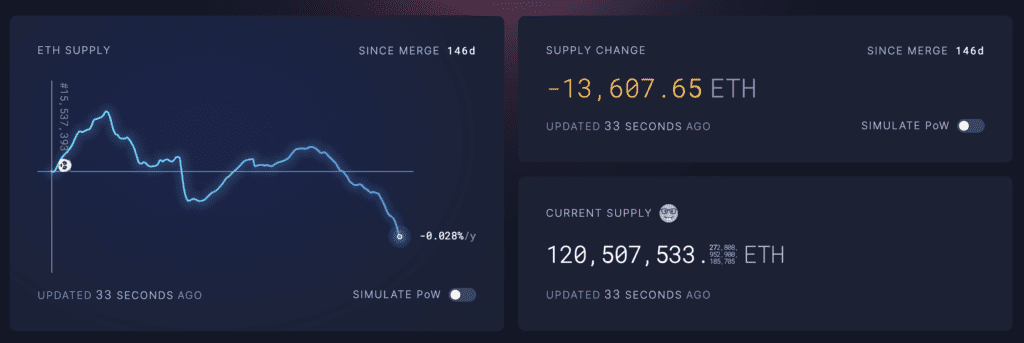

Ethereum’s current annual inflation rate is -0.02%, and the total supply has decreased by more than 9,500 tokens since The Merge.

According to Ultrasound Money, ETH’s annual inflation rate fell below zero on January 15. This means that the ETH blockchain is burning more ETH than is being newly minted. Still, ETH trailed Bitcoin in gains as January came to an end. The most direct reason is that market funds have chosen to avoid risks, waiting for the market reaction after the ETH pledge is unlocked.

In fact, starting from the second half of 2021, the ETH/BTC trading pair has entered a phase of horizontal operation. In this range, the market value of ETH accounts for about half of the market value of BTC, which seems to be a certain value balance recognized by the current market. Break this balance requires external force or the impetus of a new narrative.

For example, the surge in activity on the Ethereum chain leads to increased deflation of ETH, or ETH is more respected by traditional finance. But there are no such signs yet, which also makes the relative valuation between BTC and ETH difficult.

Recently, Coinshares, known as “Europe’s largest digital asset investment and trading group,” released a survey to gain insight into the thoughts and actions of professional investors in the digital asset field. According to the results of Coinshares’ latest digital asset quarterly fund manager survey, among the 43 fund managers surveyed (with total assets of $390 billion), 60% of fund managers believe that ETH has the best growth prospects in 2023.

The survey also found that investments in BTC and ETH have consolidated and are increasingly being included in hedge fund portfolios, rising from 0.7% to 1.1%, with the trend towards including digital assets in portfolios driven by customer demand and speculation.

Judging from the recent upward momentum, the BTC rainbow chart has rebounded from the bottom “low-price selling zone” to the junction of the “buying zone” and “hoarding zone,” while ETH is still at the bottom of the “low-price selling zone.” If the follow-up market upward trend is confirmed, the elasticity of ETH’s rise will be greater than that of BTC.

Shanghai upgrades selling pressure

The most critical content of the Shanghai upgrade is that it will allow the withdrawal of 16.45 million ETH locked and pledged on the beacon chain since December 2020.

If the staker only wants to take out the consensus rewards earned over the years, it can be processed quickly without queuing. In other words, the total rewards (approximately 1 million ETH) obtained by staking in the past two years can be withdrawn immediately.

If the pledger wants to withdraw all the 32 ETH of each node together with the reward, it belongs to the withdrawal of the consensus layer, which involves network security and needs to wait in line. At present, the total number of ETH nodes is over 500,000. Based on this data, Shanghai can withdraw up to 1,800 nodes (57,600 ETH) per day after the upgrade.

Assuming that 10% of the nodes need to withdraw, they need to queue for more than a month. It is worth noting that now entering the Ethereum network as a validator also has to queue up, and the daily entry amount and the daily exit amount are the same algorithms. If calculated on the basis of 500,000 nodes, there are 1,800 nodes per day, which can keep the overall consensus mechanism of Ethereum stable and achieve a soft landing.

Moreover, among the ETH currently participating in the pledge, a large part (estimated to be more than 60%) is liquid. For example, ETH pledged in Lido can obtain stETH, which can be freely traded in DEX or other platforms. For those verifiers who have no long-term pledge willingness, they may have already withdrawn from the Ethereum pledge ecology. For the remaining pledged ETH, The selling pressure is not expected to be too great.

From another perspective, once the Shanghai upgrade is successful, the ETH pledged on the Ethereum mainnet can be withdrawn flexibly (the queue time will not be too long). In fact, the ETH pledge interest rate is a dynamic game process. When the number of pledged ETH is small, the pledge return rate is very high. From the official ETH pledge APR chart, when the total amount of pledge is 790,000, APR can reach 17.6%.

However, when a high APR attracts a large number of ETH pledges, the APR will slowly decrease. When the amount of ETH pledged reaches 10 million, the APR will drop to about 5%, which is the current level. However, as the amount of ETH pledged increases, the APR decline curve will be smoother.

The high-certainty, high-interest rate, and flexible pledge brought about by the open withdrawal of the ETH pledge mentioned above will not only stimulate new ETH holders to participate in pledge but also for institutions or giant whales that are pledging to continue to pledge. Favorable option.

Pledge withdrawal testnet: On February 1st, the Zhejiang public testnet allowed Ethereum users to simulate the process of withdrawing their pledged ETH. The Zhejiang public testnet, launched at 10 AM on February 1, will give validators the opportunity to perform the withdrawal function on a simulated version of Ethereum to mimic the process of the Shanghai upgrade. At the same time, ethereum’s core developers are also monitoring the mass use of such features and making adjustments to address any potential issues.

It is worth noting that the release time of the Shanghai upgrade has been under review and discussion, mainly due to the pressure caused by a large amount of capital. Until then, developers at the Ethereum Foundation had been citing March 2023 as a likely date for the Shanghai hard fork. According to recent news from Ethereum core developer Terence Tsao, the Shanghai upgrade may be completed in March or April.

After the Shanghai upgrade, Ethereum developers plan to release EIP-4844 in May or June 2023 — potentially reducing transaction fees by orders of magnitude and increasing the scalability of L2 rollup on Ethereum by 100 times.

According to data from Dune Analytics on February 2 (ETH price is around $1,600), among the pledged ETH, 35.5% of ETH is in a state of profit, while 64.5% is in a state of loss. From this perspective, the incentive for the pledged ETH to be actively withdrawn will not be too strong.

ETH merge economics

According to a recent report from Messari, the merger marks a significant change in Ethereum’s business strategy. By switching to the PoS consensus mechanism, Ethereum’s environmental impact has been reduced by more than 99%, making it a more attractive investment target for organizations interested in environmental, social and corporate governance (ESG). Additionally, it reduces miner selling pressure by nearly $500 million per month and reduces new issuance by 90%. Finally, due to the fee-burning mechanism Ethereum implemented in EIP-1559 in August 2021, it becomes a net deflationary asset with real yield.

Since EIP-1559 went live last summer, the Ethereum system has burned around 85% of all transaction fees, with the remaining 15% distributed to miners as tips. If the transaction fees burned are greater than the network’s issuance rate, Ethereum’s supply will become net deflationary. The applications that contribute the most to burning are mainly on-chain transfers, Dex transactions (Uniswap), stablecoin transfers (usdt), NFT transactions (OpenSea), wallets (MetaMask), etc. These applications also maintain a considerable amount of ETH burned in the bear market.

According to Messari, the ethereum network could experience steady-state deflation of 1% to 2% per year, depending on demand for block space. The yield in 2023 could be between 5% and 7%, establishing a “risk-free rate” for Ethereum’s financial system, depending on the number of active participants on the network and the level of network activity.

This yield curve has already begun to be constructed for investors in some DeFi protocols to track. While overall yields are currently slightly higher, Messari expects yields to eventually decline and return to normal as staking becomes more accessible and derivatives like Lido’s Staked ETH (stETH) become more common.

Indicators on the Ethereum chain

The total supply of ETH will be flat from September 2022, and there will be a decreasing trend.

In recent years, the balance of ETH exchange reverse has continued to decrease and has fallen below 20 million (the balance in the first half of 2020 was more than 30 million).

From the perspective of daily circulation distribution, ETH centralized exchanges only account for about 4% of their holdings, and institutional holdings remain relatively stable. More ETH is in on-chain wallets and pledged on the beacon chain, which is very important for the ecological development of ETH. It is also a good sign.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News