Key Points:

- Upbit, the largest exchange in South Korea, has added SEI to its KRW and BTC markets, providing more trading opportunities for SEI users.

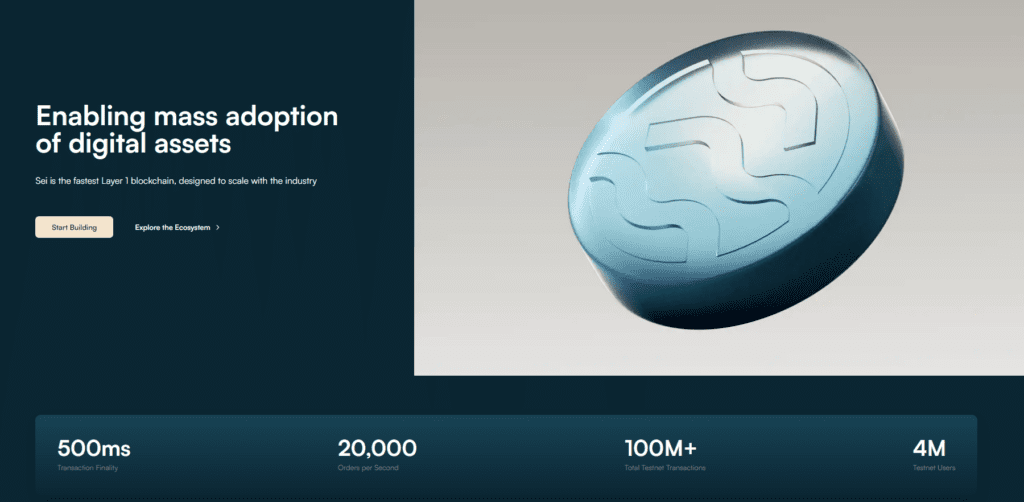

- SEI is a Layer 1 blockchain designed for exchanging digital assets.

Upbit, South Korea’s largest exchange, will list SEI on its KRW and BTC markets. SEI deposit/withdrawal will be opened on August 15, 2023, at 21:00 KST.

Upbit, South Korea’s largest exchange, has announced that it will be listing SEI on its KRW and BTC markets. SEI is a non-EVM public chain that uses the Cosmos technology stack, and this move is expected to create more trading opportunities for SEI users.

SEI is a general-purpose, open-source Layer 1 blockchain that is specialized for the exchange of digital assets. While some people may think that SEI is a DeFi chain, the exchange of digital assets is universal across gaming, social, and NFTs. Trading is general purpose so that users can trade a wide variety of digital assets on the SEI platform.

Upbit will be restricting orders under certain conditions after adding new digital assets to the KRW and BTC markets to provide a safe trading environment and accurate market information to its members. The exchange is also scheduled to support SEI deposit/withdrawal on August 15, 2023, at 21:00 KST.

SEI only supports deposits from the Sei Network and not through other networks such as BSC. All SEI deposits after the start of deposit support and before the reference price is registered on CoinMarketCap, or before the time of support for Upbit SEI trading, are all included in the Travel Rule solution verification target, regardless of whether the SEI price exceeds 1 million won.

SEI offers several popular token standards, including TokenFactory, which provides a standardized mechanism for creating fungible tokens, and CW721, which handles non-fungible tokens. CW20, although not recommended, provides another approach for handling fungible tokens.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.