Key Points:

- Lightning Labs releases new features for non-custodial Lightning Network nodes.

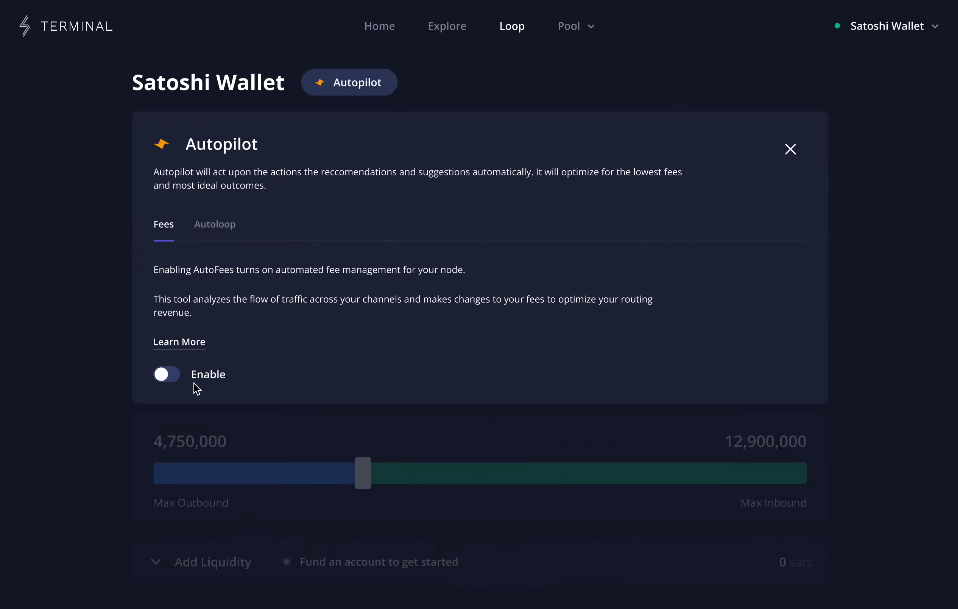

- Automated fee management helps users manage channel fees on Lightning Terminal.

- Bitcoin Lightning Network more accessible with updates to custodial accounts and LNC permissions.

Lightning Labs, the developer of the Bitcoin Lightning Network, has released a set of new features in the latest Litd release for non-custodial Lightning Network nodes.

These features were developed based on developer and node operator community feedback. The updated Litd includes automated fee management, custodial accounts, finer-grained LNC permissions, and the Pool Order Board.

Lightning Terminal’s new feature, automated fee management, helps users manage channel fees. Autofees can be turned on to manage fees for all channels or per channel. The terminal uses the top five earning channels over 60 days to set a target throughput for the entire node. It then reviews the forwarded traffic from the past seven days for each channel to adjust fees up or down. Fees are adjusted in small increments every three days.

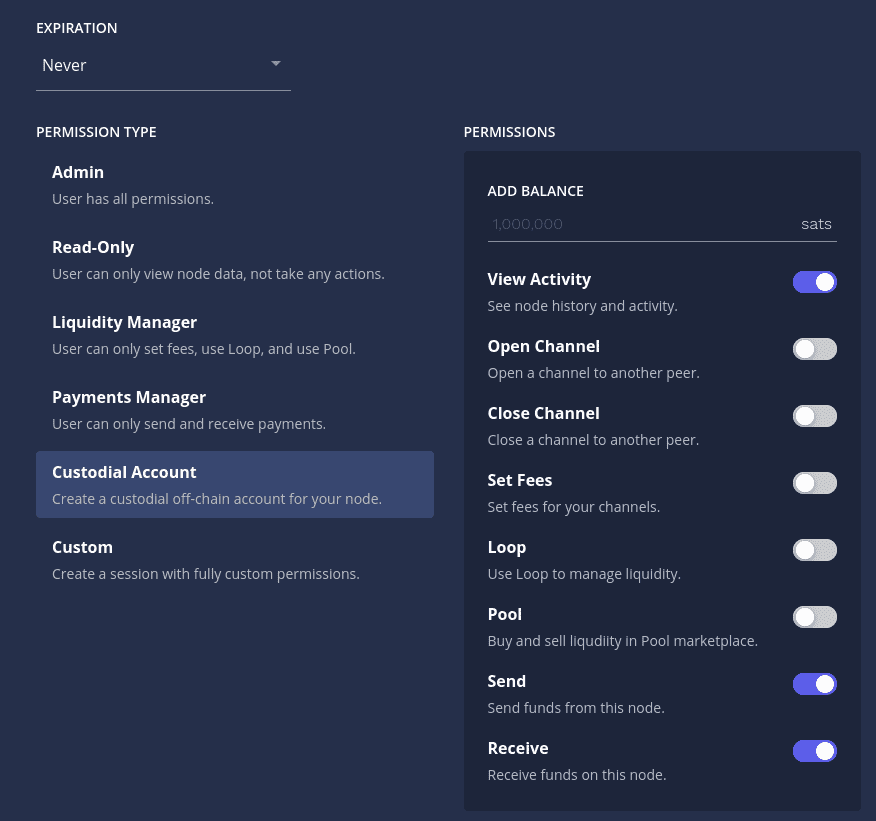

The custodial off-chain accounts feature allows node operators to provide restricted access to their node to any individual or application, with the ability to spend up to a certain amount of the node’s channel balance. This feature aims to increase end-user adoption of Lightning by giving developers an easy-to-manage system for giving users a specific amount of Lightning funds.

Lightning Node Connect (LNC) has also been updated with finer-grained permissions beyond just the existing admin and read-only types. Users can now create LNC pairing phrases with limited permissions, including Liquidity Manager and Payments Manager. Additionally, users can customize LNC session creation to create sessions with custom permissions.

Finally, Lightning Pool, a marketplace connecting Lightning node operators to liquidity providers, has moved from alpha to beta. With the latest Pool release, users can purchase or sell Lightning Network channels without needing on-chain confirmations, and unannounced channels are now available. Developers can also use MuSig2 accounts to securely add and manage funds within Pool.

These features are designed to help reduce the Lightning node maintenance overhead and make the Lightning Network more accessible for all. For more information on how to set up, configure, and use these features, check out the LND Accounts documentation in the Lightning Labs Builder’s Guide.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Thana

Coincu News