Key Points:

- Mastercard seems to have restarted its crypto-related efforts.

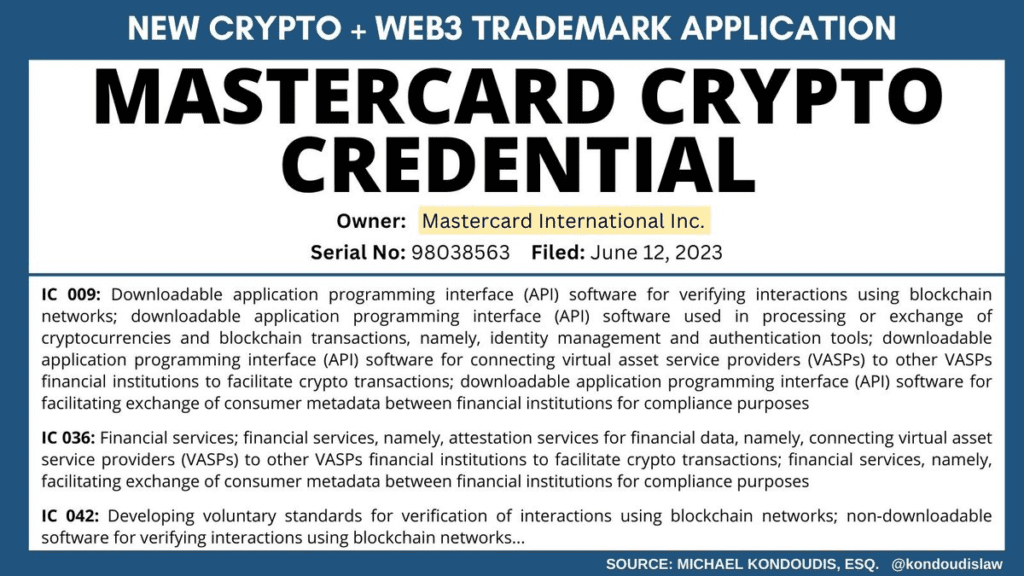

- The company has submitted a trademark application to provide crypto and blockchain transaction software.

- Mastercard announced the extension of its crypto payment card program in late April.

Mastercard will extend its efforts crypto sector with a trademark application, even as authorities and banks become leery of the area.

According to information shared by trademark attorney Michael Kondoudis on June 19, the payment processor has recently filed a trademark application to introduce software for cryptocurrency and blockchain transactions, as well as create links between virtual asset service providers for crypto transactions.

Specifically, the application, submitted on June 12 with the United States Patent and Trademark Office (USPTO) under serial number 98038563, consists of three international classes (IC) that relate to distinct identifying categories of the products and services covered by the filing – 009, 036, and 042.

Yet, the aforesaid filing is only one of many recent moves made by Mastercard to return to its crypto road after its management, like Visa’s, opted to take a vacation from the crypto push due to weak market and regulatory circumstances.

This is not the first time the world’s largest payment business has revealed cryptocurrency.

In certain regions, Mastercard has already worked with cryptocurrency exchanges such as Binance, Nexo, and Gemini to provide crypto-linked payment cards. Users may use the Binance cards to make payments in conventional currencies using monies from their crypto holdings on the exchange.

When asked whether Mastercard is thinking about limiting the amount of money that may be sent to crypto exchanges through its payments network, Raj Dhamodharan, Mastercard’s head of crypto and blockchain, responded:

“We’re not here to pick winners. We’re not here to pick which transaction should happen or shouldn’t happen.”

Bybit announced the launching of a debit card issued by Moorwand that is enabled by the Mastercard network and enables users to quickly move between the crypto and fiat worlds and make purchases or withdraw cash from ATMs in early March.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News