Key Points:

- Deflationary trend driven by 26.0% plunge in pork prices.

- July’s CPI monthly rate edges up by +0.2%, indicating complexity.

- Policymakers face challenge in balancing growth amid price fluctuations.

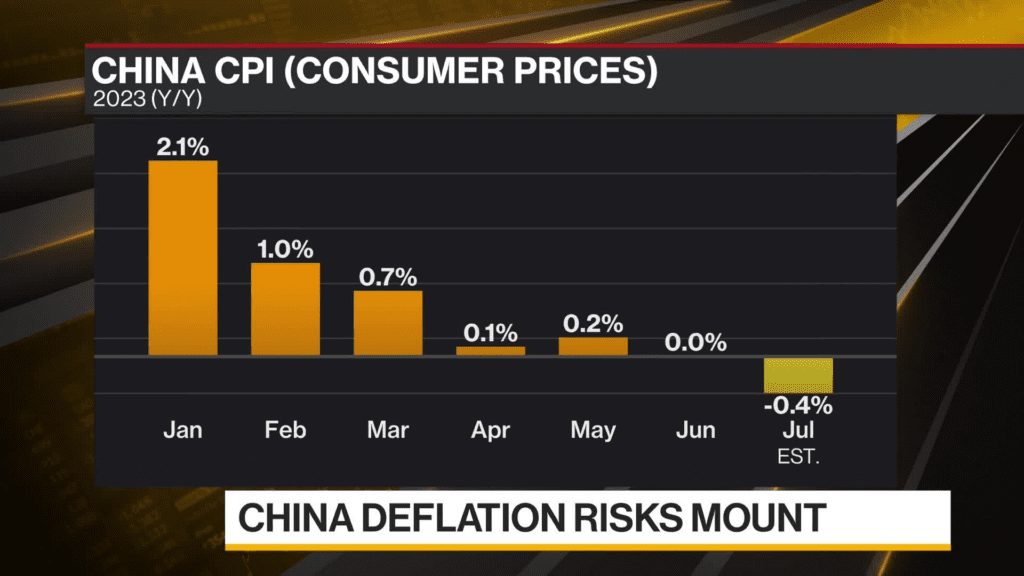

China’s economic landscape witnessed a significant shift in July as the National Bureau of Statistics revealed a surprising twist in the Consumer Price Index (CPI) data.

The annual CPI rate for the month plunged into the territory of deflation, with a notable -0.3% decrease. This unexpected turn has prompted discussions about the underlying factors causing this downturn.

One of the primary drivers behind this deflationary trend was the sharp decline in food prices. Specifically, pork prices experienced a staggering drop of 26.0%. Pork, a staple in the Chinese diet, has historically held a significant influence on the CPI, and this substantial decrease played a pivotal role in dragging down the overall index. The implications of this dip in food prices are reverberating across the economy, posing challenges for producers and suppliers alike.

Amid this deflationary environment, the CPI monthly rate for July managed to stay slightly positive, edging up by +0.2%. This nuanced increase highlights the intricacies at play within the economy, with certain sectors experiencing contrasting trajectories.

As China navigates this deflationary phase, policymakers and economists will be closely monitoring the developments. The balance between stimulating economic growth and managing the impact of fluctuating prices presents a challenging task. The government’s ability to respond to these economic shifts will be crucial in shaping the country’s recovery path and ensuring the well-being of its citizens.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.