Key Points:

According to CoinGecko’s latest report on the cryptocurrency industry in the second quarter of 2023, spot trading volumes on the top ten centralized cryptocurrency exchanges (CEX) totaled $1.42 trillion, marking a significant decrease of 43.2% compared to the first quarter. Despite some signs of recovery in Q1, transaction volumes failed to sustain an upward trend in Q2.

Binance, one of the leading exchanges, experienced a decline in dominance, slipping from 61% in March 2023 to 52% in June 2023. The exchange faced mounting regulatory pressures, contributing to this decrease. Additionally, Huobi and Crypto.com dropped out of the top ten list, making way for Bybit and Bitget. Bybit and Bitget were the only exchanges within the top ten to observe volume growth, with increases of $13.1 billion and $1.5 billion, respectively.

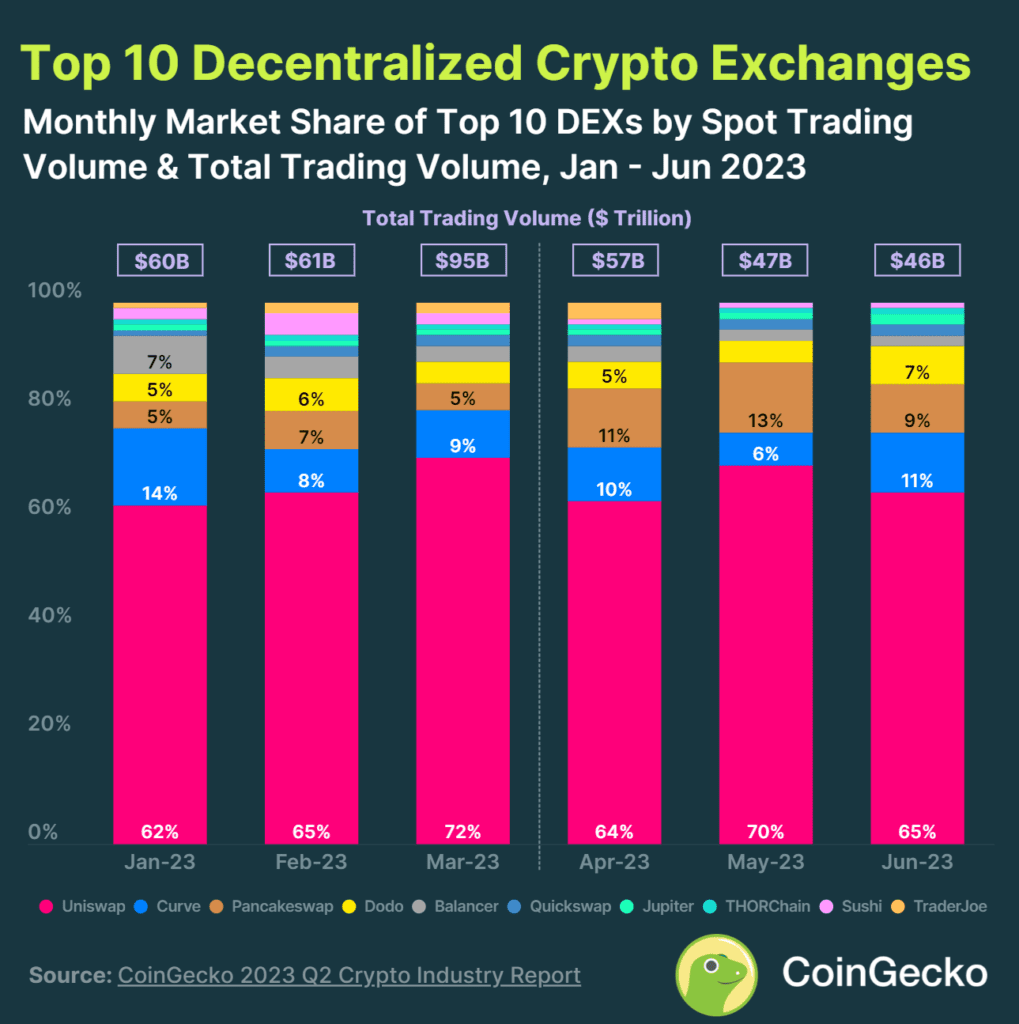

As reported by CoinGecko, in the second quarter of 2023, decentralized exchanges (DEX) saw a decline in spot trading volumes, which totaled $155 billion, down by 30.8% compared to the first quarter. Despite this decline, Uniswap maintained its position as the largest DEX, holding a dominant market share of 70% in May.

The Q2 report reflects the dynamic nature of the cryptocurrency market, with shifts in trading volumes and market share among both centralized and decentralized exchanges. Regulatory pressures and changing market conditions played a significant role in shaping the landscape during this period.

As the industry continues to evolve, it will be interesting to observe how market dynamics and regulatory developments impact trading volumes and the dominance of key players in the cryptocurrency exchange sector.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Chubbi

Coincu News

Discover the top cryptos to buy today, including BlockDAG, Ethereum, Solana, and Cardano. Learn why…

In this article, we’ll dive into how you can still get in early on one…

GeForce RTX 50 Series deliver groundbreaking performance with 92 billion transistors, doubling the capabilities of…

You won’t believe which twenty U.S. states are racing to secure "Strategic Bitcoin Reserve" bills,…

With its presale performance already boasting over $5 million raised and 62 billion BTFD coins…

Delve into BlockDAG's unlimited 6-10% USDT cashback program. Get the latest on TRON market analysis…

This website uses cookies.