Key Points:

- The cryptocurrency market has shown signs of recovery with a net influx of assets into digital asset funds for the second consecutive week, led by Bitcoin.

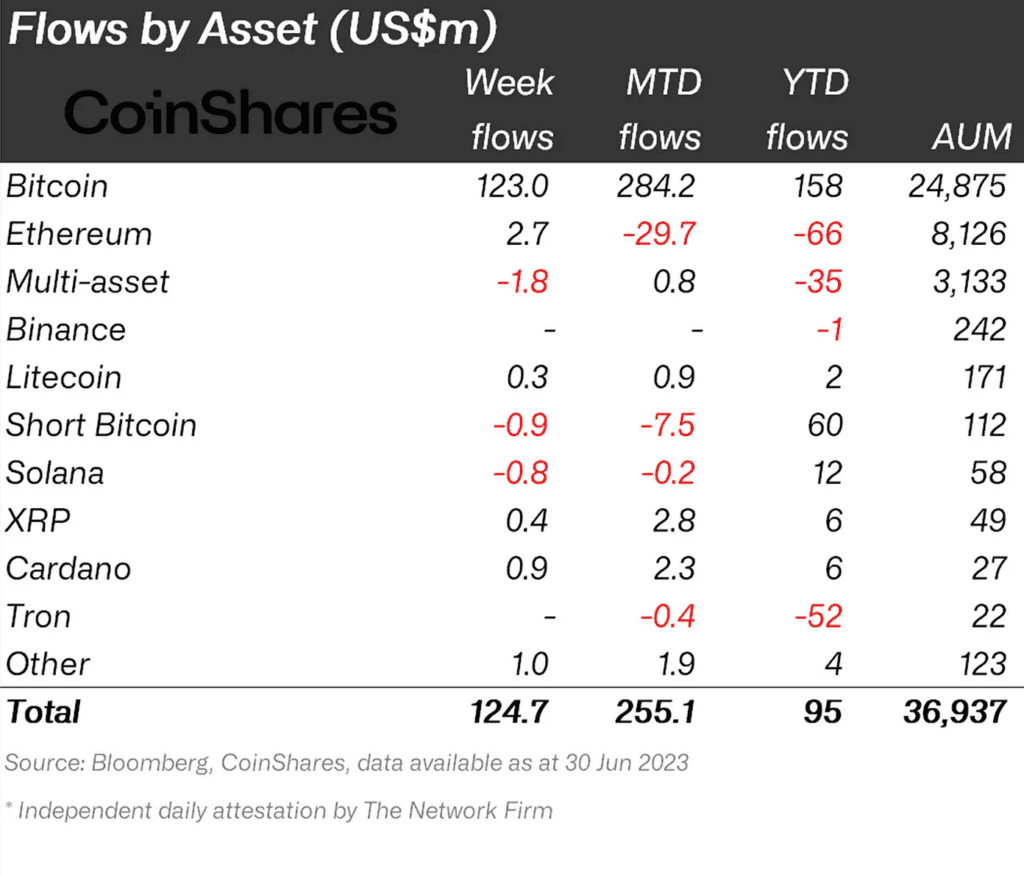

- Crypto funds received $124.7 million in the week prior to June 30, following an inflow of $199.1 million the previous week.

- Bitcoin dominated the inflows, receiving $123 million, while other cryptocurrencies like Ethereum, Litecoin, XRP, and Cardano also saw net inflows.

While the cryptocurrency market recovered, there was a net influx of assets into digital asset funds for the second week in a row, with Bitcoin (BTC) leading.

According to a CoinShares report posted on July 3, all crypto funds received $124.7 million in the week before June 30.

After $199.1 million the previous week, more than $100 million in money poured into digital asset funds for the second week in a row, reflecting the market’s general sentiment.

According to the report, net inflows into cryptocurrency funds during the last two weeks were $334 million, or over 1% of total digital asset fund assets under management.

$123 million was pumped into Bitcoin funds by asset last week, representing 98% of overall inflows. The Ethereum fund received $2.7 million. Funds for Litecoin, XRP, and Cardano also had net inflows.

A short Bitcoin fund that bets on Bitcoin’s collapse has lost money for 10 weeks in a row, with $900,000 withdrawn. Notwithstanding the current bearishness for short bitcoin, the report states that it is still the second-best performing asset in terms of inflows year so far, with $60 million.

BTC’s price increased for the second quarter in a row. The price of the world’s largest cryptocurrency grew by more than 8% between April and June.

Once BlackRock, the world’s biggest asset management, Fidelity Investments, and others filed for a spot Bitcoin exchange-traded fund (ETF) in the United States, investors grew more hopeful.

Bitcoin trade volume has increased by more than 60% in the last 24 hours. The coin is still trading for more than $30,500.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News