Key Points:

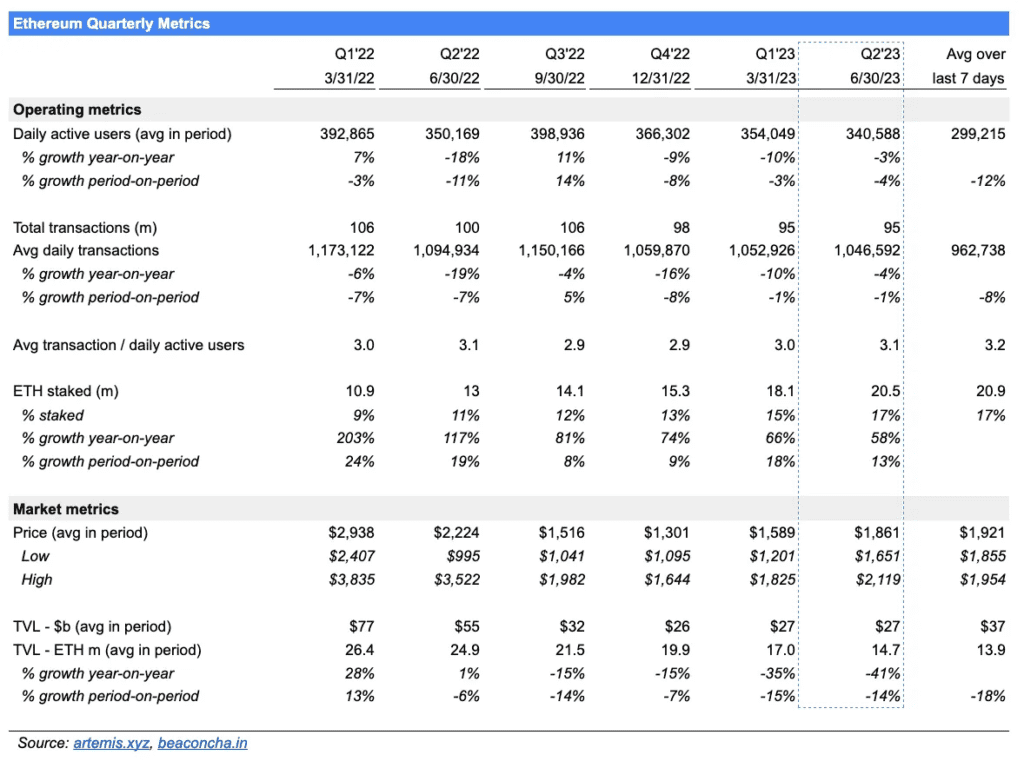

- Ethereum had 340,588 daily active users in Q2 2023, with limited daily transactions of 1 million.

- Staked ETH represents 17% of the total supply, and the slowing trend suggests that staking may not grow as fast as previously expected.

- Ethereum is now burning $5M worth of tokens per day, a significant difference from the previous selling pressure of $22M worth of ETH tokens daily.

In Q2 2023, Ethereum had 340,588 daily active users, with daily transactions limited to 1 million. Staked ETH represents 17% of the total supply, and Ethereum is now burning $5M worth of tokens per day, as per TechFlow.

In Q2 of 2023, ETH had 340,588 daily active users, a 3% decrease year-over-year. However, the number of daily active users has been improving since Q1 2023 and Q4 2022, when it was down approximately 10%. The daily active user growth has been stagnant since 2021. Over the past year, the number of DAUs in the ecosystem has grown from 400,000 to around 800,000, but this does not necessarily mean that more people interact. Instead, part of ETH’s DAU has also become the second layer of ETH’s DAU.

The ETH ecosystem includes its second-layer scaling solutions, which are growing healthily and show a healthy network. Layer-two scaling solutions drive its growth; their success is critical to Ethereum. The upcoming implementation of EIP-4844 will significantly impact layer 2 scaling solutions and Ethereum.

The average number of daily transactions on ETH is limited to about 1 million per day, and the number of transactions on Ethereum has almost quadrupled in the past year. The second layer adds up to 2 million transactions per day. Polygon’s PoS chain averages 2.4 million transactions per day. If these transactions were migrated to the Polygon zkEVM chain or another ETH second layer, it would nearly double the number of daily transactions in the Ethereum ecosystem. The average daily transaction volume of the entire Ethereum ecosystem will reach 3 million in the second quarter of 2023, up from 2 million in the first quarter of 2023.

Staked ETH represents 17% of the total supply, and the amount of staked ETH has grown dramatically before and after the successful implementation of Shapella. However, the trend of slowing growth suggests that the amount of staked ETH may not grow as fast as previously expected by more than 50%. The lower the staking ratio, the higher the staking reward paid to validators and, therefore, the higher the ETH rate of return.

Ethereum went from selling pressure of $22 million per day to buying demand of $5 million per day, a difference of $28 million. This $28 million move equates to 4.5% of Ethereum’s market capitalization. Ethereum is now burning (i.e., buying back) $5 million worth of tokens per day, while it used to sell $22 million worth of ETH tokens per day.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.