Key Points:

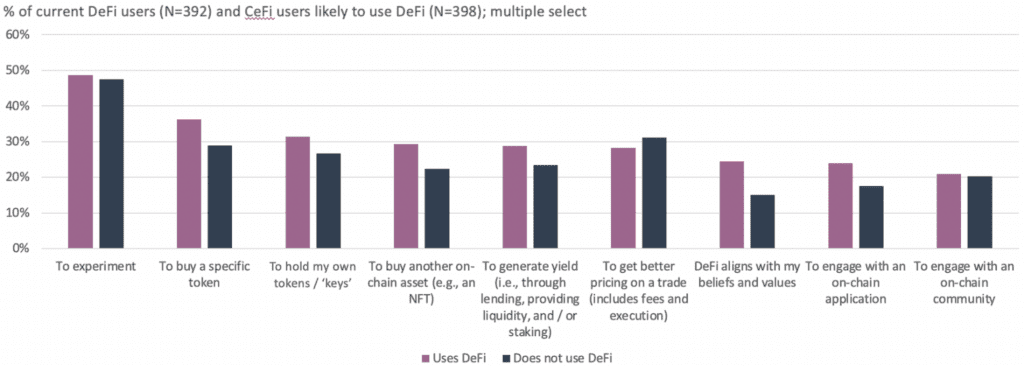

Despite these concerns, nearly half of surveyed CeFi users were motivated to experiment with DeFi protocols in the next 12 months. To overcome these barriers, products must focus on designing applications that simplify and abstract complexity unique to crypto.

Transaction fees and costs were also notable barriers to entry. Still, as Ethereum continues to scale and Layer 2 solutions see greater adoption, DeFi will become more economically accessible for price-sensitive users.

Additionally, improved support will help boost the comfort with DeFi. CeFi users cited “Better educational resources” and “Increased user support” as improvements that would increase their willingness to trade on decentralized platforms. Products that target this CeFi segment have already invested in these educational resources.

According to the blog, DeFi is a more straightforward and accessible tech stack for financial markets. It is transparent, self-custodial, and runs on publicly verifiable code instead of middlemen more interested in profits than consumers. However, DeFi is still unfamiliar to the average person as the internet was in the 1990s.

CeFi platforms often offer content and onboarding that helps beginners feel more comfortable exploring crypto. However, these CeFi products still suffer from the same lack of accountability and transparency that plagues the legacy financial system.

The survey focused on CeFi, DeFi, hybrid, and non-crypto users, and they received 1,860 responses whose demographics closely reflected US Census Demographics. The survey results reveal that DeFi can potentially attract a much wider audience. Still, educating and supporting users as they navigate this new landscape will require a concerted effort.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Thana

Coincu News

A $144 million crypto whale says WallitIQ (WLTQ) will rally 55,000%, and XRP price is…

Looking for short-term crypto investments? Explore Qubetics, Chainlink, and Kaspa, their unique benefits, and why…

Discover why BTFD Coin, Dogwifhat, and Act I are the best meme coins with 1000X…

Solana (SOL) and Ripple (XRP have been regarded as leading cryptocurrencies in the market.

Discover the best coins to join this weekend, including Qubetics, Ethereum, and Filecoin. Explore Qubetics’…

In this regard, Pudgy Penguins (PENGU), VeChain (VET) and Remittix (RTX) are all sub ten-cent…

This website uses cookies.