Key Points:

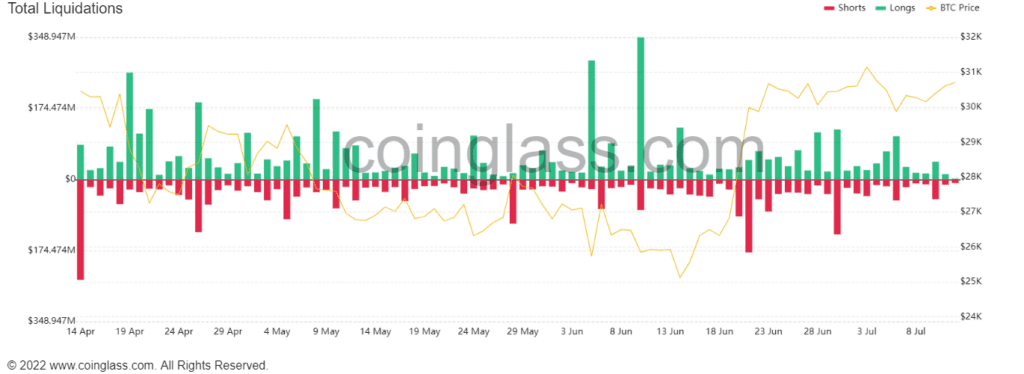

- Bitcoin futures saw lowest liquidations since April indicating waning interest among traders.

- Just under $9M worth of futures were liquidated, with BTC making up a large share of the $28M of crypto-tracked liquidations on Tuesday.

- Large liquidations can signal the local top or bottom of a price move, which may allow traders to position themselves accordingly.

Bitcoin (BTC) futures logged the lowest liquidations since April on Tuesday, a sign of sudden waning interest among futures traders.

According to data from Coinglass, just under $9 million worth of bitcoin futures were liquidated. This is a relatively small amount compared to the total $28 million of crypto-tracked liquidations on Tuesday. In fact, this was among the lowest levels of liquidation we’ve seen so far this year.

Liquidation means in the context of futures trading. Essentially, liquidation is when an exchange forcefully closes a trader’s leveraged position. This happens when a trader is unable to meet the margin requirements for a leveraged position or fails to have sufficient funds to keep the trade open. This can be a risky and stressful situation for traders, and it’s important to be aware of the potential for liquidation when engaging in futures trading.

Large liquidations can sometimes signal the local top or bottom of a price move. This can give traders valuable information that they can use to position themselves accordingly. However, in this case, the low levels of liquidation likely indicate a lack of interest in bitcoin futures trading, rather than a specific price move.

The slump in futures trading volumes on Tuesday may also be a sign of waning interest among traders. Compared to Monday, futures trading volumes fell by 21%. However, open interest – the number of unsettled contracts – rose 1.16%. This suggests that traders opened more positions but ultimately used significantly lesser leverage. This could indicate a lesser risk-on sentiment among traders.

According to FxPro senior market analyst Alex Kuptsikevich, bitcoin may see sideways action in the coming months, which could contribute to lower futures trading volumes than usual. Kuptsikevich notes that bitcoin was up 0.6% in the past 24 hours and is approaching the upper boundary of its short-term range at $31.4K. He suggests that only a break above this level will indicate that the market is ready for further gains, with potential targets near $35.5K by the end of the month. This suggests that there may be some potential for traders to make gains in the coming weeks, but it’s important to be cautious and keep an eye on the market as it continues to evolve.