Key Points:

- Funds worth $265 million have left Multichain since July 7, with frozen funds and burned tokens adding complexity to the situation.

- The community and stakeholders are monitoring the situation closely and investigating the origins of the outflows.

- The outflow of funds raises questions about the motives behind the transactions.

According to statistics from SlowMist, the outflow of funds from Multichain has reached a staggering $265 million since July 7.

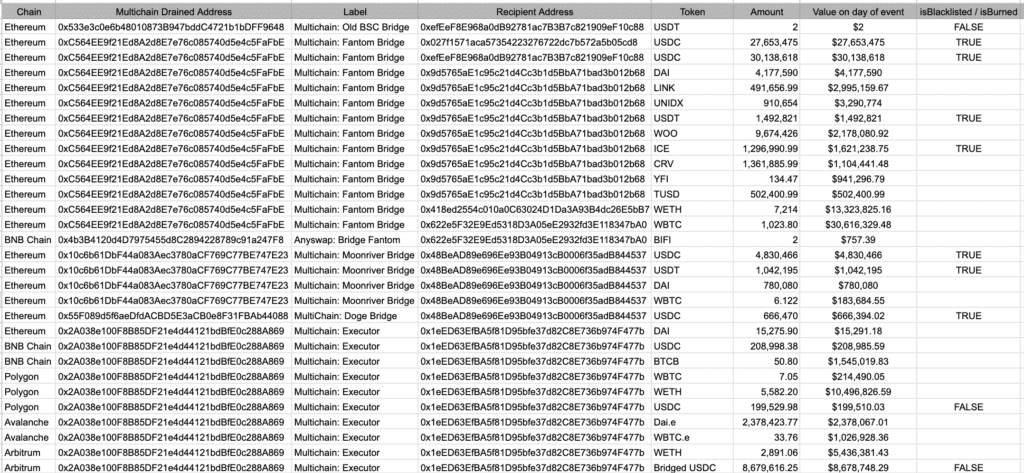

The funds have been distributed across various chains, including Ethereum, BNB Chain, Polygon, Avalanche, Arbitrum, Optimism, Fantom, Cronos, and Moonbeam.

Within this total amount, Circle and Tether have frozen $65.82 million, while the token issuer has burned 1,296,999.99 ICE, equivalent to approximately $1.62 million. The outflows encompass a range of transactions, such as the transfer of USDT through the Multichain: Old BSC Bridge, as well as USDC, DAI, LINK, UNIDX, USDT, WOO, ICE, CRV, YFI, TUSD, WETH, and WBTC.

Additionally, BIFI has been ported from Anyswap through the Bridge Fantom, while USDC, USDT, DAI, and WBTC have been transferred through the Multichain: Moonriver Bridge. USDC has also been transferred through the Doge Bridge from Multichain. Furthermore, assets including DAI, USDC, BTCB, WBTC, WETH, Dai.e, WBTC.e, USDC Bridge, BTC, fUSDT, ETH, and more have been moved out by the Executor from Multichain.

In an interesting twist, certain assets, such as WBTC, USDT, and ETH, were moved from the address marked as Fake_Phishing183873 by Etherscan. However, it is believed that this labeling may be inaccurate, and the address could have previously belonged to the official Multichain account.

The significant outflow of funds from Multichain raises questions about the motives behind these transactions. The involvement of frozen funds and burned tokens adds another layer of complexity to the situation. The community and stakeholders will undoubtedly closely monitor these developments and investigate the origins and implications of these outflows.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.