Key Points:

- Curve founder makes strategic on-chain moves after 2 million USDT transfer.

- Repays 7.14 million FRAX debt, recovers 5 million CRV, showcases financial acumen.

- Initiates responsible return of Abracadabra’s lending position with 2 million MIM.

On-chain data reveals a series of intriguing transactions by Curve founder following a 2 million USDT transfer.

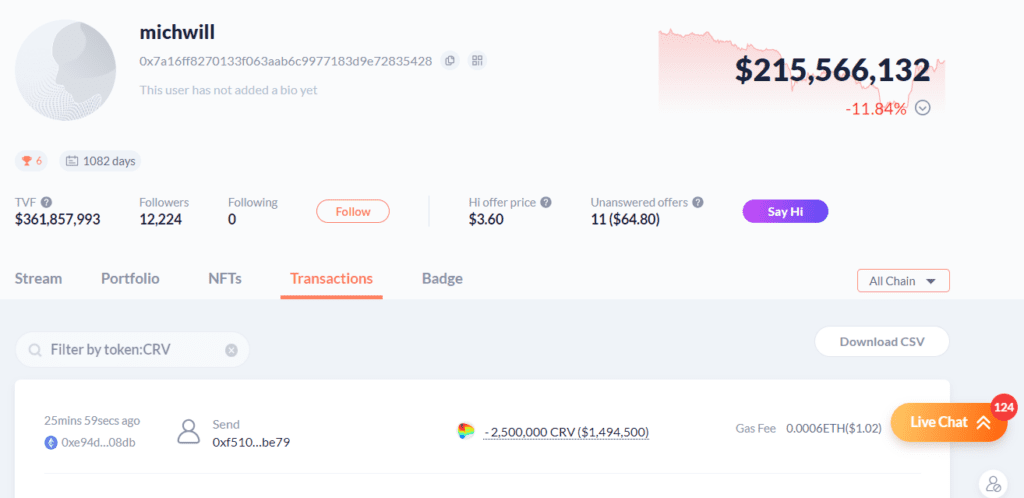

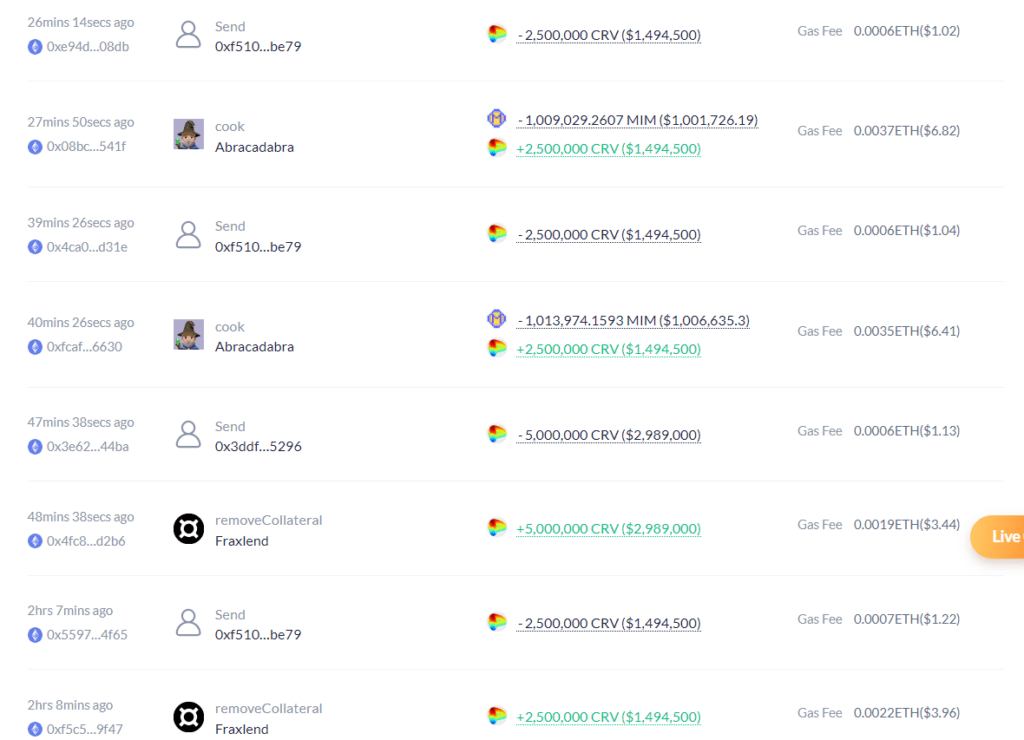

The founder converted 200 USDT into FRAX, clearing a 2 million FRAX debt and recovering 5 million CRV. Moreover, the Curve founder has paid off a total of 7.14 million FRAX debt. Additionally, the founder initiates the return of Abracadabra’s lending position, repaying approximately 2 million MIM with 2 million USDT and withdrawing 5 million CRV. The crypto community is abuzz with speculation over the founder’s strategic moves and implications for the DeFi landscape.

A notable sequence of on-chain transactions has brought the founder of Curve into the spotlight. Following a transfer of 2 million USDT to the founder’s address, a calculated series of moves ensued, revealing a calculated and strategic approach.

The Curve founder converted 200 USDT into FRAX, which was immediately used to settle a 2 million FRAX debt. This move showcases the founder’s astute financial management and the potential for leveraging stablecoins to address debt obligations.

The founder then recovered 5 million CRV tokens, adding to the intrigue surrounding the on-chain activities. This acquisition of CRV tokens raises questions about potential future developments within the Curve ecosystem.

The plot thickens as the Curve founder proceeds to pay off a staggering 7.14 million FRAX debt. Such a significant repayment signals a strong commitment to financial integrity and further boosts the founder’s credibility in the crypto community.

In addition to managing the FRAX debt, the founder has initiated a process to return Abracadabra’s lending position. This involves repaying around 2 million MIM using 2 million USDT and withdrawing 5 million CRV. The return of the lending position indicates a responsible and trustworthy approach to interactions with other DeFi projects.

The on-chain data surrounding the Curve founder’s actions has piqued the interest of crypto enthusiasts, investors, and analysts alike. As speculation swirls around the implications of these strategic moves, the crypto community eagerly awaits potential updates and further insights into the founder’s intentions.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.