Key Points:

- Despite Bitcoin’s decline, MakerDAO’s Maker (MKR) spiked 26% in a week as the token buyback program went live.

- A series of whales and organizations compete to transfer tokens to exchanges to take profits.

Some MakerDAO Maker (MKR) whales are taking advantage of the massive price rally to move large amounts of MKR to exchanges, possibly taking profits.

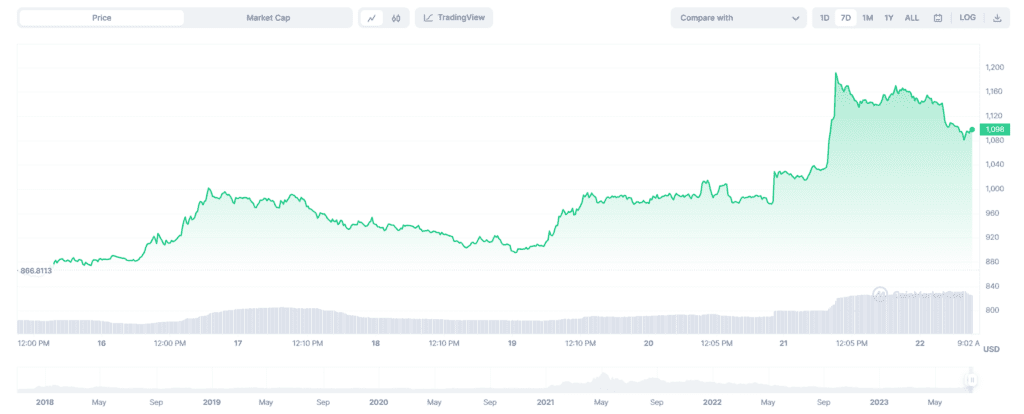

MakerDAO’s MKR token rose to near a one-year high on Friday after the introduction of a token buyback program took place. MKR briefly rallied above $1,200 early Friday, for the first time since last August, then dropped some of its gains to change hands at around $1,148. This token has gained 26.55% in the past week.

The price action occurred as the lending protocol triggered a token buyback program on Wednesday, removing the supply of Maker token from the market. A governance proposal explains that the so-called Smart Burn Engine periodically allocates excess DAI stablecoins from Maker’s extra cache to purchase MKR from the UniSwap team.

The token’s total market cap is around $1 billion, so a buyback would reduce the supply by 0.7% per month at current prices.

The notable increase in value is mainly related to recent activities involving venture capital firm Andreessen Horowitz (a16z) and CMS Holdings. Andreessen Horowitz, known for his substantial investments in various technology companies, has been observed depositing Maker tokens on the cryptocurrency exchange Coinbase, presumably to sell them.

The number of MKRs reported by a16z is 12,864, worth about $12.6 million. A private transfer of 6,900 Maker tokens ($8 million) was made to a new address, hinting at potential plans to deposit more funds on an exchange. Currently, a16z holds 12,396 tokens worth about $14.4 million.

At the same time, CMS Holdings, a private investment firm specializing in blockchain and decentralized finance, has reduced its recently accumulated holdings of MKR. Just before the spike, the company sent 525 token (worth around $614,000) to Binance.

Previously, CMS Holdings withdrew 1,325 tokens ($1.54 million) from Binance and Bitget, with an average price of $793. The company’s Maker holdings are 800 tokens, with an approximate value of $936,000. This abrupt correction in the holdings of these influential market players could play a role in the price increase of MKR.

Furthermore, another whale decrypted the amount of 4,210 tokens ($4.85 million) and deposited it all on Binance 12 hours ago. This whale amassed 4,210 tokens (worth $3.19 million at the time) from Binance at $758, making a profit of ~$1.66 million.

The massive whale action caused the token’s price to temporarily decline to $1,097, down 8% over the past 24 hours.

Maker is one of the largest and oldest DeFi lending protocols and also issued $4.6 billion worth of DAI stablecoins. It is led by a decentralized autonomous organization (DAO), where MKR holders vote on governance proposals.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.