Key Points:

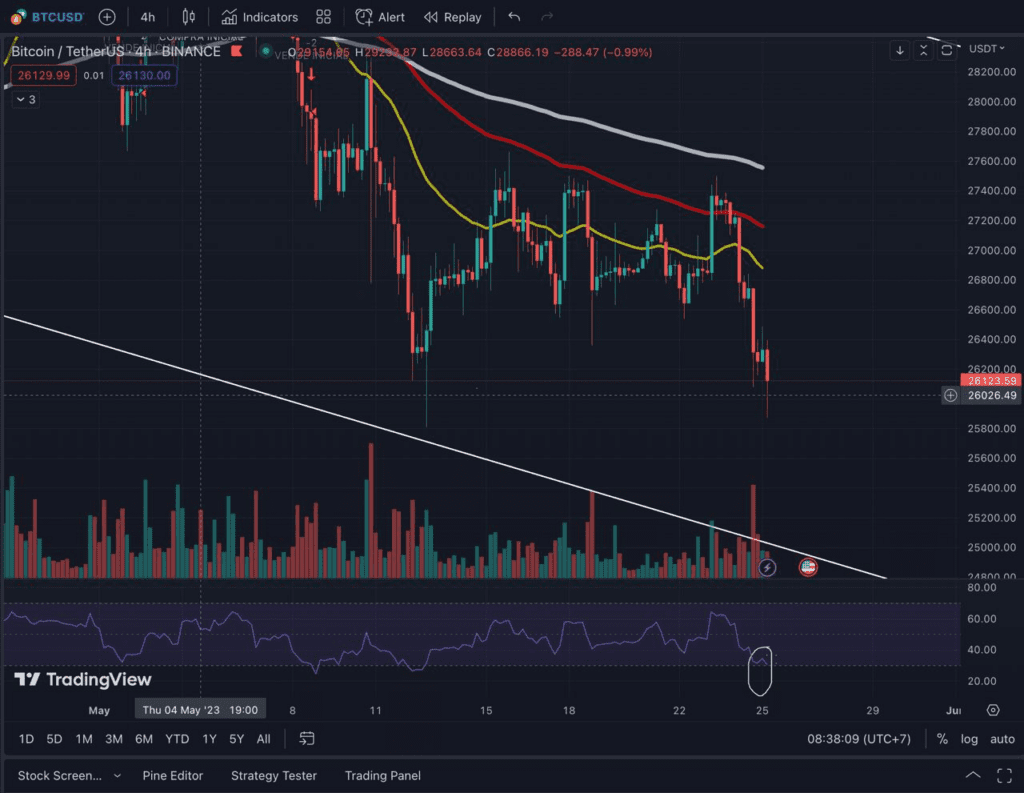

- Bitcoin continues to fall and break out of the $26,000 mark amid worries about the US debt ceiling and heightened Sino-US tensions.

- Bitcoin’s price movement over the past 30 days has been at its lowest level since the beginning of this year.

- The correlation between this market’s most significant currency and US stocks has decreased markedly.

Bitcoin (BTC) has fallen off the $26,000 mark after a long period of trading around the $27,000-$26,500 mark, causing its correlation with US stocks to have dropped markedly.

Before that, the largest cryptocurrency in the world was trading around the threshold of 27,000 USD/BTC for three consecutive weeks. Price volatility is relatively low. Average trading volume over the past 7 days has hit the lowest level in 2 and a half years.

Today, BTC, after closing a strong bearish candle on the daily frame, confirmed that the momentum of the bulls is overwhelmed, but on the larger time frame, BTC price has reached weekly support.

In addition to the smaller timeframes, the momentum indicators are already in the oversold area. This does not rule out the possibility that BTC will retest the $25,000 support area and continue to withdraw and retest the resistance areas over $27,000 and $28,000.

Asian shares fell on Wednesday as investors traded cautiously after Sino-US tensions increased following China’s trade war. The ban on products by US memory chip maker Micron Technology manufactured for security concerns. Traders are also concerned that negotiations to raise the US debt ceiling have not progressed.

Major US stock futures fell. Tech-heavy Nasdaq-100 futures fell 0.17%, S&P 500 futures fell 0.19%, and Dow Jones Industrial Average futures fell 0.20%.

Sluggish debt ceiling negotiations have also weighed on investor sentiment, with House Speaker Kevin McCarthy saying on Tuesday that the two sides have yet to reach an agreement to avert a government default on the June 1st debt ceiling of 31.4 trillion US dollars.

The correlation between Bitcoin and US stocks can be seen decreasing, and this has been a popular trend since the beginning of this year. However, according to Bitcoin advocates, the cryptocurrency is a safe-haven asset during market volatility.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Foxy

Coincu News