Recently, Arbitrum has taken a significant step toward decentralization with the upcoming airdrop of its governance token, ARB. With its rapid growth and a slew of new and innovative projects, it’s no surprise that Arbitrum is quickly becoming the most active and exciting community in the crypto world. This article will lead you to the promising projects being developed within its ecosystem.

Introduction

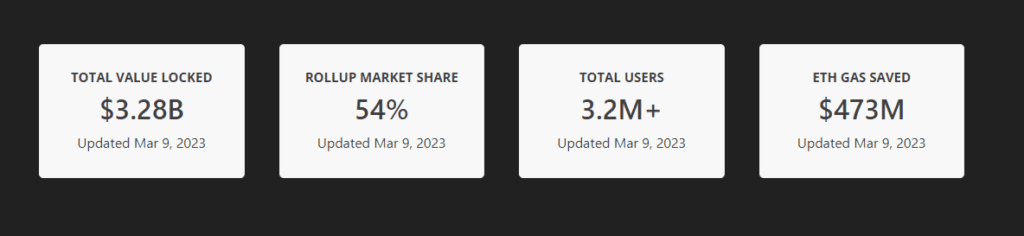

Arbitrum, the Ethereum layer 2 scaling solution, has become the talk of the town among the crypto community. The platform’s impressive growth in terms of total value locked (TVL) equal to $3.28 Billion and innovative projects is turning heads.

At the forefront of this success is GMX, the revolutionary perpetual DEX that has attracted a significant percentage of the TVL on the Arbitrum network. According to DefiLlama, GMX accounts for 17% of TVL, contributing to the network’s overall growth.

Recently, Arbitrum has taken a significant step toward decentralization with the upcoming airdrop of its governance token, ARB. The airdrop is scheduled for March 23, and according to the Arbitrum Foundation, it marks the project’s official transition into a decentralized autonomous organization (DAO).

The airdrop will distribute 12.75% of ARB’s total supply to those using the network in the past year. The distribution will be based on users’ activity and will not include tokens used to pay network transaction fees.

VELA Exchange

Vela Exchange ($VELA) is a decentralized exchange (DEX) that focuses on community-focused incentives, advanced perpetual futures trading capabilities, and scalable infrastructure. Compared to centralized exchanges, VELA offers several advantages, including equitable access to platform rewards, self-custody of assets, and the absence of a centralized clearing house.

VELA’s token model is similar to GMX’s dual model. The platform has two native tokens, $VELA and $VLP. The $VELA token is the platform’s utility token that can be staked to earn a share of trading fees. Users who stake $VELA tokens will also enjoy discounted trading fees, earn eVELA from buybacks, and receive ecosystem rewards.

On the other hand, the $VLP token is Vela’s liquidity provider token. It is based on USDC staking and can be redeemed for USDC. The token provides liquidity for perpetual traders, allowing them to take positions with leverage.

By offering a dual token model, Vela is catering to the needs of two different groups of users on its platform. Traders who stake $VELA tokens earn a share of the trading fees, while liquidity providers who hold $VLP tokens earn rewards for providing liquidity to the platform.

Vela’s focus on advanced perpetual futures trading capabilities makes it an attractive option for traders looking to access leveraged trading opportunities. The platform also offers a user-friendly interface and low fees, which further adds to its appeal.

Vela Exchange has made an impressive achievement with a trading volume of $4 billion in just one month of beta testing. This achievement highlights Vela’s ability to scale, grow, and adapt in the face of challenges, leading the exchange to reach this significant milestone. The industry is currently experiencing tough times, yet Vela Exchange managed to make such impressive progress. This milestone serves as a testament to Vela’s potential for continued success in the future.

CVI: Crypto Volatility Index

Crypto Volatility Index (CVI) has introduced a decentralized VIX that enables users to hedge or protect themselves from volatility in the crypto market. The project aims to provide an ecosystem of volatility trading products, including the Volatility tokens, which allow users to take a tokenized position in the form of an ERC20 token.

The CVI Index tracks the 30-day implied volatility of Bitcoin ($BTC) and Ethereum ($ETH) and acts as a “market fear index” for the crypto market. Its range is between 0 and 200 and is produced using the Black-Scholes option pricing model.

CVI uses Chainlink External Adapters to source data, which connect smart contracts with Chainlink nodes. Smart contracts dictate tasks to the nodes, such as what tasks need to be performed and at what intervals.

With its ecosystem of volatility trading products and its innovative approach to sourcing data, CVI aims to provide users with a comprehensive solution to protect themselves from market volatility.

CVI offers two main features for its users to benefit from:

- Firstly, the CVI Platform AMM enables users to trade the index and hedge against market volatility directly.

- Secondly, users can trade volatility uniquely with Volatility Tokens, allowing these tokens to be traded on multiple DEXes and CEXes without losing their peg to their respective indices. This feature enhances the accessibility of CVI to other protocols.

- Index Peg: CVI tokens are pegged to the underlying volatility index, ensuring that the token’s value reflects the level of volatility in the market. In the event that the token deviates from this peg, traders can take advantage of arbitrage opportunities to bring the token back in line with the index.

- Hedging and Exposure: CVI tokens provide a way to hedge against volatility in the market, similar to how ETFs use the VIX. Traders can use the CVI index to manage their risk exposure and protect against losses during periods of high volatility.

- Elastic Supply: To maintain the peg to the underlying index, the supply of CVI tokens is adjusted daily at 00:00 UTC. This protects the token from time decay and the actions of arbitrageurs, ensuring that the token remains closely tied to the underlying index.

Theta Vault

CVI has recently introduced their Theta Vault, which acts as a liquidity pool protecting Volatility Tokens from time decay and is the only way to add or remove liquidity from the CVI AMM. The Theta Vault uses liquidity as collateral to mint or burn Volatility Tokens and move them on DEXs.

It is the only gateway for adding or removing liquidity from the CVI AMM, and as it owns both the AMM liquidity and the DEX liquidity, it is the sole beneficiary of time decay fees, which allows the volatility tokens’ DEX liquidity to scale up without exposing the vault to Theta.

GOVI Token is the governance token of the Coti network, and it was initially distributed to early Coti users. Here’s how it was distributed:

Gamma Swap Protocol

Gamma is a decentralized platform for volatility trading and commission-free token trading without an oracle. GammaSwap is a protocol that allows users to go long gamma through constant function market makers (CFMMs) such as Uniswap, Sushiswap, and Balancer. Users can purchase long straddles and expose themselves to payoff functions, similar to call-and-put options, providing new investment opportunities and portfolio diversification.

As a DEX, GammaSwap enables feeless trading, and liquidity providers can provide liquidity to CFMMs through GammaSwap. Liquidity providers will send their tokens to GammaSwap, which will deposit them into a CFMM in exchange for LP tokens. However, LP tokens from other CFMMs will not be provided to the liquidity provider shorting Gamma but will remain in GammaSwap. GammaSwap will issue its own GammaSwap liquidity pool tokens that represent a liquidity provider’s stake in the CFMM’s liquidity pool and are identical to liquidity pool tokens issued by CFMMs like Uniswap.

Why GammaSwap?

Users can earn a higher yield on their LP positions compared to other AMMs like Uniswap. Although there is an additional smart contract risk associated with using GammaSwap, this risk can be mitigated through audits and bug bounties. GammaSwap also incorporates an interest rate in their profit equation, which is determined by the fees paid by the long gamma side. This means that the yield is always higher than what users would earn on Uniswap or other traditional AMMs.

The profit equation is Profit = Trading fees – IL + Interest rate.

The long gamma position available on GammaSwap offers several benefits to users. These include the ability to trade on the volatility of any token pair and to create hedging strategies to protect against risks such as rug pulls or impermanent loss.

Currently, GammaSwap is operating on Testnet, allowing users to experiment with the platform by providing short gamma or borrowing long gamma liquidity. This provides an opportunity for users to explore how they can profit from impermanent gains.

LuxWorld: Travel to Earn

LuxWorld is a decentralized social app based on the Social-Fi concept, which combines social networking and finance to create a unique user experience. The platform was created with the goal of contributing to the recovery and promotion of tourism, entertainment, and physical activities worldwide after the Covid-19 pandemic.

LuxWorld is starting with Game-Fi, which aims to rebuild the tourism industry and establish relationships between brands and their customers. The platform also emphasizes a Social-Fi aspect to incentivize user-generated Web 3.0 content and build a sustainable community. In the future, LuxWorld plans to partner with leading brands in all fields to offer attractive benefits to its users.

LuxWorld is now live on Arbitrum One

LuxWorld initially chose to develop on the Ethereum blockchain due to its extensive user base and accessibility to users without requiring bridges. However, since launching on a CEX exchange, the project has received feedback from users regarding high gas fees and slow transaction speeds on Ethereum.

In preparation for mainnet operation, LuxWorld has decided to migrate to Arbitrum One, an Ethereum Layer 2 scaling network that offers low gas fees and high transaction speeds.

To ensure that token holders retain their rights, the project has conducted a token swap based on a snapshot taken on February 24th, 2023. Tokens have been airdropped to holders at a ratio of 1:1 and subsequently transferred to their wallet addresses on the Arbitrum network.

The contract address on Ethereum will be replaced by the new contract address on Arbitrum: 0x58b13dE0b56c91497B1AaEb344BE2a4D7d0478C2.

Link to Arbiscan: https://arbiscan.io/token/0x58b13de0b56c91497b1aaeb344be2a4d7d0478c2

The tokenomics remains unchanged.

LuxWorld has announced the beginning of the second phase of their Beta App Testing event, which is open to all users. To participate, users must register their email on the provided form between February 22-23.

The testing period occurred from February 24 to March 3, during which users can test the beta app and join the private group chat for support.

Users who provide feedback on the app will be rewarded with $200 USDT and a Contributor Role on Discord. To receive the reward, users must fill out a feedback form, and the project team will choose the top three testers based on their evaluation of all feedback. Additionally, users can upgrade their role in Discord by sharing their experiences after testing the app.

Check-in Node in LuxWorld

LuxWorld introduces a unique concept of digital real estate through Check-in Nodes, which enables users to earn passive income in the metaverse. These non-fungible tokens (NFTs) on the Binance blockchain allow users to own a specific location in the virtual world, where travelers can check in and earn rewards.

Imminent Launch

LuxWorld, the Web3 Lifestyle Social App based on Social-Fi, will launch its mainnet after the successful beta testing phase. The platform is going open to users worldwide, offering a decentralized social application that combines social networking and finance to incentivize and reward user-generated content.

LuxWorld’s new blockchain infrastructure allows for faster and more efficient transactions, enabling users to engage with the platform seamlessly. With a user-friendly interface, LuxWorld is designed to be accessible to anyone, regardless of their technical expertise or familiarity with blockchain technology.

LuxWorld will offer various rewards to users who engage with the platform after the mainnet launch. In addition to earning rewards for creating and sharing content, users can also earn rewards by participating in LuxWorld’s various community events and initiatives.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Thana

Coincu News