Key Points:

- $73K stolen from BNB Smart Chain due to Vyper vulnerability similar to the one on Curve Finance. 3 different exploits used. Hackers battling it out on-chain to recover funds.

- Vyper vulnerability can affect other protocols.

- Community and developers must work together to identify and fix these vulnerabilities quickly to ensure blockchain security and longevity.

BNB Smart Chain is a decentralized platform that has recently suffered from copycat attacks due to a vulnerability in the Vyper programming language.

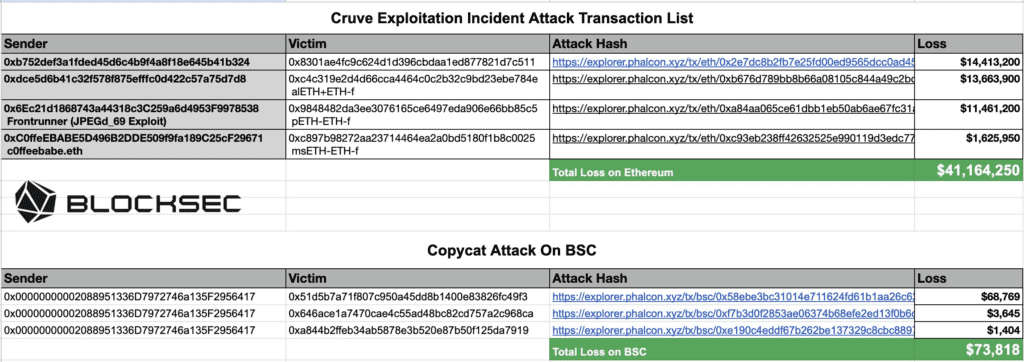

This issue is similar to the exploit that occurred on the decentralized finance protocol Curve Finance. As a result of these attacks, around $73,000 worth of cryptocurrencies on BSC has been stolen across three different exploits. This is concerning, especially because similar exploits targeting liquidity pools on Curve Finance have resulted in losses exceeding $41 million.

The vulnerability was caused by a malfunctioning reentrancy lock on Vyper versions 0.2.15, 0.2.16, and 0.3.0. This programming language is widely used for Web3 projects and was designed for the Ethereum Virtual Machine. The Vyper vulnerability could also affect other protocols that use the afflicted Vyper versions.

In response to the exploit, a number of white hat and black hat hackers have been battling it out on-chain trying to disrupt each other’s exploit attempts or efforts to recover funds. One potential whitehat, known as “c0ffebabe.eth,” even managed to grab some funds to store for safekeeping. On July 30th, they sent an on-chain message asking affected protocols to contact them to organize the return of the stolen funds.

While these exploits are concerning, it is important to remember that the blockchain space is constantly evolving, and vulnerabilities are bound to happen from time to time. However, it is crucial that the community and developers work together to identify and fix these issues promptly to ensure the security and longevity of the blockchain ecosystem.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.