Key Points:

- Lido’s Token Staking Protocol has been added to Grayscale’s DeFi Fund.

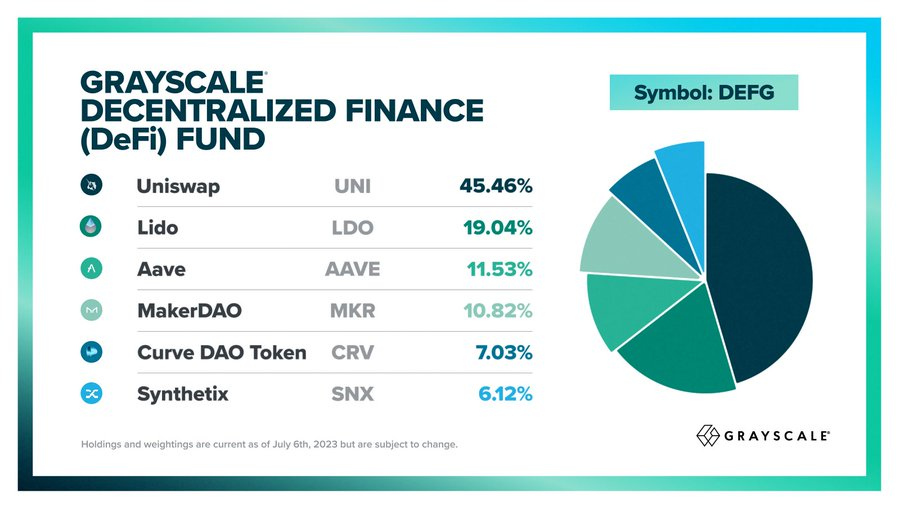

- LDO’s proportion in the fund is 19.04%, second only to Uniswap’s UNI with 45.46%.

- Grayscale said it adjusted the DeFi fund’s portfolio, selling a certain number of existing tokens by the weight of each token and using the proceeds to buy LDO.

Grayscale added the LDO token to its DeFi fund on July 7 and instantly made it the second-largest token in its fund, behind only UNI.

The digital asset manager announced the change on Friday. Lido (LDO) is currently the second largest token in the Grayscale DeFi fund, accounting for 19.04% of it.

Grayscale DeFi Fund currently accounts for 45.46% of each token in Uniswap (UNI), 19.04% of Lido (LDO), 11.53% of Aave (Aave), 10.82% of MakerDAO (MKR), and 10.82% of Curve Token DAO (CRV) at 7.03% and Synthetix (SNX) at 6.12%.

This digital asset manager said it adjusted the DeFi fund’s portfolio, selling a certain number of existing tokens by the weight of each token and using the proceeds to buy LDO.

“In accordance with the CoinDesk DeFi Select Index methodology, Grayscale has adjusted the DeFi Fund’s portfolio by selling certain amounts of the existing Fund Components in proportion to their respective weightings, and using the cash proceeds to purchase Lido (LDO),” Grayscale said in a company release. “No tokens were removed from the DeFi Fund.”

Lido, a liquid staking service, also offers tokens that aim to make staking on Ethereum cheaper. Lido staking ETH (stETH) is its most popular product and the seventh largest cryptocurrency, according to CoinGecko. STETH performing well has made LDO, the governance token linked to Lido, more attractive to investors.

The DeFi fund is one of the digital asset manager’s most miniature products, with $3.1 million in assets under management. By comparison, its flagship product, Grayscale Bitcoin Trust (GBTC), has over $18 billion in assets. The DeFi Fund has also been running moderately hot, down more than 73% since its launch in July 2021.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.