Key Points:

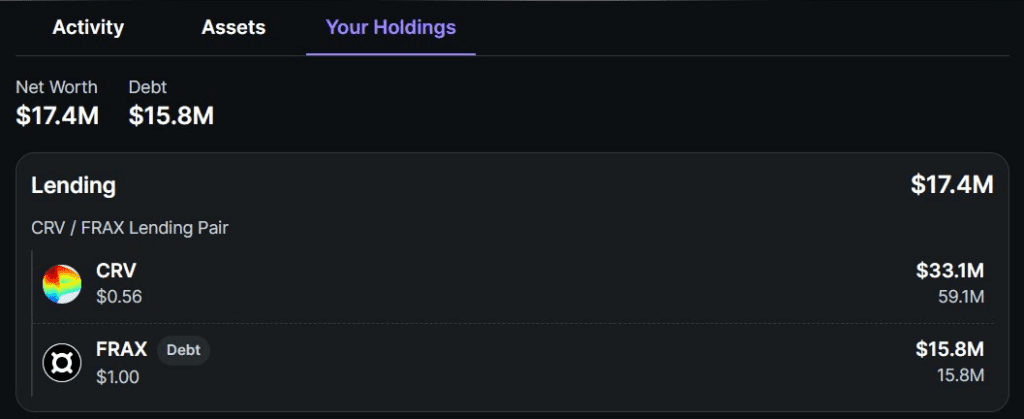

- Delphi Digital warns of Curve founder Michael Egorov’s risky position on Frax Finance, with 59 million CRV collaterals and 15.8 million FRAX debt.

- Fraxlend’s time-weighted variable rate poses significant risks, with an interest rate expected to surge to nearly 10,000% APY in 3.5 days.

- Potential liquidation of Egorov’s large holdings could lead to a drastic drop in CRV prices, impacting the broader DeFi ecosystem.

In a recent Twitter update, Delphi Digital, a reputable crypto investment research institution, sounded the alarm over Curve Finance founder Michael Egorov’s significant exposure to Frax Finance.

The report revealed that Egorov currently holds a staggering 59 million CRV collaterals and 15.8 million FRAX debt positions on the platform, overshadowing his holdings on Aave. While the position might seem smaller in size, the intricate dynamics of Fraxlend’s time-weighted variable rate pose substantial risks to the CRV ecosystem.

Delphi Digital’s analysis highlighted that at the current utilization rate of 100%, the interest rate on Fraxlend doubles every 12 hours, reaching a concerning 81.2% at press time, merely an hour ago. Alarmingly, this rate is projected to surge to an eye-watering 10,000% annual percentage yield (APY) within a short span of 3.5 days. Regardless of the fluctuations in the CRV price, such an astronomically high interest rate could eventually lead to the liquidation of Egorov’s position.

In the worst-case scenario, with a maximum loan-to-value (LTV) ratio of 75%, the position’s liquidation price could plunge to 0.517 CRV/FRAX within 4.5 days, equivalent to less than a 10% drop from the current price. While Egorov has attempted to mitigate risks by reducing debt and utilization rate, repaying 4 million FRAX over the last 24 hours, his efforts have been in vain as the market’s utilization rate stubbornly remains at 100%. This is primarily due to the immediate withdrawal of liquidity by users upon repayment.

With a position of such magnitude hanging in the balance, Delphi Digital expressed serious concerns about the impact on CRV prices, considering the limited liquidity in the ecosystem. An 8-figure liquidation of Egorov’s holdings could trigger a drastic depreciation of CRV value, potentially causing ripple effects throughout the DeFi ecosystem.

To address the escalating risks, Michael Egorov deployed a new Curve pool and gauge on the same day, aiming to incentivize liquidity towards the lending market. The pool, consisting of crvUSD and Fraxlend’s CRV/FRAX LP token, received a seeding of 100,000 CRV rewards. This pool, directly linked to his borrowing on Fraxlend, poses the most substantial risk to his potential liquidation. Within four hours of its launch, the pool attracted $2 million in liquidity, resulting in a reduction of the utilization rate to 89%.

Despite these efforts, the crypto community remains vigilant about the potential ramifications of such a high-stakes situation. The health of Curve Finance hangs in the balance as the market anxiously awaits further developments in this unfolding financial saga.

Curve Finance reported yesterday that, in addition to many Ethereum pools, an Arbitrum-based liquidity pool may have been “possibly compromised” over the weekend.

According to preliminary assessments, the site was used for more over $24 million on Sunday. But, as the theft occurs in real-time, blockchain security company PeckShield has increased the stolen amount to $52 million.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.