Key Points:

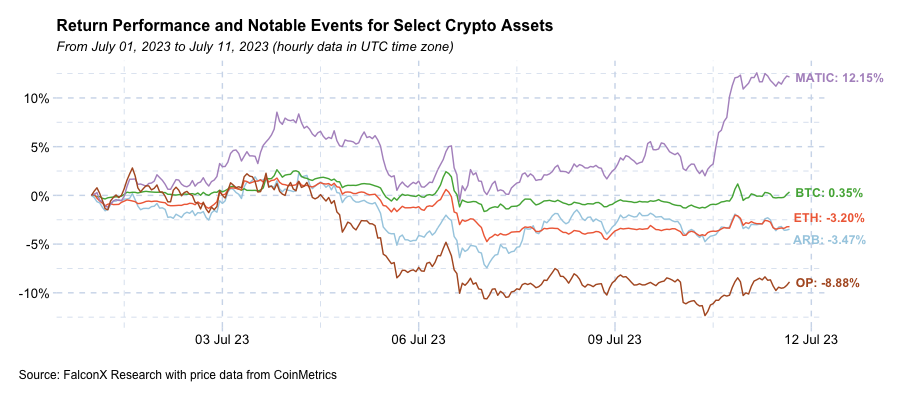

- Polygon’s MATIC token is up 12% in July, outperforming BTC and ETH.

- MATIC’s strong performance is linked to speculation around the upcoming Polygon 2.0 network update.

- Polygon Labs is collaborating to establish a “value layer” and improve tokenomics and governance for Polygon 2.0.

Polygon is showing signs of a comeback this month after a poor performance in the previous months.

The native token of the Ethereum scaling network has shown a 12% increase in July as of Tuesday afternoon, while Bitcoin remained flat and Ether saw a decline of 3.2%. Meanwhile, cryptocurrencies tied to layer-2 solutions Arbitrum and Optimism saw respective declines of 3.5% and 8.9% over the same period.

Industry experts speculate that MATIC’s comparatively strong performance could be attributed to a major network update, Polygon 2.0. This major upgrade, which is labeled as a “vision for unlimited scalability and unified liquidity, powered by Zero-Knowledge technology,” per the project’s roadmap, is the most relevant technical announcement in the industry at the moment. FalconX research note’s head of research, David Lawant, stated that “We expect MATIC to keep closing its gap versus peers as more details of the upgrade roadmap become more apparent to the market.”

Polygon Labs collaborated with developers, researchers, node operators, validators and other stakeholders to establish the upgrade roadmap, which is expected to be implemented in several phases. The first phase is geared towards establishing what’s dubbed a “value layer,” which mirrors how the “rest of the internet operates.” Other architectural overhauls, including a validium, are intended to reduce costs and boost transaction throughput. There are also plans to revamp tokenomics and governance processes.

Despite MATIC’s recent gains, it still has a ways to catch up as it is down 3.2% over the year to date, underperforming against BTC, ETH, ARB, and Solana, all of which are up more than a third. However, with the beginning of the implementation of Polygon 2.0, MATIC could potentially catch up to its peers and become a leading cryptocurrency in the market.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.