Key Points:

- Coinbase CEO revealed that the SEC asked the exchange not to allow any tokens from Bitcoin.

- If compromised, it could set a precedent leading to most US crypto businesses operating out of the law.

- This partly shows the dictatorship and uncompromising decision of the SEC towards cryptocurrency service providers.

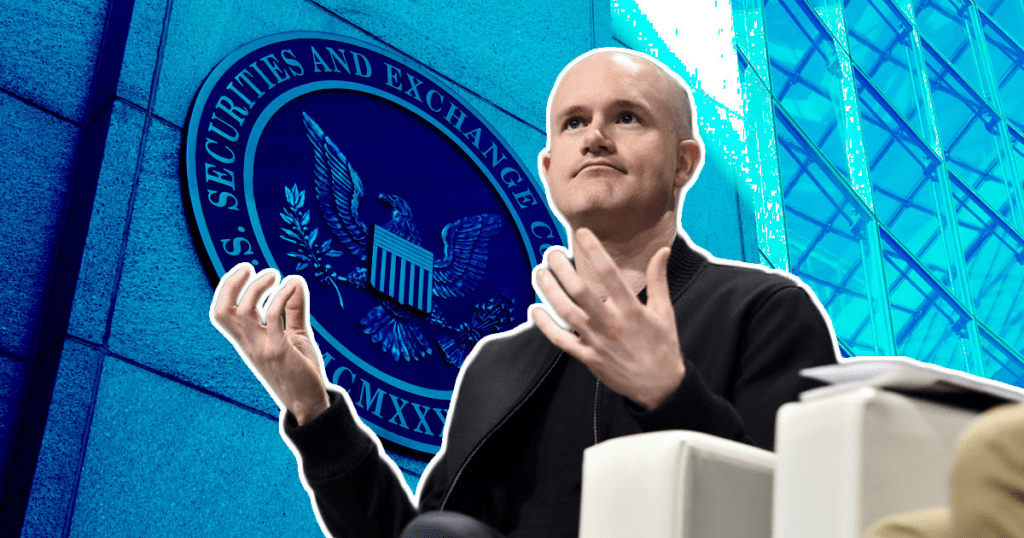

In an interview, Coinbase CEO Brian Armstrong told the Financial Times that the US SEC had asked Coinbase to stop trading all cryptocurrencies other than bitcoin.

Armstrong revealed that the SEC told him at the time that “we believe all assets other than Bitcoin are securities.” Although Armstrong asked how the SEC came to this conclusion when all of the company’s assets would be delisted, they have yet to receive an answer.

If Coinbase agrees, it could set a precedent leading to the majority of US crypto businesses outlawing unless they register with the commission.

The report said the SEC declined to comment on the settlement regarding Coinbase’s delisting of all tokens other than Bitcoin and its impact on the rest of the industry. Strong action by the SEC could lead to a greater movement in the crypto industry for all tokens and crypto service providers in the market.

As mentioned earlier, the SEC sued Coinbase in early June, alleging that the cryptocurrency trading platform simultaneously acts as a broker, exchange, and clearinghouse for unregistered securities – specifically, 13 different cryptocurrencies that the SEC alleges met the requirements of the Howey Test, a 1940s precedent set by the US Supreme Court.

Coinbase has been announcing the SEC lawsuit for months, publishing a blog post when it first received a Wells Notice from the regulator and maintaining a legal effort to convince the court that it is currently not There is enough regulatory clarity for crypto industry participants to know whether or not they are violating federal securities laws.

So far, both sides have not shown any concessions before the opponent. It is possible that the lawsuit will take as long as the SEC lawsuit against Ripple (nearly 3 years) before any conclusions are reached.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.