One of the key developments that have played a crucial role in this expansion is cross-chain bridges technology. The concept of cross-chain bridges has gained immense significance in this regard, as they enable seamless and secure asset transfers between blockchain networks.

These bridges offer users a unique opportunity to interact with their assets across multiple blockchains, thereby unlocking a new world of possibilities for trading, lending, and other financial activities. By enabling cross-chain interoperability, these bridges have made it possible to move value across different blockchain networks, without the need for intermediaries.

While the benefits of cross-chain technology and cross-chain bridges are undeniable, many users may find the prospect of using them daunting, especially those new to the technology. However, with the right guidance and resources, anyone can learn how to use cross-chain bridges effectively.

This article aims to provide a comprehensive guide to everything you need to know about cross-chain bridges. It covers the fundamental concepts behind cross-chain technology and explains how cross-chain bridges work. Additionally, it provides detailed instructions on how to start using cross-chain bridges today, along with tips and best practices to help users navigate this exciting new technology with confidence.

What is a cross-chain bridge?

A cross-chain bridge is a software that enables the transfer of digital assets from one blockchain network to another. This is particularly useful for decentralized finance (DeFi) applications, as users can transfer their assets without the need for a centralized exchange. In other words, cross-chain bridges help to maintain the decentralized nature of DeFi.

By using cross-chain bridges, users gain access to a wider range of markets and liquidity pools. This allows them to take advantage of more opportunities and diversify their investment portfolios. It also reduces the risk of centralization, as users are not tied to a single exchange or network.

Furthermore, cross-chain bridges can help to increase interoperability between different blockchain networks. This can lead to more collaboration and innovation in the blockchain space, as developers are able to build on each other’s work and create more complex applications.

In summary, cross-chain bridges are an important tool for the continued growth and development of the decentralized finance ecosystem. They offer users more flexibility and freedom, while also promoting collaboration and innovation in the blockchain space.

How does a cross-chain bridge work?

Cross-chain bridges are an innovative way to transfer assets from one blockchain network to another. They offer a simple and user-friendly solution, thanks to their intuitive widgets and interfaces. In essence, cross-chain bridges enable users to lock up their assets on one blockchain network while issuing a corresponding representation on another blockchain network.

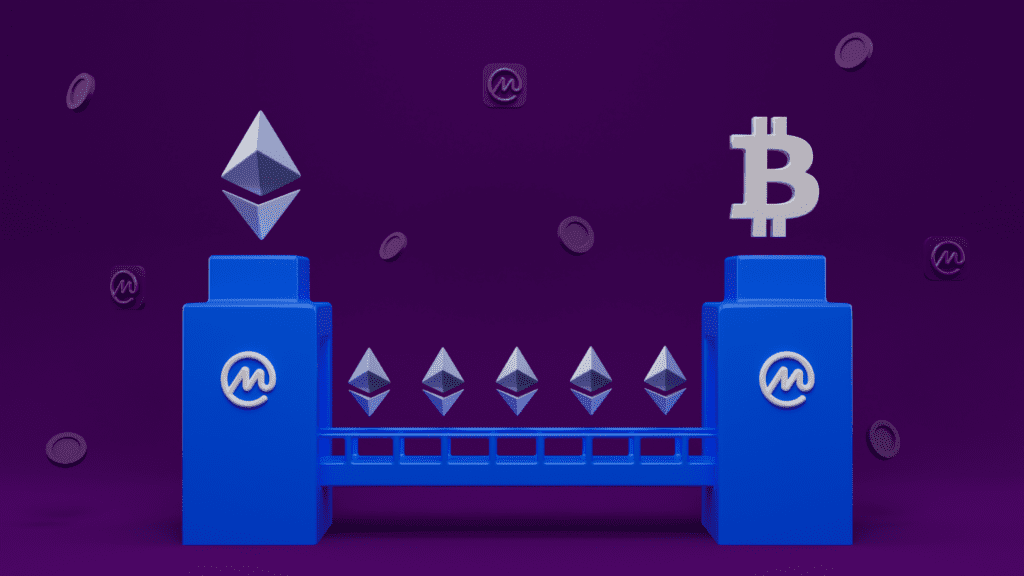

A great example of this is Bitcoin (BTC) being transferred from the Bitcoin network to the Binance Smart Chain (BSC). Using a cross-chain bridge, you can easily send your BTC to the contract on the Bitcoin network, which locks up your BTC and issues an equal amount of wrapped BTC (wBTC) on the BSC. With your wBTC, you can participate in DeFi applications or trade it for other tokens on the BSC.

When you’re ready to swap your wBTC back to the Bitcoin network, you simply send it back to the cross-chain bridge contract on the BSC. The contract then burns the wBTC and releases the amount of BTC on the Bitcoin network. This process is not only secure but also efficient, making cross-chain bridges a reliable option for transferring assets between different blockchain networks.

How to use a cross-chain bridge?

In today’s world, we have several blockchain networks that use different protocols to validate transactions, and the transfer of digital assets from one network to another can be a complicated process. However, with the help of a cross-chain bridge, this process can be made significantly more straightforward.

Firstly, to use a cross-chain bridge, you need to have a digital asset on one blockchain network that you want to transfer to another. This could be any cryptocurrency or digital token that you hold on a particular blockchain network. Additionally, you will need a compatible wallet supporting the cross-chain bridge protocol. There are several wallets available in the market that support cross-chain bridging, including popular wallets like MetaMask and Trust Wallet.

Once you have the asset and the wallet, the next step is to use a cross-chain bridge. Here is a step-by-step guide to using a cross-chain bridge:

Step 1: Link your wallet to the blockchain network to transfer assets. This is done by adding the network to your wallet, which will allow you to access your digital assets on that network.

Step 2: Go to the cross-chain bridge interface and pick the asset you want to transfer. To do this, you need to select the asset you want to transfer from the list of supported assets on the cross-chain bridge.

Step 3: Enter the amount of the asset you want to transfer and approve the transaction. You will be required to confirm the transaction on your wallet, and once approved, the transaction will be broadcasted to the blockchain network.

Step 4: Wait for the transaction to be confirmed, on the blockchain network. This step is crucial as it takes time for the blockchain network to validate and confirm the transaction.

Step 5: Once the transaction is confirmed, you will receive the corresponding representation of your asset on the target blockchain network. This representation will be in the form of a digital token or cryptocurrency that can be used on the target blockchain network.

Step 6: You can now use the transferred asset on the target blockchain network. This means that you can use the transferred digital token or cryptocurrency to interact with other smart contracts or decentralized applications on the target blockchain network.

Step 7: To transfer the asset back to the original blockchain network, follow the same steps in reverse. This means that you need to repeat the above steps, but in reverse order, to transfer the asset back to the original blockchain network.

These steps are only possible because of smart contracts, which are digital programs that automatically carry out operations following an agreement. Smart contracts have revolutionized the way we transact on blockchain networks, and cross-chain bridges have made it possible to transfer digital assets between different blockchain networks.

In conclusion, the use of cross-chain bridges has simplified the process of transferring digital assets between different blockchain networks. By following the above steps, you can transfer your digital assets seamlessly and take advantage of the benefits offered by different blockchain networks.

Conclusion

Cross-chain bridges have revolutionized the blockchain technology and decentralized finance space by introducing the ability to transfer digital assets between different blockchain networks. This creates an entire new realm of possibilities and grants access to a vast range of DeFi applications. For instance, with the help of cross-chain bridges, it is now possible to trade and swap digital assets without the need for centralized exchanges. This means faster and more efficient transactions, reduced fees, and increased security.

In addition, cross-chain bridges have the potential to solve the issue of blockchain interoperability. With the help of these bridges, multiple blockchain networks can communicate with each other, enabling a more seamless transfer of value between different ecosystems. This is particularly important as blockchain continues to grow and new ecosystems emerge.

Therefore, it is crucial to start exploring the possibilities of cross-chain bridges today and take your cryptocurrency trading to the next level. By doing so, you will be able to stay ahead of the curve and leverage the full potential of this game-changing technology.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Annie

Coincu News