Key Points:

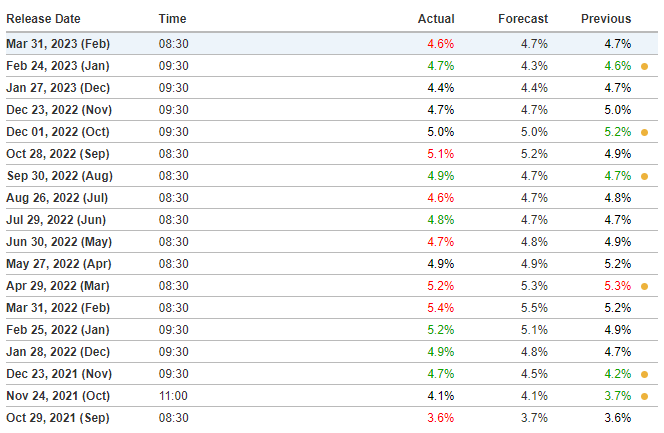

- The February US core PCE price index was 4.6%, slightly lower than expected than the previous value.

- Despite some areas of ebbed inflation, others have seen pernicious rises in shelter costs.

- Recent data shows that borrowing through emergency Fed lending programs decreased slightly, indicating that banking problems may be under control.

The US core PCE price index for February was slightly lower than expected at 4.6%, giving the Fed more confidence in their decision-making.

The United States core PCE price index for February was announced at 4.6%, which was slightly lower than the expected 4.7%. The previous value of the index was also at 4.7%. The odds of a 25-basis-point rate hike by the Fed in May and no rate hike are now roughly equal. Analysts believe the lower-than-expected data should give the Fed more confidence in their decision-making.

While inflation has ebbed in some areas, it has remained pernicious in others, particularly in the case of shelter costs, which have risen sharply. Despite this increase, Fed officials are looking beyond it and expect rents to decelerate through the year. However, it’s worth noting that inflation is likely to remain well above the Fed’s 2% target into 2024. As such, officials remain focused on bringing down prices despite the current bank turmoil.

According to recent data, borrowing through two emergency Fed lending programs decreased slightly last week, indicating that banking problems may be under control and there has been no panic for liquidity among undercapitalized banks.

Overall, while the lower-than-expected PCE price index may give the Fed more confidence, the persistent inflation problem in some areas remains a concern. The Fed’s focus on bringing down prices and the decrease in borrowing through emergency Fed lending programs show that officials are taking steps to address this issue. As the situation continues to evolve, it will be interesting to see how the Fed adjusts its policies to ensure stability in the economy.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Thana

Coincu News