniswap with a decisive influence: Bubblemaps statistics show that a16z can control 41.5 million UNIs through 11 addresses, which accounts for 4.15% of the UNI supply.

And so far in this voting, a16z has taken the upper hand by using only 1,500 UNI weights, which also means that a16z’s UNI weight is an indispensable voting force for passing any UNI proposal.

In fact, a16z is not unwilling to deploy Uniswap to BNB Chain – after all, when Uniswap decided whether to deploy it in Polygon, Celo, and zkSync, a16z voted for it.

According to the specific statement retweeted by Changpeng Zhao, the core of this struggle is that a16z is unwilling to use Wormhole as a cross-chain bridge as a cross-chain option for Uniswap to log on to BNB Chain.

This involves a direct battle between venture capital firms a16z and Jump – they respectively support LayerZero and Wormhole, two cross-chain bridges.

In fact, it is not uncommon for DeFi agreements to actively or passively choose sides because of the influence of the VC behind them to provide capital support. As early as August 2021, SushiSwap revealed why it chose to use Arbitrum instead of Optimism as its first Layer-2 expansion solution.

Among them, SushiSwap bluntly said that it was because Optimism gave Uniswap preferential treatment and promoted Uniswap to go online first: Although “SushiSwap has been deployed on Optimism’s Kovan test network, but was finally told that Uniswap will get this opportunity, and Optimism very directly told Uniswap that it must be deployed first.”

According to SushiSwap, Optimism favored Uniswap because it was influenced by investors a16z and Paradigm, and bluntly stated that these two venture capital firms might “collude” to influence and benefit their vested projects.

The governance game in the blockchain world

There is nothing new under the sun. Earlier in November 2021, another wonderful “House of Cards” plot of Curve, another leading DeFi protocol, was staged.

First of all, we need to review the mechanism design of Convex-Curve:

CVX is the native Token of Convex. Holding CVX is equivalent to having control over Convex. CVX is the governance token of the Convex platform. By locking CVX, LPs can vote on Convex’s veCRV governance decisions:

Convex uses the more attractive cvxCRV incentive in exchange for the user’s CRV;

Convex locks this part of CRV for four years in exchange for the largest Curve voting rights (veCRV);

After Convex obtains a large number of veCRV, it is equivalent to controlling Curve;

In other words, controlling CVX is controlling Convex, and controlling Convex is equivalent to controlling Curve. At this time, it can increase the incentive weight for a specific stablecoin pool, which leads to many interesting things—such as bribery by the stablecoin project party.

In November 2021, the Mochi stablecoin USDM team used Convex to launch a “governance attack” on Curve in which “bad currency is exchanged for good currency”:

First, Mochi launched the governance token MOCHI and launched a USDM stablecoin (mortgage casting, MOCHI is one of the collateral) liquidity pool incentives on Curve;

Then, the Mochi project party used a large amount of MOCHI it held to print a large amount of USDM and then exchanged it for DAI on Curve;

Then, the Mochi project used the exchanged DAI to purchase a large amount of CVX (about 6,000 ETH) and then voted and successfully increased the rate of return of the USDM liquidity mining pool on Curve (distribution of CRV rewards);

Finally, attracted by the high yield, more liquidity providers participated until the liquidity pool of the USDM stable currency reached 100 million US dollars. The project party minted MOCHI into USDM and exchanged it into DAI in the pool. Directly cash out and run away, resulting in a loss of up to 30 million US dollars;

The whole process can be regarded as a textbook-level case surrounding the governance logic of low-quality stablecoins, Curve, and Convex. This also shows from the side that Convex exerts an increasingly important influence in the entire encryption market through its “control” of Curve.

What happened to DeFi?

Since the “DeFi Summer” in 2020, the entire DeFi track has achieved considerable development. The market has spawned many subdivisions, such as DEX, lending, derivatives, fixed income, algorithmic stablecoins, asset synthesis, and aggregators.

However, since reaching its historical peak on May 19, 2021, traditional DeFi blue chips such as UNI, LINK, SUSHI, and SNX are gradually showing signs of decline. Whether it is an established DeFi leaders such as Uniswap and Synthetix, or a “DeFi 2.0” rookie such as OHM, they all seem to have escaped. Can’t bear the fate of being gradually indifferent and disgusted by the market.

Especially in the development of the encryption world in the past 2022, after experiencing the successive prosperity of narratives such as NFT, DAO, Metaverse, and Web3, DeFi has been forgotten by most market participants and has become a market narrative that has fallen out of favor.

However, temporarily putting aside the sluggish performance of the vertical DeFi protocol token in the secondary market, only from the inside of the DeFi track, there are still some interesting variables happening.

The most notable thing is that in addition to playing the role of the underlying components, with the DeFi leaders of these protocol layers as the center, the tools and application layer DeFi projects around them have also begun to be continuously derived and more advanced functions have been continuously strengthened.

It is obvious that more and more DeFi “tool applications” revolve around a single underlying “Super DeFi Protocol” to assist it in improving richer advanced derivative functions, relying on the underlying “Super DeFi Protocol” to develop and grow, And eventually feed back the underlying “Super DeFi Protocol” to achieve greater empowerment, thus gradually producing a unique and self-contained “small ecology.”

Just as Uniswap+dextools\Unitrade\Yin is equivalent to liquidity management, Curve+Convex is to stable currency exchange, etc., what is more, interesting is that further “cooperation” is taking place between this small ecology.

Taking Curve as an example, it is well known that in the stablecoin exchange, especially in the large-amount stablecoin exchange track, Curve’s handling fees, exchange slippage, and impermanent losses are far lower than those of other AMM DEXs, such as Uniswap or Sushiswap, and it is a well-deserved industry leader.

But at the same time, Curve and Synthetix, a synthetic asset protocol, also cooperate to launch a cross-asset exchange service, providing the Swap function of common assets (such as ETH/WBTC pairs).

This is also a microcosm of the current many DeFi protocols starting from many channels to carry out self-salvation.

Conclusion

After experiencing the Cambrian explosion in 2020 and peaking and falling in 2021 and 2022, the current scene innovation in the DeFi world has basically reached saturation. How to further improve the governance mechanism and improve the encryption economic model in the entire protocol mechanism? The role is the key to opening the second half.

In general, whether it is “governance evolution” or the innovation of the Token economic model in the DeFi world, there is still a long way to go. Let us wait and see where it will go.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Website: coincu.com

Harold

Coincu News