There is a clear opportunity for the traditional finance industry to bring tremendous value to the crypto market by adopting Real world assets (RWA) with blockchain technology. So how is this combination created, and does its applicability really meet expectations?

How did Real World Assets (RWA) enter the blockchain world?

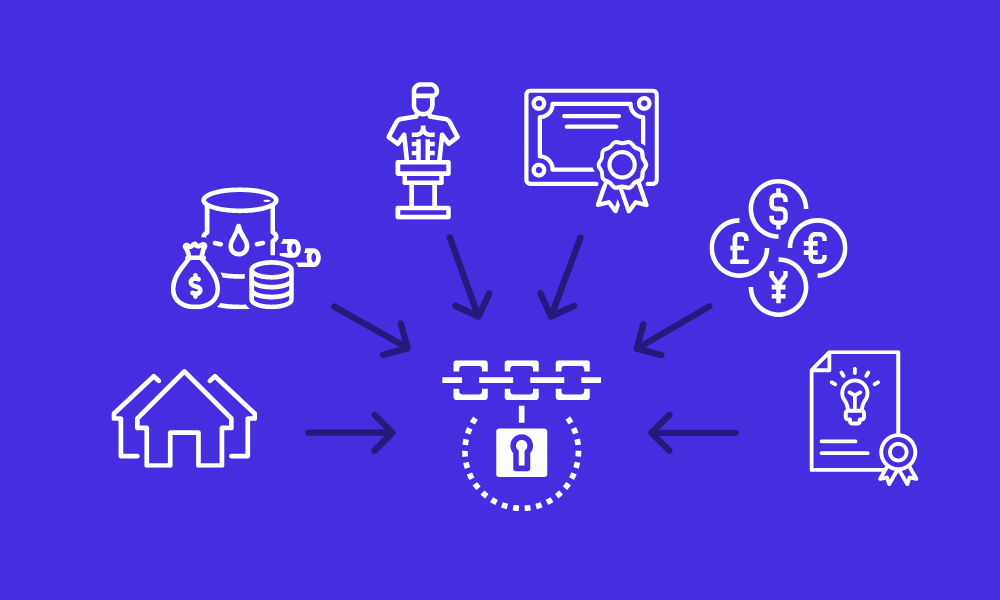

Real World Assets (RWA) are assets that possess a value that is inherent, tangible, or physical in nature and resides in the physical world. RWA’s scope is broad and includes everything from actual items such as real estate, liquor, merchandise, artwork, and vehicles, to contractual or legal rights such as patents and copyrights.

Tokenization is the process of representing ownership of RWA as digital tokens on a blockchain. This method transforms physical assets like real estate, precious metals, and commodities into digital tokens with unique attributes, allowing them to be traded on cryptocurrency exchanges. Tokenization brings RWA into the crypto space, breaking down barriers that previously hindered access to these lucrative markets.

Why RWA needs to combine with blockchain

Real World Assets is a bridge between the current cryptocurrency market, real-world assets and resources, and the mainstream financial market, as a mechanism that benefits all participants.

By encrypting these assets, RWA creates a transparent and secure environment where ownership is recorded on an immutable ledger. This ensures trust and reduces counterparty risk, enhancing the overall security of the asset class.

Tokenization of these assets on a blockchain platform allows partial ownership, allowing investors to buy and sell smaller portions of these assets. This process dramatically increases liquidity in the market, making it easier for investors to enter and exit positions without going through intermediaries or complicated legal procedures.

In addition to stability, Profitable RWA (yRWA) provides an additional avenue for income generation in the crypto market. yRWAs allow investors to earn a stream of interest or income from the underlying asset. This income can be derived from rental payments, dividends, interest, or other sources of revenue related to the property.

The cryptocurrency market has undergone significant infrastructural development, with robust blockchain networks and decentralized exchanges. These advancements provide a solid foundation for the tokenization and trading of real-world assets, allowing for seamless integration of RWAs into the existing ecosystem.

Applications of RWA in blockchain

Real Estate Investment

One significant application of real world assets in crypto is the tokenization of real estate properties. Due to high capital requirements and illiquidity, real estate investment has been limited to high-net-worth individuals or institutional investors. However, tokenization allows for fractional ownership, enabling multiple investors to own a property jointly.

Fractional ownership opens the doors for an overall range of investors to participate in real estate investments, making it easier for individuals with limited capital to diversify their portfolios. In addition, tokenization streamlines the process of buying and selling real estate assets, as ownership transfer becomes as simple as transferring tokens on the blockchain.

Forex Trading

Commodities like gold, silver, oil, and agricultural products are essential components of traditional investment portfolios. Integrating these assets into the crypto space through tokenization offers numerous benefits. Tokenization liquidity enables users to trade commodities 24/7 on cryptocurrency exchanges. It also facilitates fractional ownership, making it possible for investors to own a portion of valuable commodities that may have been out of reach in the traditional market.

Furthermore, tokenization reduces the complexity of traditional commodity trading, as it relates to transparent intermediaries, and provides a decentralized platform for transactions.

Art and Collectibles

The world of art and collectibles has always been exclusive, with only a select few having access to valuable artworks and rare collectibles. Tokenization presents a groundbreaking opportunity to democratize this space. Investors can own fractional shares of these assets by tokenizing valuable art pieces and collectibles.

This newfound accessibility allows a wider audience to invest in art and collectibles and liquidity in the market. Tokenized assets can be easily traded on various crypto platforms, making it more convenient for art enthusiasts and investors to buy, sell, or exchange their shares.

Venture Capital and Private Equity

Traditionally, investing in private companies or venture capital funds has been reserved for accredited investors and institutions. However, tokenizing real-world assets in the form of equity shares brings innovation to this space. Startups can raise capital by selling tokens that represent equity in their retail ventures, opening up opportunities for investors to participate in early-stage investments.

Tokenization also enables easier and faster transfer of ownership, allowing investors to exit their investments more smoothly than in traditional private equity markets.

Intellectual Property Rights

The realm of intellectual property, including patents, copyrights, and trademarks, can greatly benefit from blockchain-based tokenization. Creators and inventors can tokenize their intellectual property assets, granting them greater control over their creations and enabling transparent monetization.

By using smart contracts, tokenization ensures that creators receive royalties and licensing fees automatically when their work is used or reproduced, reducing overhead and protecting the intellectual property rights of creators.

Debt Instruments

Beyond equity, tokenization also extends to debt instruments. RWA, like mortgages, loans, and bonds, can be transformed into digital securities. Tokenizing debt instruments provides various advantages, including improved liquidity, easier transferability, and reduced transaction costs.

For tokenized debt instruments present an opportunity to diversify their investment portfolios further and participate in fixed-income assets with greater ease.

Supply Chain Management

Blockchain technology has already proven its worth in enhancing supply chain transparency, traceability, and efficiency. By integrating real-world assets into the blockchain, companies can offer consumers more insights into the origins and journey of products.

Tokenization can be used to represent physical assets at different stages of the supply chain, ensuring that the product’s authenticity and quality are maintained and that consumers can trust the information provided.

Stablecoins

Stablecoins are cryptocurrencies designed to maintain a stable value by pegging their worth to a reserve of real-world assets. These assets can include fiat currency, precious metals, or other commodities. By backing stablecoins with tangible assets, users can have confidence that their value will not be subject to extreme volatility, making them more practical for daily transactions and as a store of value.

Conclusion

The integration of real-world assets into the crypto space through tokenization represents a groundbreaking leap in finance. By leveraging blockchain technology, we can democratize investment opportunities, increase liquidity, and promote transparency in traditional markets. These applications of real-world assets in crypto are not only reshaping finance but also contributing to the wider adoption of blockchain technology across various industries. As technology continues to evolve, we can expect even more innovative applications that bridge the gap between traditional finance and the decentralized world of cryptocurrencies.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.