The Open X Project reviews writes smart contracts that facilitate the open exchange of ideas and value permissionless blockchains make possible. OpenXSwap is an aggregator, NFT Market, and project management platform. The core development team strives for each feature to be permissionless, trustless, accessible and immutable.

What is The Open X Project?

The Open X Project is dedicated to crafting intelligent contracts that enable the unrestricted sharing of ideas and the exchange of value, leveraging the potential of permissionless blockchains. Within this initiative, OpenXSwap operates as an aggregator, NFT Market, and project management platform. The central development team is committed to ensuring that every feature embodies the principles of being permissionless, trustless, accessible, and unchangeable.

The primary objective of this endeavor is to tokenize exchanges through nonfungible positions, supervise their equitable launch, and cultivate a system of decentralized governance to carry forward the outcomes. When engaging with the aggregator, auto-compounding vaults, NFT Market, token generator, NFT Collection generator, and governance contracts, participants enjoy the liberty of permissionless interaction. Furthermore, for projects or NFT communities seeking governance infrastructure, the option exists to deploy forums and vote contracts.

Open X Project on Optimism

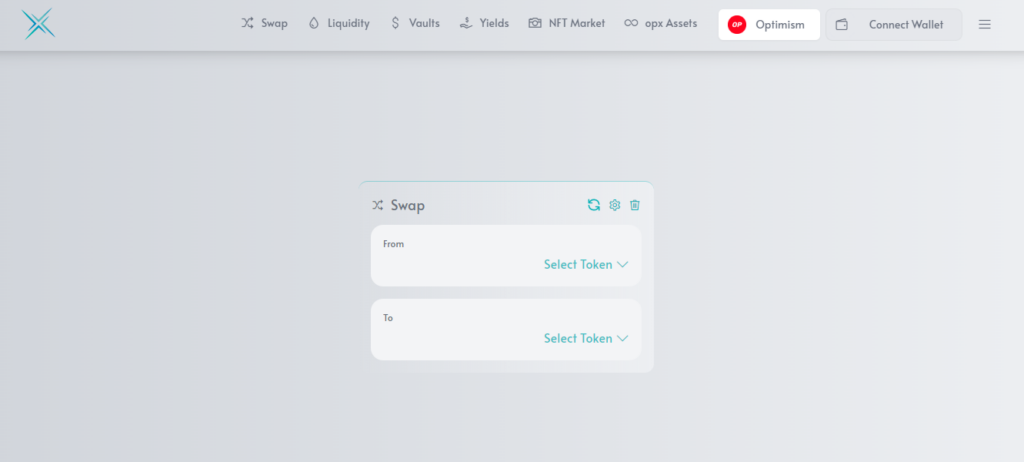

OpenXSwap

OpenXSwap’s native token, The Open X Project reviews , serves as the base pairing for our exchange. Liquidity Providers receive it in exchange for participating in Active Yield Generating Pools. These emissions will be determined by the Core development team until the project has passed into its Governance phase.

At that time, users and projects can propose to the Governance community new pools to receive The Open X Project reviews emissions. Once accepted, an epoch-by-epoch emissions allocation is determined by the number of votes it gets from the users (or project) relative to other Active Yield Generating Pools.

1. OpenX

OpenX Token Address: 0xc3864f98f2a61A7cAeb95b039D031b4E2f55e0e9

There was no presale or ICO for The Open X Project reviews. All tokens in circulation were fairly distributed to liquidity providers and governance participants.

OpenX has a hard cap of 16,624,999.99.

Emissions for LPs are scheduled to run until 2027.

No more The Open X Project reviews than this can ever be minted.

Expansionary emissions multipliers will last for three months after emissions begin.

The schedule is as follows:

Breakdown of The Open X Project reviews (Optimism) distribution:

40% of tokens minted will be used as rewards for Active Yield Generating Pools on OpenXSwap. 36% of tokens will be used in initial LP with OP. 12% of tokens will be minted for the treasury wallet for operations, maintenance and marketing. 6% of tokens will be set aside for reimbursement of Harmony’s OpenX. 6% of tokens will be minted to fund development, vested over two years.

2. xOpenX

xOpenX is the Governance Token of The Open X Project reviews.

It must be vote-escrowed in an OpenX-OP NFT to participate in governance.

OpenX tokens can be used to mint xOpenX tokens at an ever-increasing rate (ever-increasing since xOpenX earns inflation from the MasterChef and transaction fees from the OpenXMaker).

Snapshot of the OpenX Bar

APR: Current annualized rate of emissions (denominated in OpenX) from the MasterChef.

TVL: Market value of the underlying OpenX tokens deposited in the bar.

PVL: Personal market value of the connected wallet’s OpenX tokens deposited in the bar.

Stake Weight: Weight of xOpenX tokens in connected wallet relative to all xOpenX tokens.

Total OpenX Staked: Amount of all OpenX currently deposited in the bar.

Total xOpenX Supply: Current total xOpenX minted and circulating.

1 xOpenX =: Current mint ratio, or the amount of OpenX one receives per 1 unwrapped xOpenX.

3. vexOpenX

vexOpenX is not a token. It is a value generated that determines the relative voting power of one The Open X Project reviews OpenX-OP NFT compared to the rest of Governance. This value is, however, tokenized via its NFT and theoretically could be used to post collateral or sell the value of the votes in the future.

4. Fees and Distribution

The .3% fee* applied to each trade is collected and broken down as follows:

50% of all fees are returned to Liquidity Providers and accrue in real time. 33% of all fees are used to buyback and burn* OpenX, removing it from circulation forever. 17% of all fees are used to buyback OpenX and distribute it to holders of xOpenX.

5. Aggregator

The router for The Open X Project reviews OpenXSwap on Optimism aggregates liquidity from OpenXSwap, Velodrome, and Zip Swap, allowing users to utilize liquidity on each exchange with just one transaction. We intend to add more exchanges to the aggregator as other projects deploy on Optimism.

Our aggregator is our “most deployed” contract. It is available on the following chains:

- Optimism: 0x777E713B6f87765C314BFA682cDc04C02Cb64777

- Polygon: 0x7e710c4cd8be478a2c52ed93b90b968a87777777

- Harmony: 0x7e710c4cd8be478a2c52ed93b90b968a87777777

- Ethereum: 0x7e710c4cd8be478a2c52ed93b90b968a87777777

- Avalanche: 0x7e710c4cd8be478a2c52ed93b90b968a87777777

- Fantom: 0x7e710c4cd8be478a2c52ed93b90b968a87777777

- BSC: 0xb4f4B60DC1FA2bFb9fF9fc054ca2e40bB1aa889c

- Optimism Goerli: 0x777E713B6f87765C314BFA682cDc04C02Cb64777

NFT Market

Most NFT contracts allow for listings in ETH only, which can be volatile. Our contracts allow any NFT to be listed for any token (including ETH and stables) while charging just 1% per transaction.

This allows veNFTs for projects such as Velodrome (veVELO) and SolidLizard (veSLIZ) to be sold for their underlying tokens (VELO and SLIZ), avoiding the possibility of slippage.

These contracts create an any-ERC20-for-any-ERC721 exchange. When listing an NFT, one will visit our site and see the following prompt. (We will use veVELO for VELO as an example.):

NFT ADDRESS: In this prompt, list the contract address for the NFT one wishes to list. In our example we are listing veVELO, so we would copy the veVELO address and paste it in the ‘NFT Address’ (veVELO contract address: 0x9c7305eb78a432ced5C4D14Cac27E8Ed569A2e26).

One would then copy and paste the NFT ID in the ‘NFT ID’ prompt. veVELO IDs can be found by visiting the Velodrome application vesting page (https://app.velodrome.finance/vest) and searching the list for the particular lock the user wishes to list via the NFT Market contracts.

One then simply selects the ERC20 one wishes to receive for the veNFT. In this case, we are selling a 100 veVELO veNFT, locked for four years, for a 50% discount (we will take 50 VELO for it).

NOTE: veVELO veNFTs must be reset before they can be listed. See the Velodrome documentation for a step-by-step guide to resetting your veNFT so it can be listed on a secondary marketplace.

Once this data is inputted, the listing will be displayed before prompting confirmation transactions.

Once that is done, your listing will now show on the market page for anyone to find and bid!

Note the “REMOVE” action available only for NFTs listed by the User.

Clicking “INFO” on a veNFT from Velodrome will also show the vesting schedule for the veVELO.

Vaults

Our LP-compounding vaults currently support almost all projects* with liquidity on Velodrome.**

As of this writing, our vaults have the lowest fees (and thus highest APYs) on Optimism. There is no deposit or withdrawal fee. Vaults compound whenever a user deposits or claims a vault bounty.

93% of vault rewards are swapped to the underlying LP tokens, compounding the deposits. 6% of vault rewards are converted into The Open X Project reviews OpenX-ETH LP (collected by the Open X Project). 1% of vault rewards are due to the user that claims a bounty to compound the vault’s LPs.

To claim a bounty, simply click on “Bounty” for the vault(s) worth*** claiming (remember to account for gas fees). Claiming is permissionless, accessible, and an easy way to get involved.

Deposits and Withdrawals

To deposit or withdraw, click on a vault to prompt the deposit and withdrawal interface.

Selecting “Gauge” allows one to unstake LP currently deposited on Velodrome. Selecting “Vault” will allow deposits of unstaked Velodrome LPs into the vault.

The user needs unstaked Velodrome LP tokens to deposit into the vault *or* one of the tokens that constitute the liquidity pair to zap into the vault. If you already have Velodrome LP tokens, simply make your selection, chose the number of LP tokens you wish to deposit, approve spending of your LP tokens, and confirm the deposit transaction. Withdrawal follows the same process in reverse.

Zapping in and out of the Vaults

The Zap and Unzap (pictured) features perform multiple actions in the same transaction. They are used in conjunction with our vaults to quickly make and break LP tokens.

If you hold one of the tokens of your preferred pair but do not currently have LP tokens, you can utilize the zap function to skip the process of making LP tokens. Zapping (and sometimes unzapping) involves swapping tokens to create or break LPs. and is subject to slippage. Visit the swap page to create a mock transaction using our aggregator to gauge slippage if needed.

Unzapping allows you to remove and break the LP in one transaction. Select “both” to simply break the LP and return the tokens to your wallet. Select either of the tokens (in this example, OpenX The Open X Project reviews or WETH) to break the LP and swap either of the tokens for the other in one transaction.

Open X Project on Abitrum

aOpenX

aOpenX is complimentary project to opxveSLIZ and future opxve projects. It is Arbitrum native but, unlike OpenX The Open X Project reviews Optimism, we are not against bridging aOpenX The Open X Project reviews in principle. The opxveVELO project provided valuable experience for future opxve projects. We have refined the mechanics to ensure all future opxve projects focus on a hard-peg up front. We will then accumulate surplus voting positions and allocate some of their emissions to aOpenX pairings. Projects that strengthen our voting position in various ve(3,3) DEXs, such as our Convex LP-style vaults on Arbitrum, will be deployed to hasten the accumulation of large ve-positions in partner projects.

The Open X Project reviews is a fork in spirit, but not in code, of Convex. Its possibilities will grow in time in conjunction with our various opxve projects. As we integrate with more protocols, each with their own unique mechanics, aOpenX The Open X Project reviews will find its value proposition within each ecosystem as use cases arise.

opxveSLIZ

opxveSLIZ is an algorithmic synthetic currency pegged to price of SLIZ. It features the same developers, security features, and pegging logic as opxveVELO. The collateralization model has been revised to provide more directional exposure to the underlying early. More importantly, the revenue model excludes any projected revenue that is not secured via smart contract.

LP boosting available on SolidLizard offers the project strategies unavailable to opxveVELO.

Conclusion

Open X Project has fostered an environment of knowledge sharing, resource pooling, and cross-disciplinary cooperation. By providing a platform for individuals and organizations to contribute their expertise, the project has sparked innovative solutions, pushed boundaries, and accelerated the development of cutting-edge technologies.

One of the most notable achievements of the Open X Project has been its ability to tackle complex challenges that transcend the capabilities of a single entity. Through collective efforts, the project has not only overcome technological hurdles but has also paved the way for new paradigms in problem-solving. The ethos of openness and inclusivity has led to the emergence of solutions that have the potential to reshape industries, enhance user experiences, and drive societal progress.

Furthermore, the Open X Project’s impact extends beyond technical achievements. It has nurtured a culture of transparency, where insights and outcomes are shared openly for the betterment of all. This approach has not only enriched the knowledge base of the community but has also built trust and fostered meaningful relationships among participants.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.