As the volume of staking on Ethereum increases, the risk of centralization increases, making the network less resilient to attacks or technical failures. That’s what protocols using Distributed Validator Technology (DVT) are for. In this article, we’ll look at what makes DVT such an essential tool for Ethereum’s health and whether it could be the next big key to unlocking a more decentralized Ethereum staking ecosystem.

Critical Issues for Staking ETH

To become a staking operator on Ethereum, help decentralize the network, and earn staking rewards, you must first be aware of two significant risks: key theft and node failure. First, two private keys are involved in the Ethereum network’s authentication process, the signing and withdrawal keys, and they can be stolen if you don’t secure them properly.

Additionally, node failure can occur if you have a validator client software bug or a weak Internet connection that causes your validator node to go offline, resulting in severe penalties, i.e., partial eth. Your bet has been taken away.

Those two staking risks may discourage the average Ethereum user from running a validator node, but you also need to stake a minimum of 32 ETH to use it. These barriers to entry may explain the success of custodial staking solutions offered by many centralized exchanges that make staking much easier for regular Ethereum holders.

However, this solution has a significant drawback: exchanges control your assets, holding them with their private keys. That means you have to trust the custodian with your cryptocurrency, and the history of the blockchain space is full of examples of this being wrong: exchanges can halt withdrawals or even break produce. This staking solution goes against the characteristics that blockchain represents and presents a significant risk of centralization.

You might be wondering whether we are done with the Merge already. Yes, but that’s just another milestone in Ethereum’s proof-of-stake development. Now that the Beacon Chain has merged with Ethereum’s Execution Layer, there is still a lot of work to ensure that the Ethereum consensus layer can meet the demands of being the next world computer.

What is Distributed Validator Technology (DVT)?

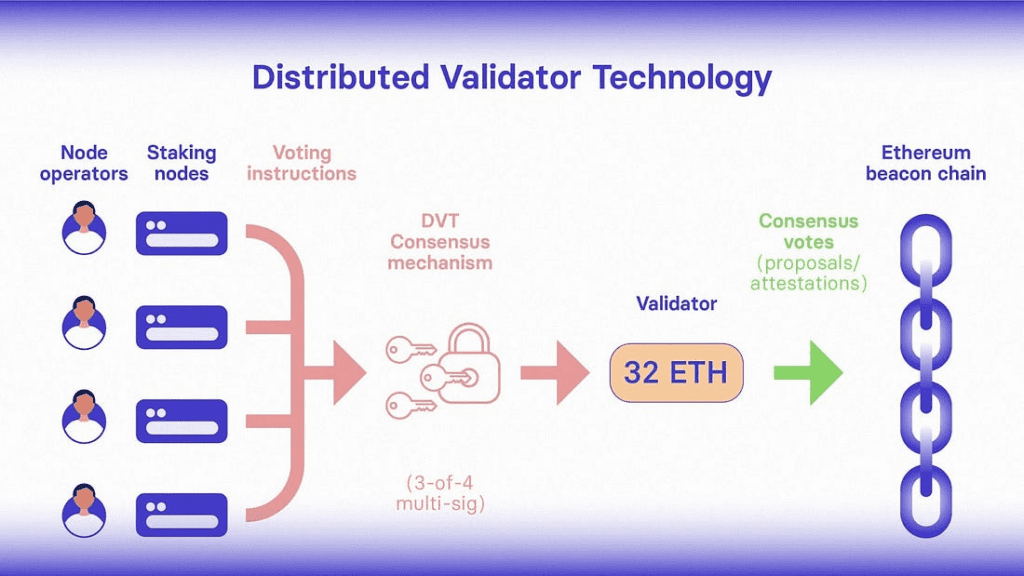

Distributed Validator Technology (DVT) is a primitive technology that allows Ethereum PoS Validators to run on multiple nodes or machines. This allows a cluster of nodes run by an individual, group, or community of miners to act together as a single validator on Ethereum. It is running the validator as a node cluster improves its resiliency while significantly reducing the fidelity validator’s cut-off risk, regardless of its size. This makes staking more powerful and accessible to all validators.

For larger validators, DVT ensures high availability and reduces infrastructure costs.

For smaller validators, like community staking pools or home-based validators, DVT offers an equivalent level of protection that larger validators would have.

Ultimately, this improves validator engagement, leading to greater stake decentralization.

The mechanism of action of DVT

As mentioned earlier, Distributed Validator Technology (DVT) allows validators to run on multiple machines, which is achieved using various technologies. One key enabler is Distributed Key Generation (DKG), a cryptographic process that allows participants to collaboratively generate private keys without any member having access to the full key.

In DKG, each participant generates a shard of a private key. These segments are combined to produce a full private key. This approach ensures that the validator does not need to store the entire private key in a single node, but can instead distribute key segments across multiple nodes.

Even if a shard or subset of the key goes offline and the transaction cannot be signed, the remaining key shards are intact and available for signing. Public Verifiable Secret Sharing (PVSS) and Verifiable Secret Sharing (VSS) are commonly used techniques to ensure the correctness of key generation, whereas PVSS combines evidence does not know to verify publicly.

When keys are shared and stored across multiple nodes, coordination mechanisms are needed to ensure secure verification and communication between nodes to ensure complete signature generation. This coordination constitutes the essence of DVT and can be achieved through various mechanisms, one common being the threshold signature scheme.

In this scheme, several designated verifiers must cooperate in signing transactions, preventing any verifier from signing alone and enhancing the security of the verification process. Regarding consensus, the SSV network, as a DVT product, uses the Byzantine Fault Tolerance (BFT) protocol to achieve signature consensus among nodes.

In addition, DVT has to solve the problem of sharing the infrastructure between the nodes responsible for hosting the primary shards. Shared infrastructure can lead to associated node failure, undermining the goal of decentralization. In the SSV network, users can flexibly distribute key shards among different node operators according to geographical locations, data centers, data center brands, application deployments, guests, and other factors.

This highlights the importance of implementing multiple clients as a key component of DVT. Having customer diversity is critical to the long-term viability of the Ethereum network, as it reduces the risk that a single customer with the majority market share causes a fork or other disruption. which may result in the validator being penalized.

Obol Network is a company actively developing DVT as an infrastructure orchestration layer for staking. Their non-custodial middleware, Charon, ensures that the protocol has no escrow keys.

Instead, only validator clients hold and manage the private keys to sign transactions. Charon acts as an intermediary between the signaling client and the validator client, intercepting communication and synthesizing the signature before forwarding the signature back to the signaling client.

This design approach removes the protocol’s ability to sign arbitrary data, puts the Obol network in a less controlling role, and ensures greater security. By integrating these technologies and methods, DVT enhances the security, decentralization, and efficiency of the Ethereum validator ecosystem.

How does DVT improve staking on Ethereum?

DVT allows validation to be performed alongside clusters of nodes instead of just as single, independent validator nodes. By eliminating single points of failure, DVT will enable validators to operate with operational redundancy while not increasing the risk of cutbacks. This benefits validators of all sizes:

Great Authenticator

For larger validators, improved redundancy and lower risk of cutouts allow more nodes to be run on fewer machines, which reduces hardware costs. It also reduces the amount of insurance cuts needed to protect themselves.

Additionally, running multiple nodes per cluster allows for more client configurations and geographies distribution, reducing the risk of correlation failure in any location or client type.

Liquid Betting Protocol

For liquidity staking protocols, in addition to improving efficiency and reducing risk, DVT allows for greater operator involvement. By providing redundancy in the network, LSPs eliminate dependence on any operator that leads to downtime.

Operators can be organized into different clusters. If one operator goes down, it will not affect any full validator nodes in the network since the operators are active. Other actions will meet the thresholds for authentication. Ultimately, this improves the performance of the protocol for manufacturers.

Community & Home Authenticator

Most importantly, with DVT, smaller validators can also run nodes more confidently, providing uptime and efficiency metrics comparable to larger validators. This can be achieved with a home validator that works with others as a community validator that doesn’t rely on just any machine.

DVT also lowers the ETH requirements for any individual who wants to run a single node, as you can now have multiple nodes making up the 32 ETH needed for validation. With this, DVT has the potential to improve home validator engagement exponentially.

Future challenges

To achieve redundancy, DVT adds a middleware component to the Ethereum consensus, and with it comes certain trade-offs:

Increased complexity: As with any multi-node implementation, more moving parts are needed to run the entire validator. This requires limited coordination between the different operators in the cluster and adds potential areas for problems.

Latency: DVT introduces some additional network hops under the mechanism of consensus and message sharing among nodes in a cluster. However, this is mitigated by designing DVT to use direct P2P connections across nodes in a cluster (rather than a single gossip network).

Operational Cost: Since multiple nodes are required to join instead of just a single node, hardware, and operating costs increase. This can be offset by being able to run more validators on the same set of machines due to improved DVT run validator resiliency.

Conclusion

In conclusion, the arrival of DVT represents a significant step forward for the staking ecosystem. It provides a secure, flexible, decentralized infrastructure for staking, making it attractive to individual bettors, operators, and staking pools.

Regardless of what type of validator you are or how you ultimately believe that validator distribution should be, DVT acts as a decentralized force on the entire Ethereum network while adding resilience and reducing risk. This is a primitive technology that will benefit everyone in the Ethereum ecosystem.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Foxy

Coincu News