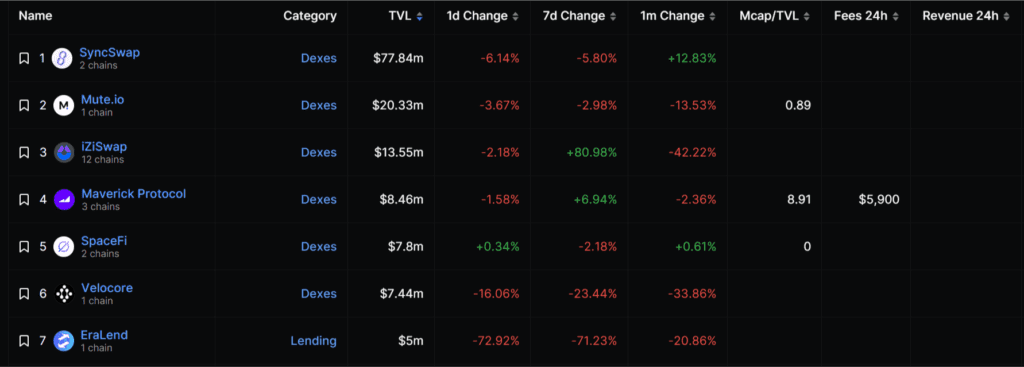

Money flow continues to pour strongly into the zkSync ecosystem due to the FOMO wave after the Arbitrum blockchain airdrop event. Mute.io Review – zkSync’s flagship DEX platform. Currently, Mute.io TVL is ranked 2nd in the system’s TVL rankings, just behind Syncswap. So, what’s so special about the Mute.io project? The following article will provide all the information you need about this project.

What is Mute.io?

Mute is the DeFi Hub platform for projects built on zkSync. The predecessor of Mute is a PoW-based Blockchain project named NIX to create a layer 2 solution applying zero-knowledge proof technology. However, the project was then redirected to build on zkSync and renamed Mute.io.

Currently, Mute.io is the 2nd DEX in the entire zkSync Era ecosystem, just behind SynSwap, with TVL reaching $20.3 million.

Why does Mute.io stand out?

Mute.io stands out as a zkRollup-based DEX on top of the zkSync Era. It includes modules like a limit order, pledge platform, and bond platform. It supports wallets, exchanges, LP pools, Amplifiers, bonds, and DAO governance functions. It allows ETH, USDC, MUTE, WISP, ZKINA, MVX, IDO, WETH, USD+, ZKDOGE, DOF, BOLT, ZKFLOKI, and other assets to trade and provide liquidity. Users can get LP tokens after providing liquidity in LP pool and commit them to Amplifier to earn income.

The Mute Switch Amplifier feature is one of the things that makes the protocol stand out. This is a form of bonus rewards for Liquidity Providers who are holding a certain amount of MUTE tokens in the wallet.

The extra APY for users will be deducted from the platform’s revenue and fees. Projects that want to attract users to provide liquidity to their pool can register to participate in the Amplifier program to be allocated MUTE tokens from Mute.io to reward liquidity providers.

Besides, Bond is also an improvement of Mute. Users can use their LP tokens to buy MUTE from Mute DAO at a lower price (Bond). After buying the Bond, MUTE will be issued in 7 days. If ROI is positive, user can earn Grab more MUTE than LP token. Through the Bond, the Mute DAO is able to increase the liquidity owned by the deal, increase its treasury revenue, and the long-term liquidity of the deal. dMute is the DAO token of the Mute.io ecosystem. Users must lock MUTE for 7 to 364 days and get dMUTE back. After the lock time, the user can change the MUTE.

Mute.io Review: Products

Mute Switch

The Mute Switch is a zkRollup DeFi Platform built on zkSync v2. Invest & trade, earn yields, and participate in Bonds all on one decentralized, community driven platform. Leverage the security of Ethereum without high gas fees.

Features include:

- AMM based DEX w/ Limit orders

- Stable and Normal AMM curve pools

- Variable LP fees: Stable (0.01%-2%), Normal (0.01%-10%)

- Fixed and Dynamic Protocol fees

- 0% LP minting fee

- 1-3s settlements

- 95%+ gas cost savings compared to L1 ETH

- Yield Generation Platform

- Bond Offerings

- DAO

Mute Switch provides 2 types of pools:

- Pool Stable with LP fees (providing liquidity) from 0.01% – 2%. This pool is used to trade asset pairs that have correlated prices (like USDC/DAI).

- Pool Normal with LP fee from 0.01% – 10%. This pool is used to trade unrelated assets (like ETH/WBTC).

Mute Amplifier

The Mute Switch Amplifier is a liquidity reward protocol that allows LPs to gain additional revenue APY & take part in the Mute ecosystem. Amplifier rewards are fueled by platform revenue and fees, which come directly from the buy back and make system the Mute DAO has in place. Projects that get approved to be a part of the Amplifier program get allocated a specific amount of $MUTE over a period of time with a target APY for the liquidity providers.

The APY in an amplifier is variable and is determined by a ratio of the users snapshotted dMute vote value vs total Mute rewards in the pool. To own the Max Amplified APY, you must own the same amount of Mute rewards in the pool as you do of dMute votes.

Mute Bonds

Bonding is the act of exchanging MUTE-ETH LP tokens for MUTE tokens from the Mute DAO. Mute.io will set the exchange rate (for example 1 MUTE-ETH LP will exchange for how many MUTE tokens), as well as set the vesting time for that exchange.

In other words, Bonding is when you are selling your LP tokens, in exchange for a receipt of vesting MUTE tokens. The total value of vesting you will receive will be slightly more than the value when selling LP tokens on the market.

The purpose of Mute bonds is to increase the amount of Protocol Owned Liquidity via the Mute DAO which increases the revenue towards the treasury and long term liquidity for the protocol. The benefit to bonding allows a user to purchase Mute at a lower cost basis. Bonds are sold at a first come first serve basis. A bond ROI starts at 0% and increases slowly until it is purchased. Once purchased, the cycle is reset with a new bond and dMute is payed out immediately. The dMute is issued with a 7 day time lock. After 7 days, the dMute can be redeemed for MUTE directly, or re-locked with different parameters.

Limit Orders

Limit orders on the Switch utilize the native AMM as a liquidity and inventory provider. Due to this, limit orders can cause substantial or minimal slippage on limit orders based on the volume of the order and depth of the liquidity on the pair being traded. Regardless if a limit order causes a 10% slippage on the AMM pair being traded, the limit order owner still receives the amount the order was placed for. For limit orders to work, there is a free market of market making bots that scan and execute trades based on their strategy and fees.

Mute DAO

Is the DAO of Mute.io, with the governance token MUTE, acting as an intermediary token to unlock access to the DAO. To participate in the Mute DAO, users need to lock the MUTE for a certain period of time (7 – 364 days) and receive in return dMute, a soulbound token (non-transferable and tied to a unique wallet address). The longer a user locks the MUTE, the more dMute the user will receive. From there, the power in the DAO to propose and vote will be higher.

dMute vote utility:

- Dictates a users Amplifier Boost of a Amplifier Pool

- Modifications to the AMM protocol fee (0.1% currently, can be fixed or dynamic depending on pair)

- Creation of additional Amplifier pools and reward distributions

- Creation of additional Bond Offerings and distributions

- All Mute DAO utility

Mute.io Review: Tokenomic

Basic information

- Token Name: MUTE token

- Ticker: MUTE

- Blockchain: Ethereum and zkSync

- Token Contract on Ethereum: 0xA49d7499271aE71cd8aB9Ac515e6694C755d400c

- Token Contract on zkSync: 0x0e97c7a0f8b2c9885c8ac9fc6136e829cbc21d42

- Token Type: Utility, Governance

- Total Supply: 40,000,000 MUTE

- Circulating Supply: 40,000,000 MUTE

Token Allocation

Mute started out as a proof-of-work blockchain network with the goal of creating a layer-two solution using zero-knowledge proofs. The project later transitioned to the ERC-20 standard and began building on zkSync. Throughout this process, Mute remained committed to fairness and decentralization. It was launched in a fair manner, with no ICO, pre-seed, or early investments, and it was GPU mineable. About 10% of block rewards were allocated to the Mute treasury. The migration from Mute’s native chain to ERC-20 was carried out through a 1:1 coin/token swap. All swaps were conducted transparently and can be verified on the Ethereum Blockchain via Etherscan.

The Treasury wallet holds approximately 8% of the total Mute token supply. These funds are being used to support the ongoing development of Mute, and the history of the treasury address and its movements can be tracked. In the future, the treasury and its assets on L2 will be controlled by the DAO through dMute.

Additionally, Mute has integrated/merged a side token called VOICE into its total supply. As part of this arrangement, VOICE token holders were able to swap their tokens for Mute tokens at a rate of 1:197,55. The resulting Mute tokens are included in the project’s total supply, and holders of VOICE tokens are still able to conduct this swap via the smart contract.

Mute.io Review: Fee

Mute.io fee source will include two types:

- Dynamic: Fees are based on each LP Pool, where:

- Fees for stable pools: Fluctuating 0.01 – 2%

- Fees for other pools: Fluctuating 0.01 – 10%

- Fixed: Fixed fee for each trading order

The above fees will be shared with the Liquidity Provider and a small part to the Mute DAO. Currently, Mute.io review has not announced the specific number that will be brought back to Mute DAO from this fee.

Mute.io Review: Team

The team behind Mute.io has a deep history with Zero-Knowledge protocols in crypto. Before Mute, the team created the first Zero-Knowledge Atomic Swap protocol between BTC and UTXO based chains, along with innovative work on Zerocoin and Sigma addressing schemes and transactions. Now, they bring that expertise to Mute and their new initiative: the Mute DAO. With a team that has a proven track record of innovation and expertise, Mute is ready to become a leading player in the zkDeFi space by building on zkSync and driving long-term value to its community.

Conclusion

Users of the DeFi platform Mute.io may trade and invest using their DEX. Additionally, users may engage in Bonds and earn interest under one roof. It is a platform that is entirely community-driven, with no outside interference. They also benefit from Ethereum’s security while avoiding high gas costs, making it the ideal setting for trading.

The platform offers limit orders on an automated market maker (AMM) exchange. When generating pairings, it charges a 0.1% protocol cost and an LP fee that ranges from 0.1% to 10%. Additionally, it offers a 1-3 second payment period and 0% LP minting charge. Mute.io claim to save on gas costs by over 95% when compared to ETH Layer 1.

On the other hand, MUTE token is the power of the entire ecosystem. It promotes the development of the ecosystem through MuteDAO and financial proposals. Moreover, the revenue-based acquisition will drive the expansion of the ecosystem and pave the way for future projects.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.