Key Points:

- HSBC is the first bank in Hong Kong to allow its customers to buy and sell Bitcoin and Ethereum ETFs listed on the Hong Kong exchange, expanding local users’ exposure to cryptocurrencies in the region.

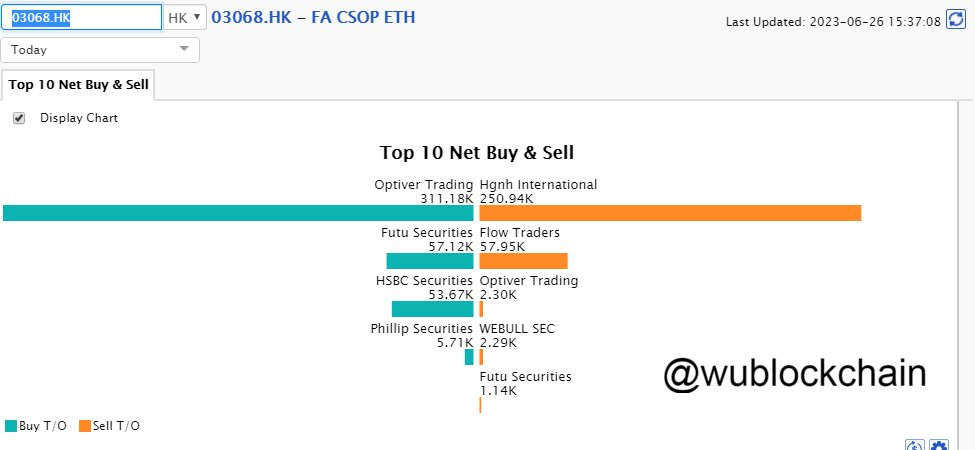

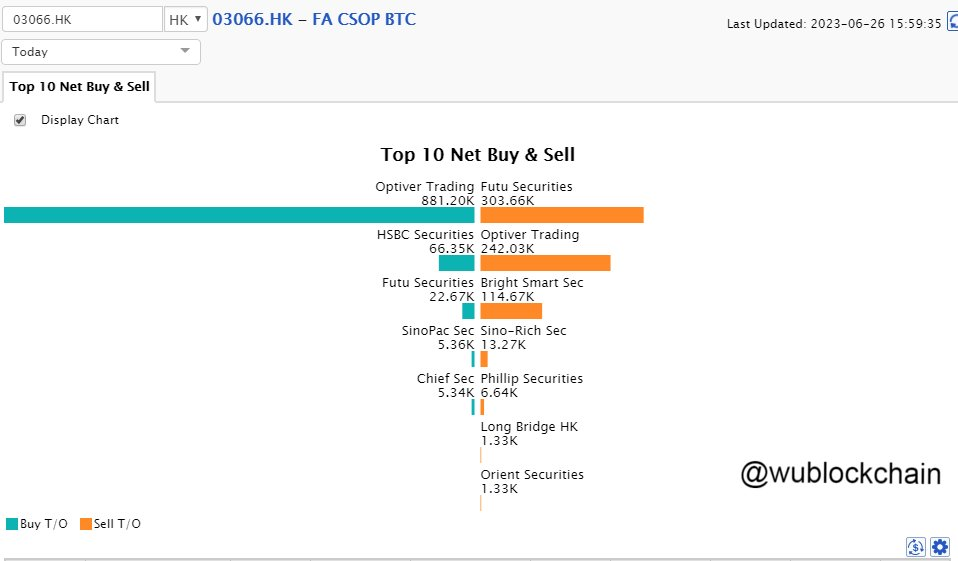

- The available cryptocurrency ETFs in Hong Kong include CSOP Bitcoin Futures ETF, CSOP Ethereum Futures ETF, and Samsung Bitcoin Futures Active ETF.

According to Wu, HSBC now allows customers to buy and sell Bitcoin and Ethereum ETFs in Hong Kong, expanding cryptocurrency exposure. Available ETFs include CSOP Bitcoin and Ethereum Futures, and Samsung Bitcoin Futures.

HSBC has made a move to expand local users’ exposure to cryptocurrencies by allowing its customers to buy and sell Bitcoin and Ethereum ETFs listed on the Hong Kong exchange. This is a significant milestone in the mass adoption of cryptocurrencies in Hong Kong, as HSBC is the first bank in the region to allow such transactions. The move comes as a result of increased pressure from regulators who are pushing for more crypto-friendly policies.

Cryptocurrency ETFs currently listed in Hong Kong include CSOP Bitcoin Futures ETF, CSOP Ethereum Futures ETF, and Samsung Bitcoin Futures Active ETF. HSBC, which has a special role in Hong Kong as issuers of the city’s currency and hold the chair posts at the Hong Kong Association of Banks lobby group, is leading the way in promoting the use of cryptocurrencies in the region.

Previously, Hong Kong’s banking regulator was reportedly pressuring lenders, including HSBC and Standard Chartered, to take on crypto exchanges as clients. Although banks do not have a ban on customers using cryptocurrencies, they are often reluctant to participate in exchanges out of concern that they could be prosecuted if the platforms are used to launder money or other illegal activities.

The HKMA, in a letter to lenders, said diligence on potential customers should not “create undue burden,” especially “for those setting up an office in Hong Kong.” During a meeting with banks, the HKMA reminded lenders that it is not illegal to conduct business with crypto companies, unlike in mainland China, where transactions related to cryptocurrencies have been banned since September 2021.

HSBC’s move is a significant step in the right direction for the financial industry in Hong Kong. It will encourage other banks to follow suit and embrace the opportunities that cryptocurrencies offer. The future of finance is digital, and HSBC is leading the way.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Thana

Coincu News