Key Points:

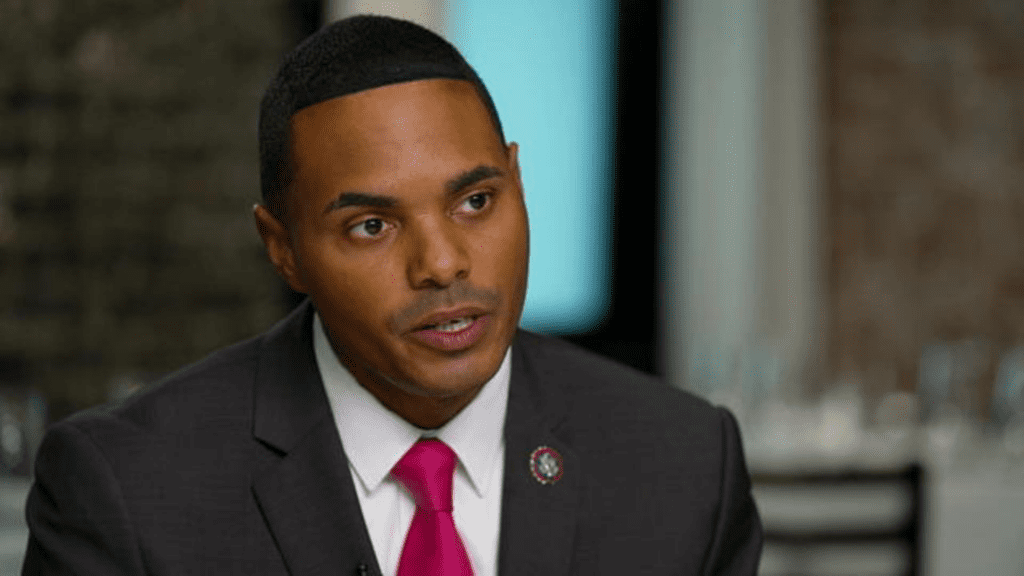

- US Congressman Ritchie Torres urges SEC to reconsider cryptocurrency regulations after legal setback.

- Court ruling suggests cryptocurrencies are not securities but can be part of investment contracts.

- The lack of clear guidance and rules from the SEC contributes to regulatory uncertainty in the crypto industry.

US Congressman Ritchie Torres has written a letter to Securities and Exchange Commission (SEC) Chairman Gary Gensler, calling for a reassessment of the agency’s regulatory approach to cryptocurrencies.

The letter comes in response to a recent legal setback for the SEC in a case involving Ripple, where a federal judge ruled that certain digital-asset transactions are not within the agency’s regulatory purview. Torres claims that this decision signifies that cryptocurrencies themselves are not securities, but they can be included in investment contracts that qualify as securities.

In the letter, Representative Torres criticizes the SEC’s enforcement tactics and suggests that the agency should learn from the recent court ruling. He argues that the SEC’s insistence on treating most digital assets as securities, which necessitates registration under current regulations, can be successfully challenged. Torres expresses concerns about the SEC’s regulatory assault on cryptocurrencies and calls for a reevaluation of its approach.

Moreover, the letter highlights the judge’s criticism of the SEC for failing to provide clear guidance and fair notice to the industry regarding the classification of digital assets. Torres emphasizes the need for the SEC to issue comprehensive rules and guidance on crypto assets under the leadership of Chairman Gensler.

The legal ruling in the SEC’s case against Ripple involved the XRP token, with the agency alleging that the sales of $1.3 billion worth of XRP constituted an unregistered securities offering. However, Judge Analisa Torres ruled that only sales to institutional buyers could be considered securities, while sales to retail purchasers and employee salaries paid with XRP did not meet the criteria of investment contracts.

Representative Torres argues that the SEC has applied the “Howey Test” inconsistently and that the recent ruling signifies a return to a more rigorous application of the test. The Howey Test, established in a 1946 court case, is used to determine if an instrument qualifies as a security based on specific criteria.

This letter from Representative Torres reflects the ongoing regulatory uncertainty surrounding cryptocurrencies in the United States. While the SEC, along with other government entities, has been striving to regulate the crypto industry, Torres takes a different stance by advocating for a more supportive and balanced approach. The outcome of the Ripple case and the concerns raised by Torres highlight the need for clearer regulations and comprehensive guidance in the rapidly evolving crypto space.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.