Key Points:

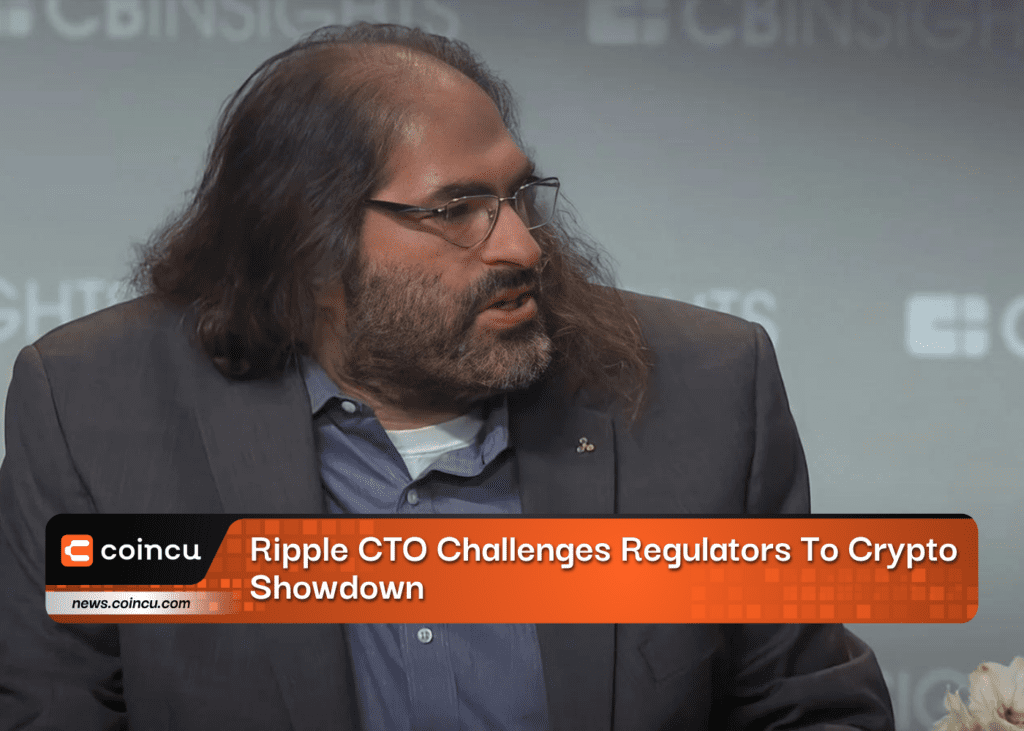

- Regulatory confusion in the crypto industry: Ripple CTO David Schwartz proposes a solution to the inconsistent regulatory approaches between the SEC and the CFTC.

- CFTC lawsuit against Binance raises questions about the regulatory status of digital assets: Bitcoin, Ethereum, and Litecoin classified as commodities, while the SEC only exempts Bitcoin from being considered a security.

- SEC Chairman Gary Gensler implies Ethereum and other PoS tokens should be regulated as securities, complicating the regulatory landscape for cryptocurrencies.

Ripple CTO David Schwartz has proposed an unconventional solution to the inconsistent regulatory approaches between the SEC and the CFTC.

In a tweet on March 28, Schwartz suggested that the two agencies should “fight out among themselves” to determine which one should regulate the crypto industry. The CTO’s proposal highlights the growing frustration with the regulatory uncertainty and the need for a clear regulatory framework for the industry.

The CFTC’s recent lawsuit against Binance, one of the world’s largest cryptocurrency exchanges, has further complicated the situation. The CFTC classified Bitcoin, Ethereum and Litecoin as commodities, while the SEC only exempts Bitcoin from being considered a security. This discrepancy has raised questions about the regulatory status of other digital assets further down the crypto spectrum.

Adding fuel to the fire, SEC Chairman Gary Gensler recently implied that Ethereum (ETH) and other proof-of-stake (PoS) tokens should be regulated as securities. This contradicts the view of CFTC Chairman Rostin Behnam, who has argued that PoS tokens should be classified as commodities. The different views on the regulatory status of digital assets have further complicated the regulatory landscape for cryptocurrencies.

Schwartz’s proposal for a regulatory face-off between the SEC and the CFTC is interesting, as it would help clarify the regulatory framework for digital assets. However, it remains to be seen whether the two agencies will take up Schwartz’s suggestion and how it will be implemented. The proposal has generated a lot of attention and interest within the crypto community, and it will be interesting to see how it develops in the coming weeks and months.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Annie

Coincu News