Key Points:

- Crypto exchange Txbit is shutting down due to market challenges and regulatory uncertainties, ceasing operations on September 14, 2023.

- Customers are urged to withdraw funds before the closure date to prevent potential losses, with a planned outage on August 14 to cancel orders and temporarily suspend trading.

- Txbit will burn 95.6559% of its remaining uncirculated tokens, while the token will still be tradable on PancakeSwap despite the exchange’s closure.

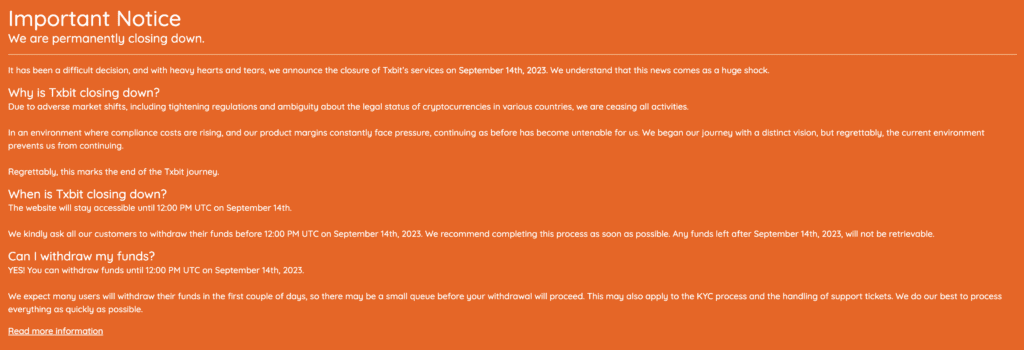

The Netherlands-based cryptocurrency exchange Txbit is set to cease operations due to challenging market conditions and regulatory uncertainties.

The exchange, known for its focus on trading Proof-of-Work (PoW) coins, has announced its closure, urging customers to withdraw their funds before the impending shutdown on September 14, 2023.

Txbit’s decision stems from the combination of adverse shifts in the market and the evolving regulatory landscape surrounding cryptocurrencies in various nations.

The exchange has cited increasing compliance costs and mounting pressure on product margins as contributing factors that have made its operations unsustainable.

The closure process will commence with a planned outage on August 14, 2023, during which all open orders will be canceled, and trading services will be temporarily suspended.

Following this period, withdrawal services will be reinstated, but customers are urged to withdraw their funds by September 14 to avoid any potential loss.

Notably, Txbit has confirmed its intention to burn the remaining uncirculated supply of Txbit tokens in the coming days, specifically 1,510,406,151.2992582 tokens, which amounts to 95.6559% of the total supply. Despite the exchange’s shutdown, the token will still be available for trading on PancakeSwap in the future.

Following this news, its token saw a severe drop of over 90% in just 1 hour.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.