Key Points:

- Espresso Systems launches testnet version of Espresso Sequencer on Polygon zkEVM, enhancing scalability and interoperability for the Ethereum ecosystem and beyond.

- Sequencers play a critical role in operating layer-2 blockchain networks, addressing fragility and centralization concerns.

- Partnership agreements with Caldera, Spire, Injective, and Catalyst AMM demonstrate growing industry support for Espresso’s Sequencer integration.

According to Blockworks, Blockchain infrastructure company Espresso Systems has unveiled a significant development in the world of blockchain technology. They have released a testnet version of the Espresso Sequencer, which operates on a forked version of Polygon zkEVM.

This testnet, named Doppio, has been running within the company, but it is set to be open to external nodes in the coming months. The Espresso Sequencer plays a crucial role in operating layer-2 blockchain networks, as it is responsible for ordering transactions from the mempool and transmitting the information back to a virtual machine. This innovative development could have far-reaching implications for the blockchain ecosystem.

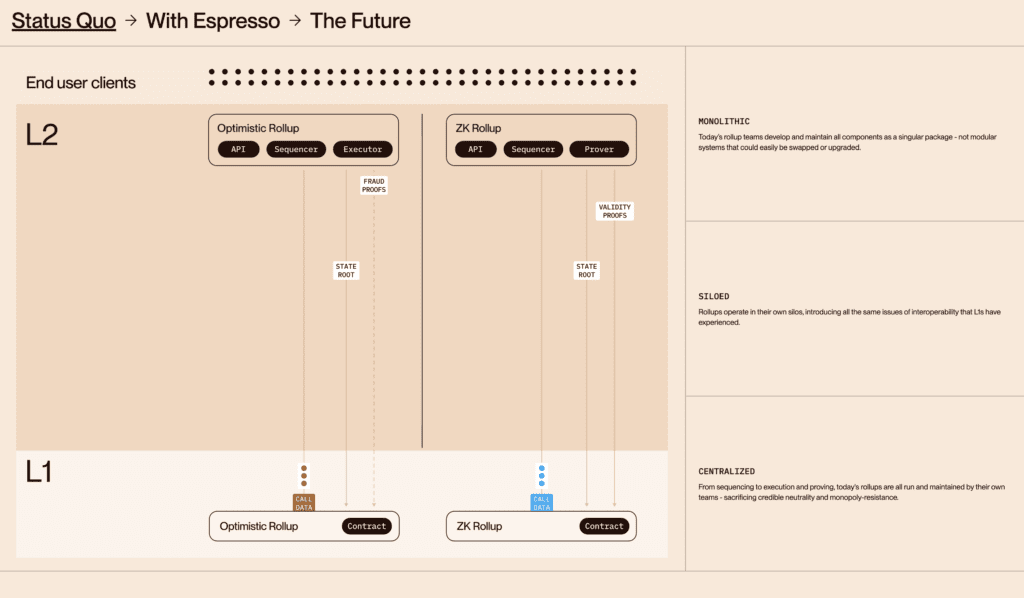

Rollups are emerging as a potent solution to scale Ethereum’s ecosystem, attracting considerable attention from blockchain developers. In the quest to reduce fragility and centralization, one key component stands out as vulnerable – sequencers. Sequencers are an essential part of rollups, running their own isolated sequencers with individual execution environments. For zero-knowledge (ZK) rollups, they even have their own provers.

In light of this, Espresso Systems seeks to address these centralization concerns and bolster the decentralization, scaling, and interoperability of rollups in both the Ethereum ecosystem and beyond.

Espresso Systems is the driving force behind the development of the Espresso Sequencer, and their achievements in this domain have attracted substantial support. The company has raised over $30 million from notable backers, including Electric Capital, Greylock Partners, Sequoia Capital, and Polychain Capital. This financial backing demonstrates the growing recognition and trust in Espresso Systems’ capabilities.

Initially, Espresso Systems had set out to build a highly scalable and privacy-focused decentralized L1 protocol. However, as they progressed in their journey, they realized the need to pivot towards building for and within the Ethereum ecosystem.

This pivot led to two separate but essential efforts. Firstly, to enhance privacy options, they developed the CAPE application, enabling custom configurations of transaction-level privacy, deployable on any EVM chain. Secondly, to address performance concerns, Espresso Systems supports rollups in decentralizing their sequencer components. This approach aims to ensure credible neutrality, security, reliability, and interoperability without sacrificing performance.

Additionally, Espresso Systems is committed to contributing to open-source developer tools. Their Jellyfish cryptography library serves this purpose, and they are equally enthusiastic about sharing research breakthroughs in privacy and scaling, exemplified by projects like VERI-ZEXE and Hyperplonk.

Espresso Systems’ overarching goal is to provide safer, more open, and performant options for on-chain interactions, with particular emphasis on privacy and performance within the Ethereum ecosystem. Their efforts to balance decentralization, security, and incentive alignment in designing the Espresso Sequencer demonstrate their commitment to the advancement of blockchain technology and the betterment of financial infrastructure for users worldwide.

With the introduction of the testnet on Polygon zkVM, Espresso is also collaborating with Caldera to develop an interface between the Espresso Sequencer and the OP stack. Existing partnerships with Spire, Injective, and Catalyst AMM also help them prioritize integration with Espresso’s Sequencer.

The launch of the testnet version of the Espresso Sequencer marks a significant step forward in this endeavor, and the company’s partnerships with other projects are indicative of the growing collaboration within the blockchain space. As they continue to innovate and drive progress, Espresso Systems may play a pivotal role in shaping the future of blockchain technology and its applications.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.