Key Points:

- Snapshot voting results show that Arbitrum’s proposal to allocate 12 million ARBs to Camelot has not been passed.

- The impending defeat of the vote comes after a heated debate both inside and outside the Arbitrum DAO forum since late last month.

- Not only the issue of conflicts of interest but also the need for clear guidelines is also one of the reasons why the proposal is rejected.

Camelot’s plan to become the first Arbitrum-native protocol to receive funding from the Arbitrum Foundation has failed, according to an ongoing DAO vote scheduled to end on July 22.

Proposal to provide a $9 million ARB grant to Camelot. Camelot will use the tokens it acquires to provide various incentives to partner projects’ liquidity pools to accelerate the ecosystem’s development and a small part to the ARB, ETH, and USDC pools.

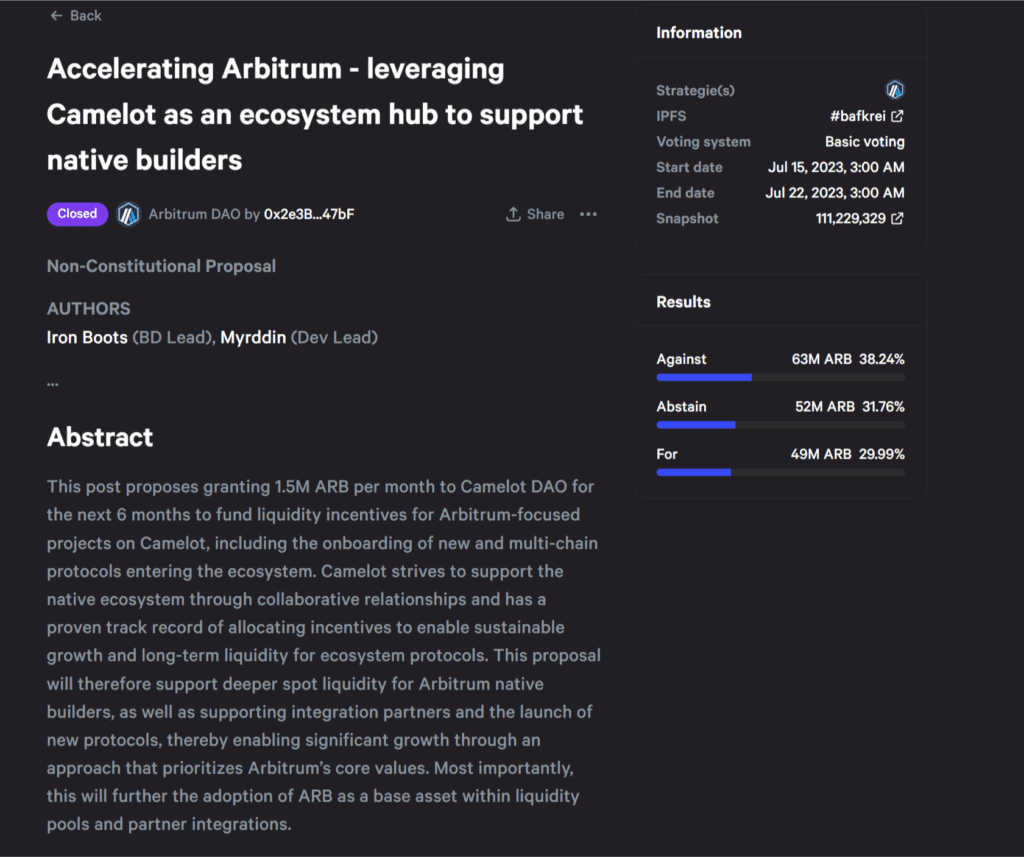

Data from Snapshot shows that 38.24% of the votes so far oppose a proposal to grant Arbitrum native decentralized exchange Camelot $11 million in Arbitrum’s native token ARB.

More than 31.76% of the votes cast by DAO participants abstained from supporting or rejecting the proposal, while only 29.99% voted in favor of the grant. The impending defeat of the vote comes after a heated debate inside and outside the Arbitrum DAO forum since the proposal was made late last month.

Supporters of the grant say that the opposition is being pushed by those with certain vested interests in rival protocols. The argument is that the funding will give Camelot an undue advantage over other decentralized exchanges in the Arbitrum ecosystem.

According to the community debate, most opponents said the lack of well-defined guidelines to direct the use of the grant was cause for concern. Clarity is essential to ensure more transparent persuasion. This hinders the ability to predict the steps to take after implementing the proposal.

Instead of giving a good reason in the justification of the proposal, it talks about Camelot’s successes. It presents a self-praise paragraph, another shortcoming in the structure of the proposal.

In addition, the sharing of tokens used to incentivize liquidity pools with only partner project teams is a step that hinders and does not support the growth of the ecosystem. In this case, the protesting community might argue that Camelot’s failure to act objectively would not be objective.

Some of the delegates who opposed the proposal also sounded the alarm about the concentration of voting power in a select group of representatives. They urge governance token holders to exercise caution in delegating their governance to prevent DAO capture – a situation where delegates form a voting block powerful enough to influence DAO decision-making.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.