Key Points:

- Poly Network hack results in substantial loss of digital assets across multiple blockchains, including Ethereum.

- Consolidation of stolen funds into a single location raises questions about the perpetrator’s intentions and plans.

- Law enforcement agencies, blockchain analysts, and the crypto community are closely monitoring transactions to recover the stolen assets.

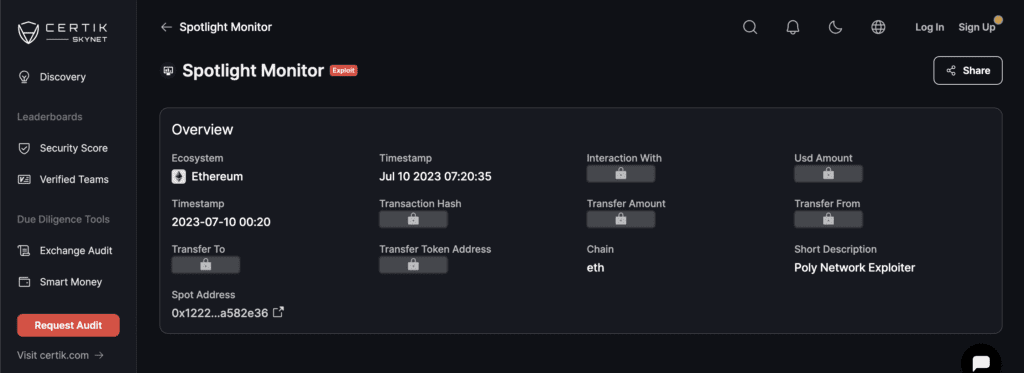

In the ongoing aftermath of the Poly Network hack, it has been revealed that the exploiter responsible for the attack has consolidated approximately 566.4 ETH into the Ethereum address 0x712.

Additionally, another 1,007.4 ETH has been transferred to the address 0xcC2bb, raising concerns about the fate of the stolen funds.

The Poly Network hack, which took place recently, resulted in the theft of a substantial amount of digital assets across multiple blockchains, including Ethereum. The hacker exploited a vulnerability in the network’s smart contract, allowing them to gain unauthorized access and transfer funds to their control.

The consolidation of approximately 566.4 ETH into the address 0x712 indicates the perpetrator’s efforts to centralize their ill-gotten gains into a single location. This move raises questions about their intentions and potential plans for the stolen funds. Law enforcement agencies, blockchain analysts, and the crypto community at large are closely monitoring these transactions for any potential leads that could help recover the stolen assets.

The transfer of 1,007.4 ETH to the address 0xcC2bb introduces another aspect to the ongoing investigation. It remains unclear whether this address belongs to the hacker or if it represents an attempt to obfuscate the flow of funds. The tracing of these transactions poses a significant challenge due to the pseudonymous nature of blockchain transactions, but efforts are underway to identify and track the movement of the stolen assets.

The Poly Network team, along with various blockchain security firms and organizations, are actively collaborating to address the security vulnerabilities that led to the exploit and to mitigate any further potential risks. They are working towards implementing enhanced security measures and protocols to prevent similar incidents in the future.

As the investigation unfolds, affected users and the wider cryptocurrency community are anxiously awaiting updates on the recovery of the stolen funds. Discussions are taking place regarding potential solutions, including the possibility of forking affected blockchains to restore lost assets. However, such measures are complex and require community consensus.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.