Key Points:

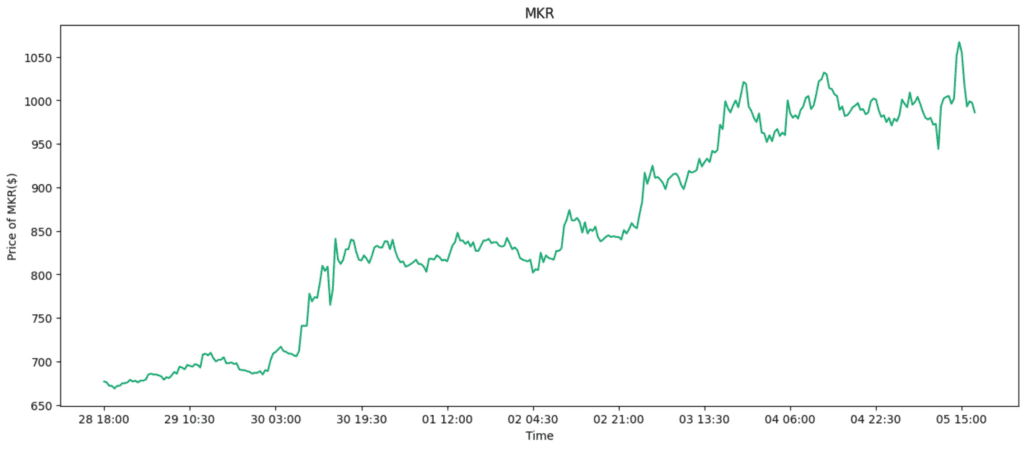

- MKR has surged 40% in 7 days due to Smart Burn Engine proposal, Spark protocol expansion & MKR repurchase.

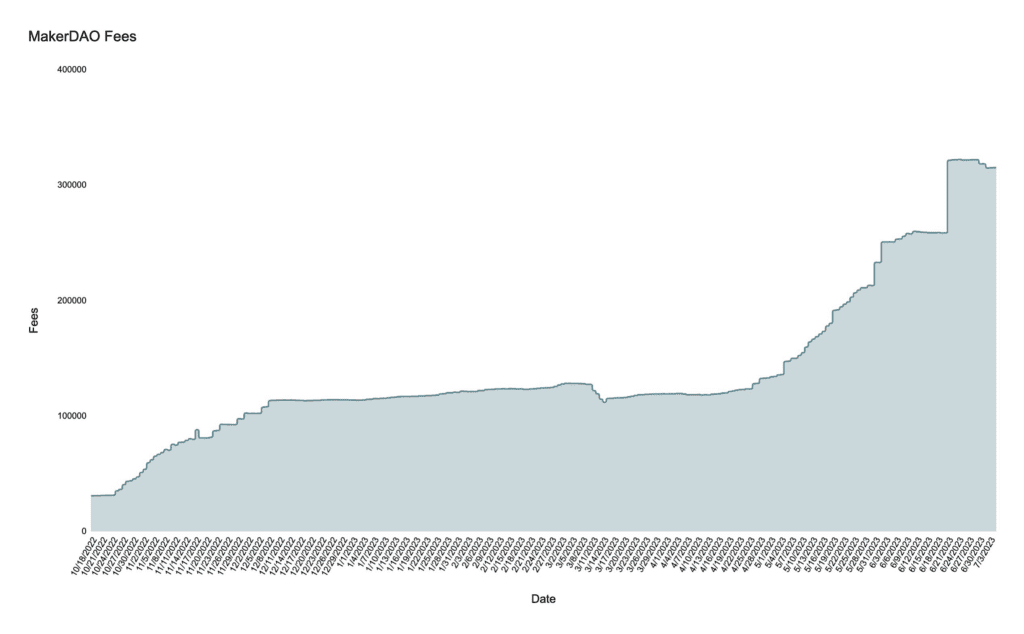

- MakerDAO currently earns $315k in fees daily.

- Fresh wallets have accumulated 18.094k MKR worth $17.35m over the past three weeks.

MakerDAO’s MKR token has surged 40% in 7 days, driven by Smart Burn Engine proposal, Spark protocol expansion & MKR repurchase deployment. On-chain data shows fresh wallets accumulating MKR.

According to the ASXN report, MakerDAO’s MKR token has seen impressive growth over the past few weeks, with a 40% increase in the past seven days alone. This growth is attributed to several factors, including the Smart Burn Engine proposal, the expansion of the Spark protocol, and the deployment of the MKR repurchase contract. MakerDAO’s earned fees have also been rapidly growing, currently earning $315,000 in fees daily.

The Smart Burn Engine launch governance proposal is transitioning MakerDAO from a buy and burn model to a new approach called the POL model. Additionally, the rapid growth of Spark, a lending platform that uses a credit line from Maker called a Dai Direct Deposit Module (D3M), is contributing to the growth of MKR.

On-chain data regarding the types of holders shows that fresh wallets have been receiving large amounts of MKR tokens from Coinbase or Coinbase Prime. In the past three weeks, 6 addresses have accumulated 18,094k MKR worth $17.35 million.

Two weeks ago, Coincu reported that the issuer of stablecoins and decentralized finance protocol MakerDAO purchased another $700 million in US Treasury bonds, bringing the platform’s DAI stablecoin reserve to $1.2 billion.

MakerDAO is an open-source project on the Ethereum blockchain and a Decentralized Autonomous Organization created in 2014. The project is managed by people around the world who hold its governance token, MKR. Through a system of scientific governance involving Executive Voting and Governance Polling, MKR holders manage the Maker Protocol and the financial risks of Dai to ensure its stability, transparency, and efficiency. MKR voting weight is proportional to the amount of MKR a voter stakes in the voting contract, DSChief. In other words, the more MKR tokens locked in the contract, the greater the voter’s decision-making power.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Thana

Coincu News