Key Points:

- The SEC may allow multiple exchange-traded funds tracking ether futures to launch.

- Volatility Shares plans to launch an ether futures ETF on October 12.

The SEC may allow multiple Ethereum futures ETFs to be listed simultaneously. Volatility Shares plans to launch an ethereum futures ETF on October 12. Since its filing in July, the SEC has not asked it to withdraw its application.

According to WSJ, the Securities and Exchange Commission (SEC) is considering allowing multiple exchange-traded funds (ETFs) tracking ether futures to launch simultaneously. Volatility Shares is set to launch its ETF tracking futures linked to the second-largest cryptocurrency on October 12, becoming the first ether futures fund to launch in the US under the standard process.

First-mover advantage in the ETF industry is important, as evidenced by the success of the ProShares Bitcoin Strategy ETF, which has gathered $1 billion in assets under management since launching in October 2021. Valkyrie Investments’ bitcoin futures ETF, launched just a few days later, has just over $28 million in assets. The SEC has not commented on the matter.

Asset managers had filed paperwork with the SEC in late July to launch an ETF that would track ether futures, and a rush of filings followed after the SEC staff told asset managers they were ready to review such filings. The agency had previously told several asset managers to withdraw similar filings they made in May.

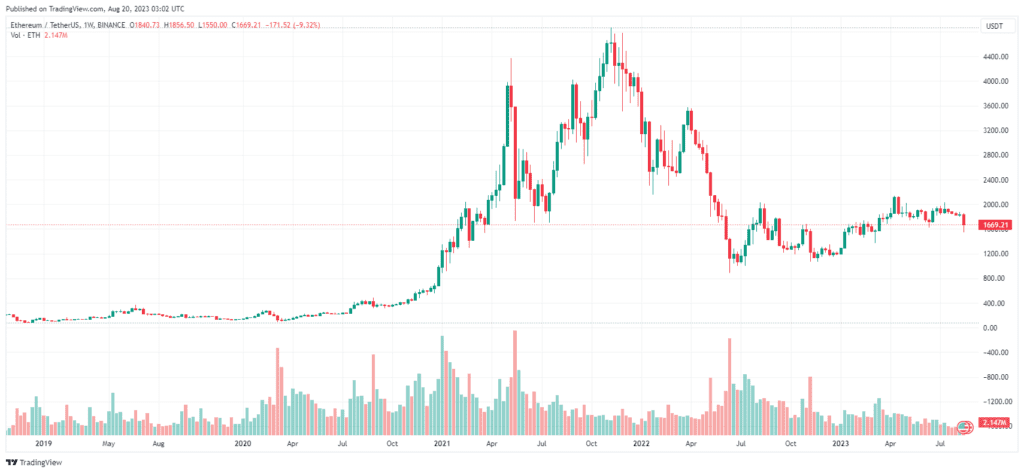

Since the July filings, however, the SEC has not asked asset managers to withdraw their applications, indicating that it is unlikely to block the launch of such funds in the fall. According to sources, the launch of an ether futures ETF is still not guaranteed. The price of Ethereum was down 16% in the past 7 days, according to CoinMarketCap data.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.